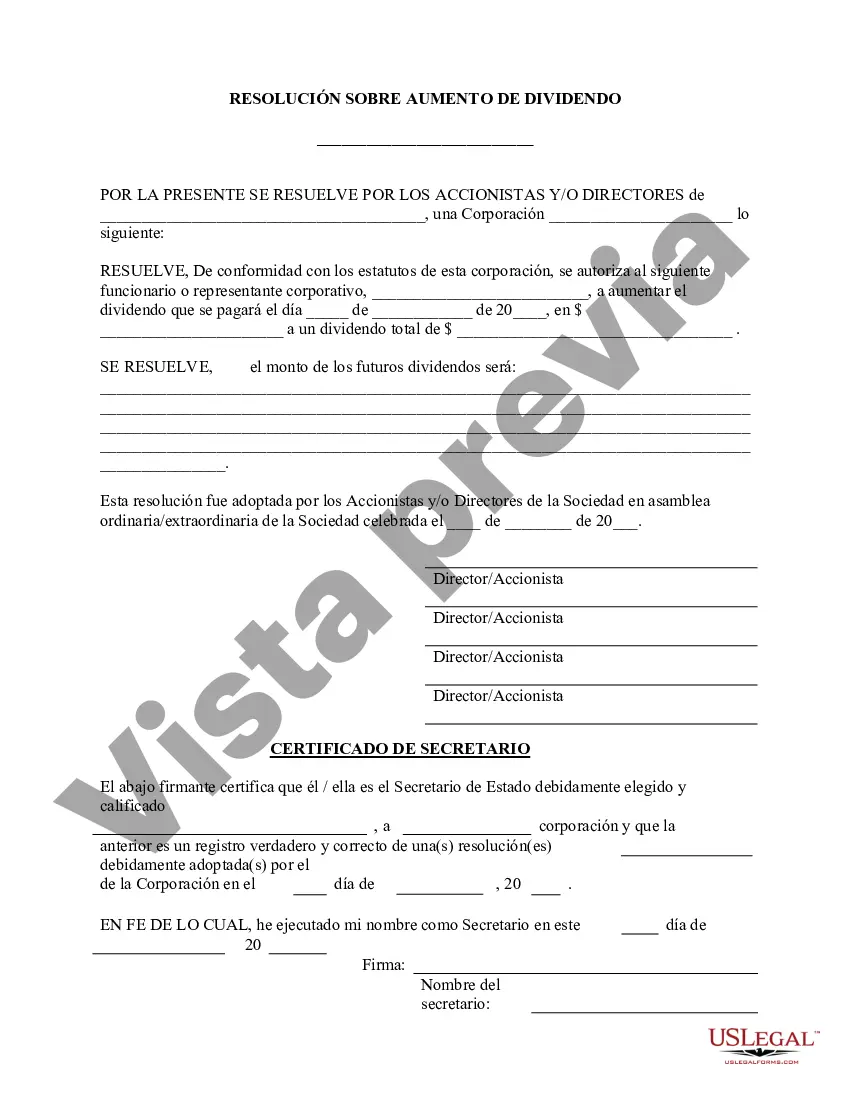

Minnesota Increase Dividend — Resolution For— - Corporate Resolutions is a legal document specifically designed for corporations operating in the state of Minnesota. This form serves as a guideline and template for companies to adopt a resolution to increase dividends. Dividends are financial distributions or payments made by a corporation to its shareholders out of its earnings or profits. It is a way for companies to share their success with their shareholders, who are the owners of the company. This resolution form helps guide corporations through the process of increasing dividends in accordance with the specific laws and regulations of the state of Minnesota. It ensures that the corporate decision-making process is conducted legally, transparently, and in the best interest of the company and its shareholders. By utilizing this resolution form, corporations can declare and approve the increase in dividend payments, establish the effective date of the dividend increase, specify the frequency of dividend payments, and outline any additional conditions or requirements related to the increased dividends. Different types of Minnesota Increase Dividend — Resolution For— - Corporate Resolutions may include variations based on specific factors such as the percentage of increase, timing of dividend payments, and any limitations or restrictions on dividend growth. Customizations can be made to cater to the unique needs and circumstances of each corporation. Overall, this resolution form is an important legal document that ensures proper governance and compliance with state laws when corporations in Minnesota decide to increase dividends. It provides a clear framework for corporations to make informed financial decisions and communicate them effectively to their shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Incrementar Dividendo - Formulario de Resoluciones - Resoluciones Corporativas - Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Minnesota Incrementar Dividendo - Formulario De Resoluciones - Resoluciones Corporativas?

Discovering the right lawful document design might be a have difficulties. Obviously, there are a lot of templates available on the Internet, but how would you obtain the lawful form you want? Make use of the US Legal Forms web site. The assistance delivers a huge number of templates, like the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions, which you can use for organization and private requirements. All of the types are checked out by experts and meet federal and state needs.

Should you be presently signed up, log in to the accounts and click on the Obtain button to obtain the Minnesota Increase Dividend - Resolution Form - Corporate Resolutions. Use your accounts to check with the lawful types you have purchased previously. Proceed to the My Forms tab of the accounts and have an additional copy from the document you want.

Should you be a new customer of US Legal Forms, listed below are simple guidelines so that you can stick to:

- Initially, make certain you have selected the right form for your personal area/county. You can look over the shape utilizing the Review button and study the shape outline to make certain this is basically the right one for you.

- If the form fails to meet your expectations, use the Seach area to get the right form.

- When you are positive that the shape is suitable, select the Get now button to obtain the form.

- Choose the costs prepare you need and enter the necessary details. Make your accounts and pay for an order utilizing your PayPal accounts or credit card.

- Opt for the submit file format and download the lawful document design to the gadget.

- Total, change and print out and sign the received Minnesota Increase Dividend - Resolution Form - Corporate Resolutions.

US Legal Forms may be the largest library of lawful types where you can find different document templates. Make use of the company to download skillfully-created files that stick to condition needs.