Title: Understanding Minnesota Lease of Business Premises — Real Estate Rental: Types, Terms & Key Considerations Introduction: The Minnesota Lease of Business Premises — Real Estate Rental refers to a legal agreement between a landlord (lessor) and a tenant (lessee) regarding the renting or leasing of commercial properties in Minnesota. This comprehensive lease is an essential document governing the rights and responsibilities of both parties involved in a business rental arrangement. In Minnesota, there are various types of leases for business premises, each catering to different business needs. This article aims to provide a detailed description of the Minnesota Lease of Business Premises and its different types and considerations. Types of Minnesota Leases of Business Premises — Real Estate Rental: 1. Gross Lease: In a gross lease arrangement, the tenant pays a fixed monthly rental amount to the landlord, who then assumes responsibility for all operating expenses, including property taxes, insurance, maintenance, and utilities. This type of lease offers simplicity and ease of budgeting for the lessee. 2. Triple Net Lease (NNN): Under a Triple Net Lease, the tenant is responsible for paying the base rent as well as the real estate taxes, property insurance, and maintenance costs. In this lease, the lessee assumes more financial responsibility and typically pays a lower base rent amount. 3. Modified Gross Lease: The Modified Gross Lease is a combination of the gross and triple net leases. It allows for negotiation between the lessor and lessee to determine specific responsibilities for expenses. For example, the tenant might pay a fixed rent amount, while the landlord maintains responsibility for property maintenance and insurance costs. Key Considerations and Terms in Minnesota Lease of Business Premises — Real Estate Rental: 1. Lease Term and Renewal Options: Specify the duration of the lease agreement, including the start and end dates, as well as any provisions for renewal or extension options. 2. Rental Compensation: Clearly outline the base rental amount and any rent escalation clauses that dictate rental increases over time. 3. Common Area Maintenance (CAM) Charges: If applicable, define the tenant's portion for common area maintenance expenses, which covers shared spaces like hallways, parking lots, and restrooms. 4. Security Deposit: Detail the amount of the deposit required, its intended use, and the conditions for its return at the end of the lease term. 5. Maintenance and Repairs: Clearly define the obligations of both parties regarding property maintenance and repairs, such as who is responsible for structural repairs, routine maintenance, and repairs caused by tenant negligence. 6. Insurance: Specify the types and amounts of insurance required for the premises, including general liability insurance, property coverage, and any necessary additional coverage. 7. Use Restrictions: Outline the permitted business activities and any restrictions on use, such as prohibiting hazardous materials or certain types of businesses that could violate local codes or regulations. 8. Termination and Default: Include provisions that detail the circumstances under which either party can terminate the agreement before the end of the lease term, as well as the consequences of defaulting on rent payments or other obligations. Conclusion: Understanding the Minnesota Lease of Business Premises — Real Estate Rental is crucial for both landlords and tenants. By grasping the different types of leases available and considering key terms and conditions during negotiation, business owners can make informed decisions to ensure a successful and mutually beneficial rental experience. Consulting legal professionals or real estate experts is highly recommended navigating the complexities of leasing commercial properties in Minnesota.

