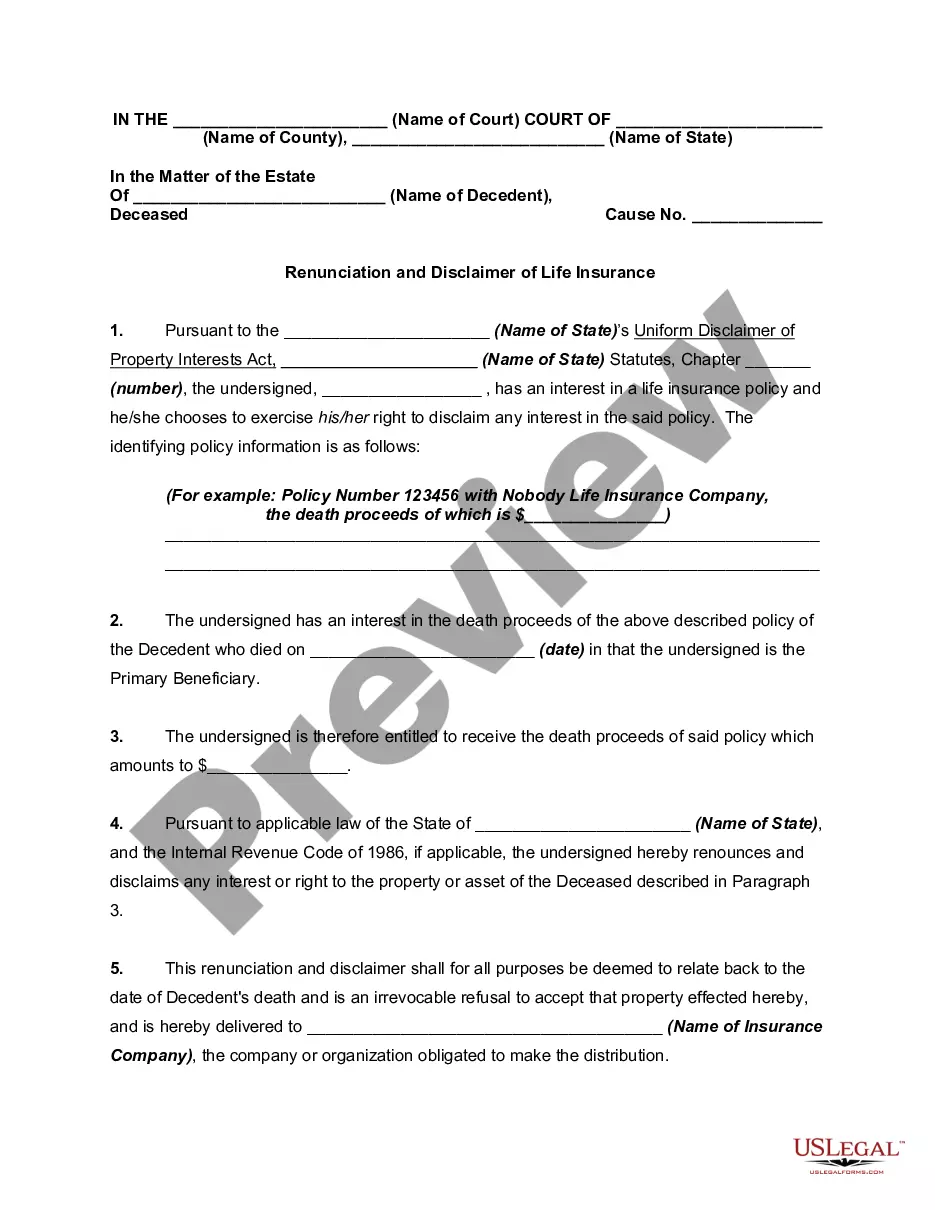

Disclaimers are used by those who receive property as heirs or legatees in an estate, or by beneficiaries of a non-testamentary transfer of property at death; for example, the beneficiaries of a life insurance policy. A disclaimer is simply a declaration by the person entitled to property that the interest in that property is disclaimed or renounced. A disclaimer allows the disclaiming heir or beneficiary to disclaim an interest in such a fashion that the right to the property that is disclaimed is treated as if it never existed.

The Uniform Disclaimers of Property Interests Act (which has been adopted by a number of states) provides the authority to make disclaimers, what interests may be disclaimed, the time when disclaimers are effective, and the effect on the distribution of the disclaimed property interests.

Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds is a legal process that allows an individual to voluntarily give up their right to receive the proceeds from a life insurance policy. This can be done for various reasons, such as for tax planning, estate planning, or to avoid a potential conflict of interest. The Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds is governed by specific laws and regulations in the state. It is important to understand these laws and consult with a legal professional before proceeding with the renunciation or disclaimer process. There are different types of Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds, which include: 1. Conditional Renunciation: This type of renunciation allows an individual to give up their right to the life insurance proceeds under certain conditions. For example, the renunciation may only take effect if a specified person or entity receives the proceeds instead. 2. Partial Renunciation: In this case, an individual can choose to renounce only a portion of their interest in the life insurance proceeds. This can be useful in situations where the individual wants to allocate a specific amount to another beneficiary or organization. 3. Disclaimer of Interest: A disclaimer of interest is similar to a renunciation but usually applies when an individual is set to inherit the policy. By disclaiming their interest, they effectively refuse to accept the life insurance proceeds, and it will pass on to the next eligible beneficiary. 4. Retroactive Renunciation: Sometimes, an individual may realize their interest in the life insurance proceeds after initially accepting them. In such cases, a retroactive renunciation can be filed to relinquish the already received benefits. It is crucial to consult an attorney familiar with estate planning and life insurance laws in Minnesota to properly execute a renunciation or disclaimer of interest. Failing to follow the correct legal procedures can result in unintended consequences and may not be legally valid. Overall, the Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds offer flexibility for individuals to control the distribution of life insurance benefits according to their preferences and circumstances.Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds is a legal process that allows an individual to voluntarily give up their right to receive the proceeds from a life insurance policy. This can be done for various reasons, such as for tax planning, estate planning, or to avoid a potential conflict of interest. The Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds is governed by specific laws and regulations in the state. It is important to understand these laws and consult with a legal professional before proceeding with the renunciation or disclaimer process. There are different types of Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds, which include: 1. Conditional Renunciation: This type of renunciation allows an individual to give up their right to the life insurance proceeds under certain conditions. For example, the renunciation may only take effect if a specified person or entity receives the proceeds instead. 2. Partial Renunciation: In this case, an individual can choose to renounce only a portion of their interest in the life insurance proceeds. This can be useful in situations where the individual wants to allocate a specific amount to another beneficiary or organization. 3. Disclaimer of Interest: A disclaimer of interest is similar to a renunciation but usually applies when an individual is set to inherit the policy. By disclaiming their interest, they effectively refuse to accept the life insurance proceeds, and it will pass on to the next eligible beneficiary. 4. Retroactive Renunciation: Sometimes, an individual may realize their interest in the life insurance proceeds after initially accepting them. In such cases, a retroactive renunciation can be filed to relinquish the already received benefits. It is crucial to consult an attorney familiar with estate planning and life insurance laws in Minnesota to properly execute a renunciation or disclaimer of interest. Failing to follow the correct legal procedures can result in unintended consequences and may not be legally valid. Overall, the Minnesota Renunciation and Disclaimer of Interest in Life Insurance Proceeds offer flexibility for individuals to control the distribution of life insurance benefits according to their preferences and circumstances.