Minnesota Indemnity Agreement in Connection with Warehouse Receipt

Description

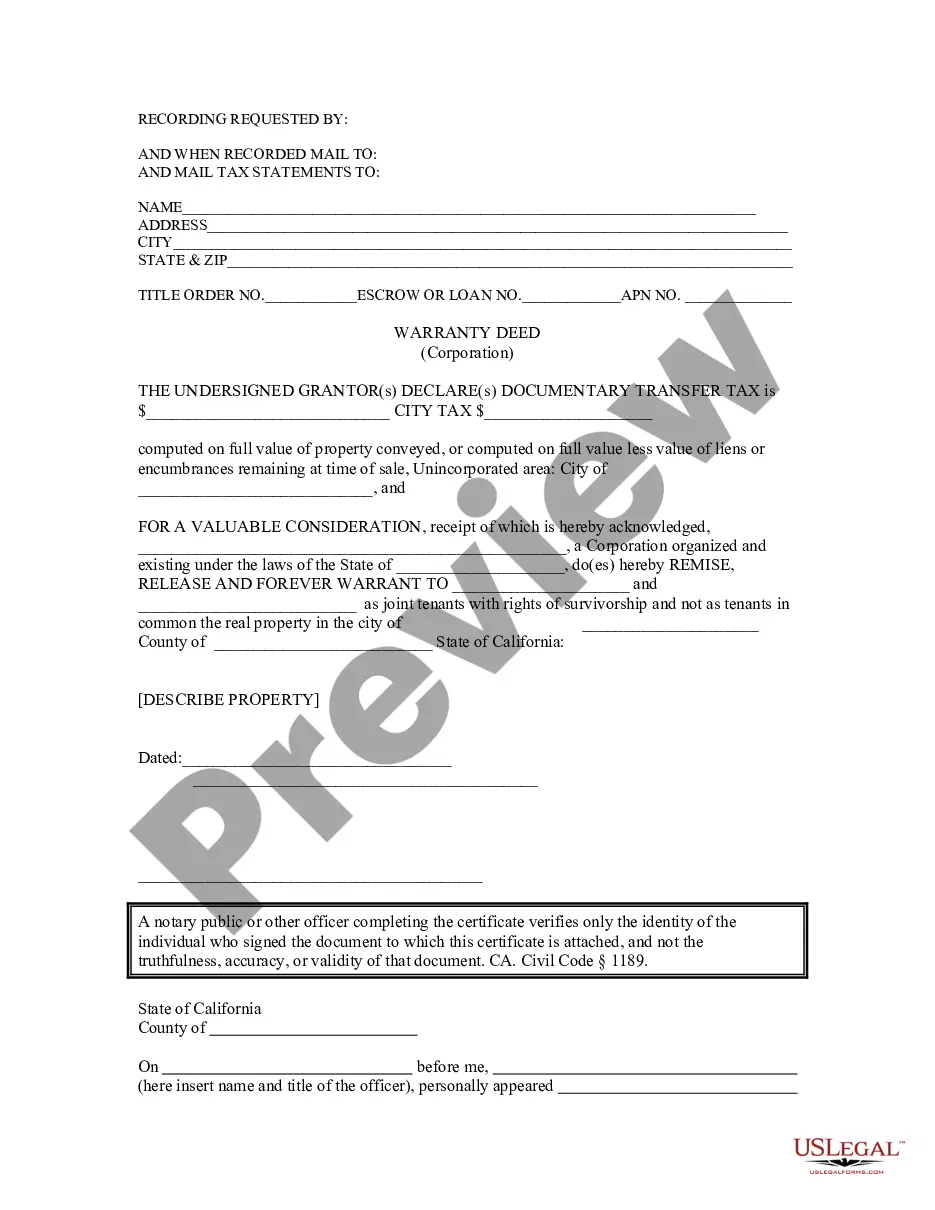

How to fill out Indemnity Agreement In Connection With Warehouse Receipt?

If you wish to acquire, obtain, or generate authentic document templates, utilize US Legal Forms, the foremost compilation of official forms available online.

Leverage the site’s straightforward and user-friendly search feature to find the documents you require.

A selection of templates for business and personal uses is organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, select the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Minnesota Indemnity Agreement related to Warehouse Receipt within just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Acquire button to obtain the Minnesota Indemnity Agreement related to Warehouse Receipt.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Make sure you have selected the form for the right city/state.

- Step 2. Utilize the Review option to examine the form’s details. Be sure to read the explanation.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to discover other templates from the legal form repository.

Form popularity

FAQ

To fill out an indemnity form correctly, start by stating the date, your name, and the name of the indemnified party. Clearly specify the reason for the indemnity and any relevant details connecting it to the Minnesota Indemnity Agreement in Connection with Warehouse Receipt. Ensure that all required fields are complete and have the form signed by all relevant parties to validate the agreement.

An indemnity contract, such as a Minnesota Indemnity Agreement in Connection with Warehouse Receipt, defines the responsibilities between the parties regarding potential losses. For example, a company may agree to indemnify a warehouse operator for any damages incurred due to its goods stored on their premises. This type of contract helps clarify rights and obligations, protecting all parties involved.

An indemnity statement typically outlines the commitment to protect one party from loss or damage. For instance, a statement might say, 'In connection with the Minnesota Indemnity Agreement in Connection with Warehouse Receipt, I agree to indemnify the warehouse owner from any claims arising from my use of their facilities.' This statement includes clear terms on both obligations and liability.

When filling out an indemnity agreement, begin by defining the parties involved and their roles. Clearly articulate the obligations and terms stipulated in the Minnesota Indemnity Agreement in Connection with Warehouse Receipt. It’s essential to include any applicable conditions and to have all parties review and sign the document to ensure mutual understanding.

Filling out an indemnity bond form requires you to provide specific details about the involved parties, the bond amount, and the purpose. Be sure to clearly state the terms under which the indemnity will apply, especially in regards to the Minnesota Indemnity Agreement in Connection with Warehouse Receipt. After reviewing the information for accuracy, ensure all parties sign the bond as required.

To properly fill out a letter of indemnity related to a Minnesota Indemnity Agreement in Connection with Warehouse Receipt, start by entering the date and your personal or company information. Clearly state the purpose of the letter, detailing the transaction or circumstances that necessitate the indemnity. Finally, include any terms and sign the letter, ensuring that all parties involved understand their responsibilities.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

There are two parties in an indemnity contract, including the indemnitee and indemnifier. The indemnitee is the party that is seeking protection, whereas the indemnifier is the one promising to hold harmless.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.