Minnesota Sample Letter for New Discount

Description

How to fill out Sample Letter For New Discount?

If you are looking to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's user-friendly and straightforward search feature to locate the documentation you need.

A range of templates for business and personal purposes is categorized by types and jurisdictions, or keywords and phrases.

Step 4. After you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the Minnesota Sample Letter for New Discount with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to access the Minnesota Sample Letter for New Discount.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

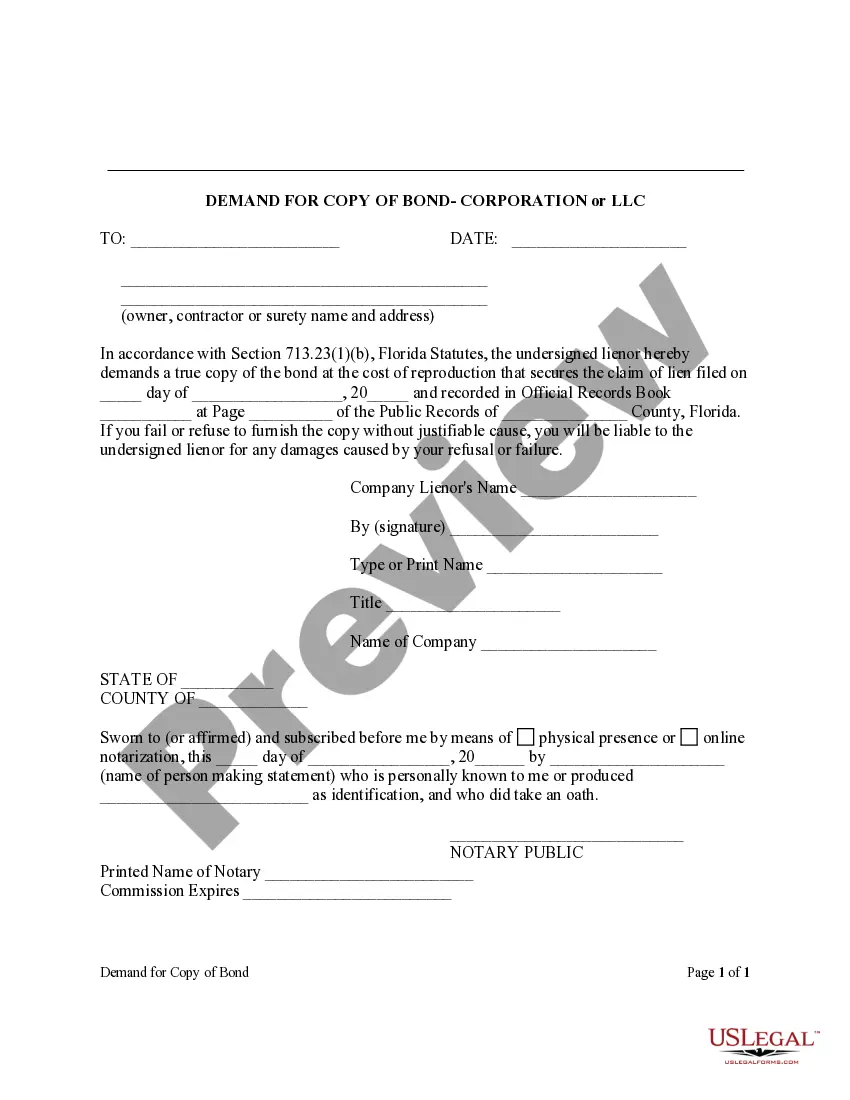

- Step 2. Use the Preview option to review the details of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To ask for an additional discount, communicate your request clearly and respectfully. Explain any special circumstances or existing discounts you've already received. Utilize the 'Minnesota Sample Letter for New Discount' to ensure your message is well-structured and persuasive. This can provide a solid foundation for your request and encourage a positive response.

When negotiating for a discount in business, approach the conversation confidently and professionally. Present your case based on previous purchases or market comparisons. Reference the 'Minnesota Sample Letter for New Discount' for ideas on phrasing your request. A well-articulated request can lead to a favorable outcome and strengthen your business relationships.

Items exempt from sales tax in Minnesota include certain clothing, prescription drugs, and food sold for home consumption. These exemptions are designed to alleviate the financial burden on consumers. It is essential for businesses to stay informed about what qualifies to avoid unnecessary tax collection. For more information, you can refer to the Minnesota Sample Letter for New Discount to better understand product classifications and exemptions.

To register for sales tax in Minnesota, businesses must complete an application through the Minnesota Department of Revenue’s website. Registration is usually straightforward and may require your business name, identification numbers, and contact details. Once registered, you will receive a sales tax permit to collect and remit taxes. The Minnesota Sample Letter for New Discount can offer tips on registration and the beginning steps of tax compliance.

In Minnesota, most retail items are subject to sales tax, but some exceptions apply. Commonly taxed items include electronics, furniture, and prepared foods. Understanding the distinctions between taxable and exempt items is crucial for business success. Always check the Minnesota Sample Letter for New Discount for the latest information on tax compliance and duties.

The Minnesota sales exemption form is a document businesses use to claim certain exemptions from sales tax. This form helps to simplify the process for both purchasers and sellers by outlining qualifying purchases. Proper use of this form ensures that you receive appropriate exemptions and maintain compliance. If you need assistance, the Minnesota Sample Letter for New Discount can offer guidance on exemption claims.

To report sales tax in Minnesota, businesses must file a sales tax return with the Minnesota Department of Revenue. This process typically occurs on a monthly or quarterly basis, depending on your sales volume. By accurately reporting sales tax, you can ensure compliance and avoid penalties. Consider utilizing the Minnesota Sample Letter for New Discount to help outline any changes in tax reporting strategies.

Form M1 is the individual income tax return required by the state of Minnesota. It is used by residents to report their income and claim applicable discounts or credits. If you're considering a Minnesota Sample Letter for New Discount, it can help you navigate any potential savings on your tax return, making the process easier. When filling out Form M1, ensure you include all relevant personal information and income details.

When writing a discount offer letter, start with a clear statement of your intention to offer a discount. Include details such as the discount percentage, duration, and any relevant terms. To assist in your writing, use the Minnesota Sample Letter for New Discount as a guide to ensure your offer is professional and persuasive.

Discount letters of credit are financial instruments that allow beneficiaries to receive payments at a discounted rate before the maturity date. They represent an agreement between parties for advance payments under specific conditions. If you need guidance, you can refer to resources like the Minnesota Sample Letter for New Discount for a better understanding.