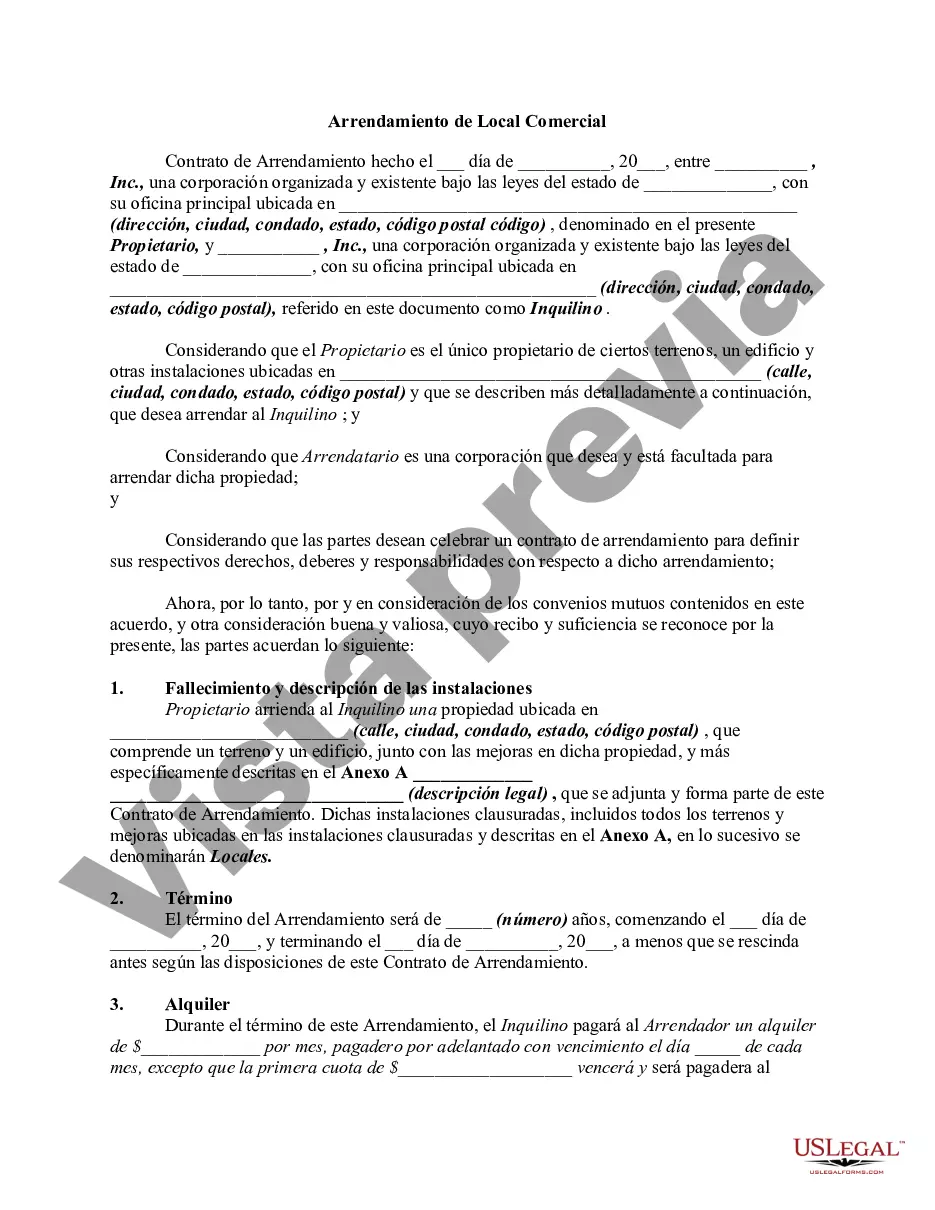

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Arrendamiento de Local Comercial - Alquiler de Bienes Raíces - Lease of Business Premises - Real Estate Rental

Description

How to fill out Minnesota Arrendamiento De Local Comercial - Alquiler De Bienes Raíces?

Are you currently in a placement the place you need to have documents for sometimes organization or personal uses just about every working day? There are a variety of legitimate file templates available on the Internet, but discovering versions you can trust isn`t easy. US Legal Forms delivers thousands of type templates, just like the Minnesota Lease of Business Premises - Real Estate Rental, which can be published to meet federal and state requirements.

Should you be already acquainted with US Legal Forms site and also have your account, merely log in. After that, it is possible to obtain the Minnesota Lease of Business Premises - Real Estate Rental web template.

Should you not have an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the type you want and make sure it is for that appropriate town/county.

- Take advantage of the Preview button to check the form.

- See the explanation to actually have selected the appropriate type.

- In case the type isn`t what you`re trying to find, take advantage of the Search discipline to find the type that fits your needs and requirements.

- If you get the appropriate type, just click Get now.

- Pick the pricing program you need, complete the desired info to make your account, and pay for the transaction using your PayPal or bank card.

- Choose a handy data file structure and obtain your copy.

Find all the file templates you have purchased in the My Forms menu. You can obtain a more copy of Minnesota Lease of Business Premises - Real Estate Rental whenever, if possible. Just go through the required type to obtain or produce the file web template.

Use US Legal Forms, one of the most extensive collection of legitimate varieties, to conserve efforts and stay away from errors. The services delivers expertly created legitimate file templates that can be used for a range of uses. Create your account on US Legal Forms and begin producing your lifestyle a little easier.