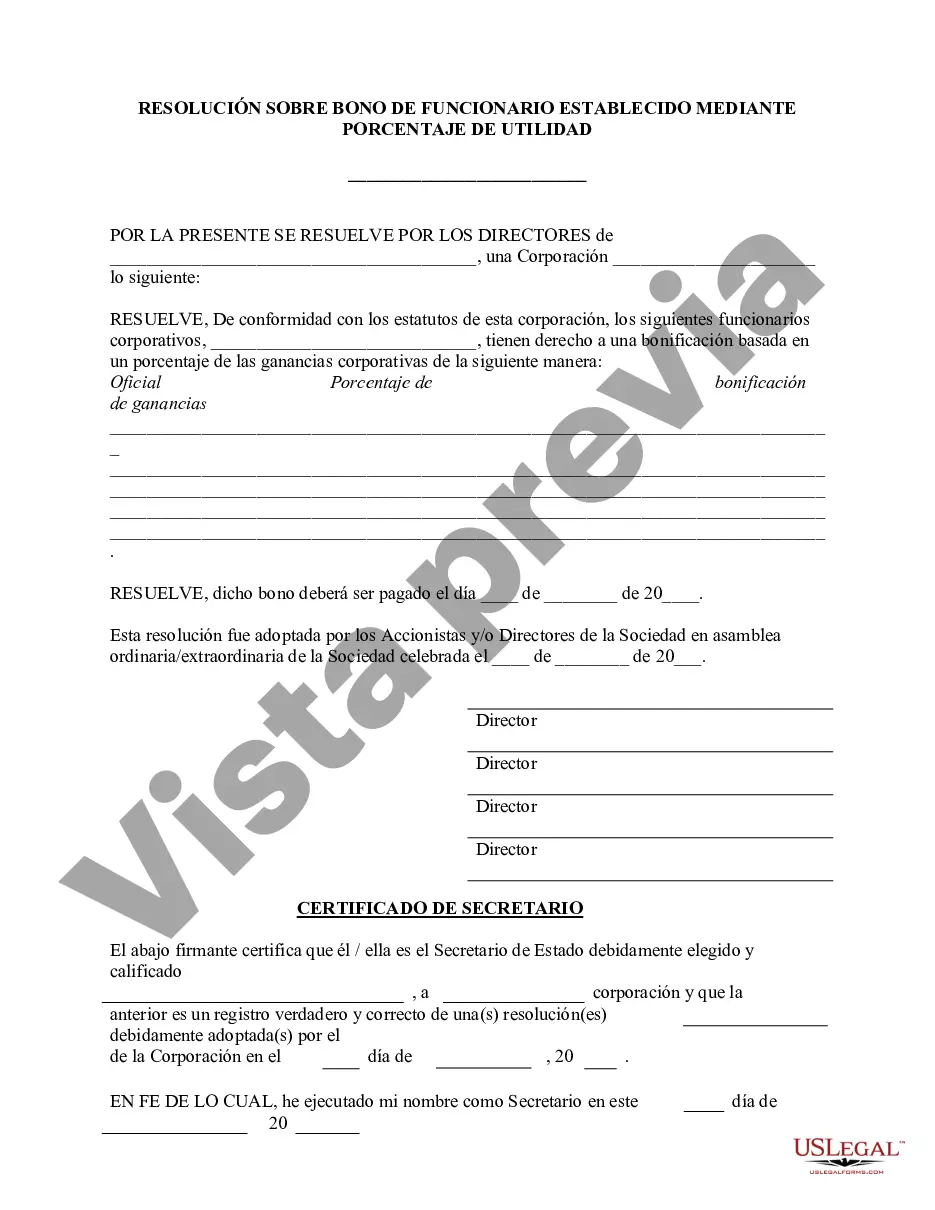

Title: Exploring Minnesota Officers Bonus — Percenprofitfi— - Resolution Form: Types and Detailed Description Introduction: Minnesota Officers Bonus — Percenprofitfi— - Resolution Form is a document that outlines the terms and conditions related to the calculation and distribution of bonuses for officers in Minnesota companies. The form serves as an agreement between the company and its officers, providing clarity on the bonus structure based on the respective percentage of profit earned. In this article, we will delve into the essential aspects of this form, outlining its purpose, components, and potential variations. 1. Understanding the Purpose: The Minnesota Officers Bonus — Percenprofitfi— - Resolution Form is designed to determine the bonus structure for officers based on the company's profit percentage. The form serves as a transparent means to define how bonuses will be allocated among eligible officers, linking their performance to the financial success of the enterprise. 2. Components of the Resolution Form: a. Profit Calculation Section: This portion defines the specific formula or methodology utilized for determining the company's profit. It typically includes details such as total revenue, operational expenses, and any special considerations for profit calculation. b. Officer Eligibility: The form specifies the criteria officers must meet to qualify for bonuses. This may include specific designations, seniority, or performance-based factors. c. Bonus Allocation: The resolution form provides a framework to determine the percentage of profit that will be allocated towards bonus payouts. This section outlines the respective percentage for each eligible officer and may also include a tiered system based on seniority or different officer categories. d. Bonus Calculation & Payment Schedule: The specific method for calculating the bonus for each officer is detailed here, along with the payment frequency (e.g., monthly, quarterly, or annually). e. Conditions and Amendments: The form may include provisions to address unique circumstances, modifications in the bonus structure, or conditions that must be met for eligibility. 3. Types of Minnesota Officers Bonus — Percenprofitfi— - Resolution Forms: a. Standard Resolution Form: This form is applicable to most Minnesota companies and includes the essential components mentioned above. It provides a straightforward bonus structure based on profit percentage. b. Tiered Resolution Form: This variation accounts for officer hierarchies within the organization. It assigns different profit percentage thresholds and bonus amounts based on the officer's seniority or category (e.g., executive-level officers, middle management, etc.). c. Performance-Based Resolution Form: This type of resolution form incentivizes exceptional performance by linking bonus amounts to a combination of profit percentage and individual