This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Minnesota Agreement for Credit Counseling Services is a comprehensive document designed to outline the terms and conditions between a credit counseling agency and consumers seeking help with their financial management. This agreement serves as a legally binding contract that establishes the rights and responsibilities of both parties involved, ensuring a transparent and trustworthy relationship. Credit counseling services provided by Minnesota-based agencies aim to assist individuals overwhelmed by debt to regain control of their financial situation. These services may include debt management plans, budgeting guidance, creditor negotiations, and educational resources to promote sustainable financial practices. The Minnesota Agreement for Credit Counseling Services encompasses various key provisions that safeguard the interests of consumers. It typically emphasizes the importance of confidentiality, ensuring that any personal or financial information shared during the counseling process remains secure and protected. Another crucial element is the disclosure of fees and payment terms, guaranteeing transparency on the costs associated with the services offered. Moreover, the agreement outlines the agency's responsibilities, such as conducting a thorough assessment of the consumer's financial situation, creating a personalized action plan, and providing ongoing support throughout the counseling process. On the consumer's end, they are expected to provide accurate and complete information about their debts, income, and expenses to facilitate a comprehensive evaluation. While there may not be different types of Minnesota Agreement for Credit Counseling Services in the strictest sense, variations may exist depending on the specific credit counseling agency. Some agencies might offer specialized services tailored to distinct demographics, such as military personnel, low-income individuals, or students. These niche-focused agreements may include additional provisions or benefits particular to those groups. In conclusion, the Minnesota Agreement for Credit Counseling Services is a critical framework that safeguards both consumers and credit counseling agencies in their pursuit of achieving financial stability. By outlining the terms and responsibilities of both parties, this agreement ensures a transparent and beneficial credit counseling experience.The Minnesota Agreement for Credit Counseling Services is a comprehensive document designed to outline the terms and conditions between a credit counseling agency and consumers seeking help with their financial management. This agreement serves as a legally binding contract that establishes the rights and responsibilities of both parties involved, ensuring a transparent and trustworthy relationship. Credit counseling services provided by Minnesota-based agencies aim to assist individuals overwhelmed by debt to regain control of their financial situation. These services may include debt management plans, budgeting guidance, creditor negotiations, and educational resources to promote sustainable financial practices. The Minnesota Agreement for Credit Counseling Services encompasses various key provisions that safeguard the interests of consumers. It typically emphasizes the importance of confidentiality, ensuring that any personal or financial information shared during the counseling process remains secure and protected. Another crucial element is the disclosure of fees and payment terms, guaranteeing transparency on the costs associated with the services offered. Moreover, the agreement outlines the agency's responsibilities, such as conducting a thorough assessment of the consumer's financial situation, creating a personalized action plan, and providing ongoing support throughout the counseling process. On the consumer's end, they are expected to provide accurate and complete information about their debts, income, and expenses to facilitate a comprehensive evaluation. While there may not be different types of Minnesota Agreement for Credit Counseling Services in the strictest sense, variations may exist depending on the specific credit counseling agency. Some agencies might offer specialized services tailored to distinct demographics, such as military personnel, low-income individuals, or students. These niche-focused agreements may include additional provisions or benefits particular to those groups. In conclusion, the Minnesota Agreement for Credit Counseling Services is a critical framework that safeguards both consumers and credit counseling agencies in their pursuit of achieving financial stability. By outlining the terms and responsibilities of both parties, this agreement ensures a transparent and beneficial credit counseling experience.

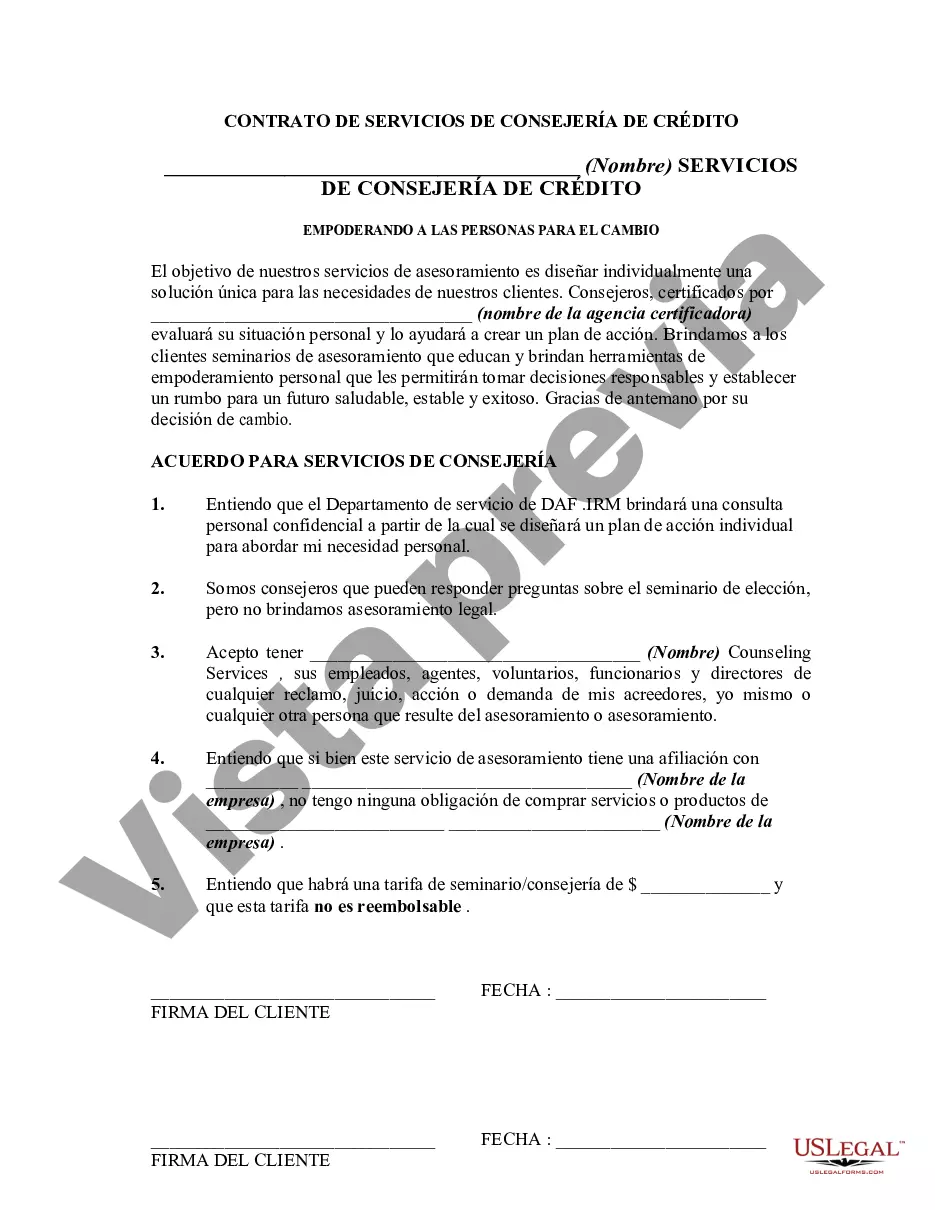

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.