or team achievement targets. d. Recurring Amendments Resolution Form: Companies that frequently modify their bonus structure may utilize this form to ensure officers receive up-to-date information and accept changes in their bonus calculations over time. Conclusion: The Minnesota Officers Bonus — Percenprofitfi— - Resolution Form is a vital document that establishes clarity regarding the bonus structure for officers based on company profits. By incorporating various relevant components, such as profit calculations, officer eligibility criteria, bonus allocation, and payment schedules, this form provides a fair and transparent framework for determining officer bonuses in Minnesota companies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Bono de Oficiales - Porcentaje de Ganancia - Formulario de Resolución - Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out Minnesota Bono De Oficiales - Porcentaje De Ganancia - Formulario De Resolución?

Choosing the right legitimate papers template might be a have difficulties. Obviously, there are a lot of web templates available online, but how will you get the legitimate kind you want? Make use of the US Legal Forms internet site. The assistance offers thousands of web templates, for example the Minnesota Officers Bonus - Percent of Profit - Resolution Form, which you can use for enterprise and personal requires. All the varieties are checked by experts and meet up with state and federal needs.

When you are previously listed, log in in your accounts and then click the Down load switch to have the Minnesota Officers Bonus - Percent of Profit - Resolution Form. Use your accounts to check through the legitimate varieties you have bought previously. Go to the My Forms tab of the accounts and get an additional version in the papers you want.

When you are a whole new end user of US Legal Forms, listed here are easy recommendations so that you can comply with:

- First, make certain you have selected the appropriate kind for your area/region. It is possible to look over the form using the Preview switch and browse the form outline to make certain it will be the right one for you.

- If the kind will not meet up with your requirements, use the Seach discipline to discover the appropriate kind.

- Once you are certain that the form is proper, click on the Get now switch to have the kind.

- Pick the pricing strategy you would like and type in the essential info. Make your accounts and buy your order making use of your PayPal accounts or charge card.

- Pick the document formatting and obtain the legitimate papers template in your system.

- Total, change and print out and sign the obtained Minnesota Officers Bonus - Percent of Profit - Resolution Form.

US Legal Forms is the largest library of legitimate varieties where you can discover various papers web templates. Make use of the company to obtain expertly-manufactured files that comply with state needs.