This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities is a legal document used in the state of Minnesota to provide detailed information about an individual's financial status. This affidavit is typically required in various legal proceedings, such as divorce cases, child custody disputes, and other matters that involve the division of assets and determination of financial responsibilities. The purpose of the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities is to provide an accurate representation of an individual's financial resources, including their income, debts, assets, and liabilities. It helps courts and parties involved in the legal proceedings to assess and determine the financial capabilities and obligations of each party. This affidavit requires individuals to provide a comprehensive breakdown of their income sources, such as employment wages, business profits, investments, rental income, and any other form of monetary gains. It also requires the disclosure of all debts, including mortgages, loans, credit card balances, and any other outstanding financial obligations. In addition to income and debts, the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities mandates the declaration of all assets owned by the individual. This includes real estate properties, vehicles, investments, bank accounts, retirement accounts, life insurance policies, valuable personal possessions, and any other significant assets. Furthermore, this affidavit requires the disclosure of liabilities such as unpaid taxes, child or spousal support obligations, pending legal judgments, and any other financial burdens that may affect the individual's financial situation. Different types of Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities can vary based on the specific legal matter they are utilized for. For instance, there may be specific affidavits designed for divorce proceedings, child custody cases, probate matters, or even bankruptcy proceedings. Each type may require additional information or have specific nuances relevant to their respective legal context. It is important to note that the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities must be completed accurately and honestly, as it serves as an essential piece of evidence in legal proceedings. Providing false or misleading information on this affidavit can have serious legal consequences. Therefore, it is advisable to consult with an attorney or legal professional to ensure the proper completion of this document.The Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities is a legal document used in the state of Minnesota to provide detailed information about an individual's financial status. This affidavit is typically required in various legal proceedings, such as divorce cases, child custody disputes, and other matters that involve the division of assets and determination of financial responsibilities. The purpose of the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities is to provide an accurate representation of an individual's financial resources, including their income, debts, assets, and liabilities. It helps courts and parties involved in the legal proceedings to assess and determine the financial capabilities and obligations of each party. This affidavit requires individuals to provide a comprehensive breakdown of their income sources, such as employment wages, business profits, investments, rental income, and any other form of monetary gains. It also requires the disclosure of all debts, including mortgages, loans, credit card balances, and any other outstanding financial obligations. In addition to income and debts, the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities mandates the declaration of all assets owned by the individual. This includes real estate properties, vehicles, investments, bank accounts, retirement accounts, life insurance policies, valuable personal possessions, and any other significant assets. Furthermore, this affidavit requires the disclosure of liabilities such as unpaid taxes, child or spousal support obligations, pending legal judgments, and any other financial burdens that may affect the individual's financial situation. Different types of Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities can vary based on the specific legal matter they are utilized for. For instance, there may be specific affidavits designed for divorce proceedings, child custody cases, probate matters, or even bankruptcy proceedings. Each type may require additional information or have specific nuances relevant to their respective legal context. It is important to note that the Minnesota Affidavit of Financial Resources and Debt — Assets and Liabilities must be completed accurately and honestly, as it serves as an essential piece of evidence in legal proceedings. Providing false or misleading information on this affidavit can have serious legal consequences. Therefore, it is advisable to consult with an attorney or legal professional to ensure the proper completion of this document.

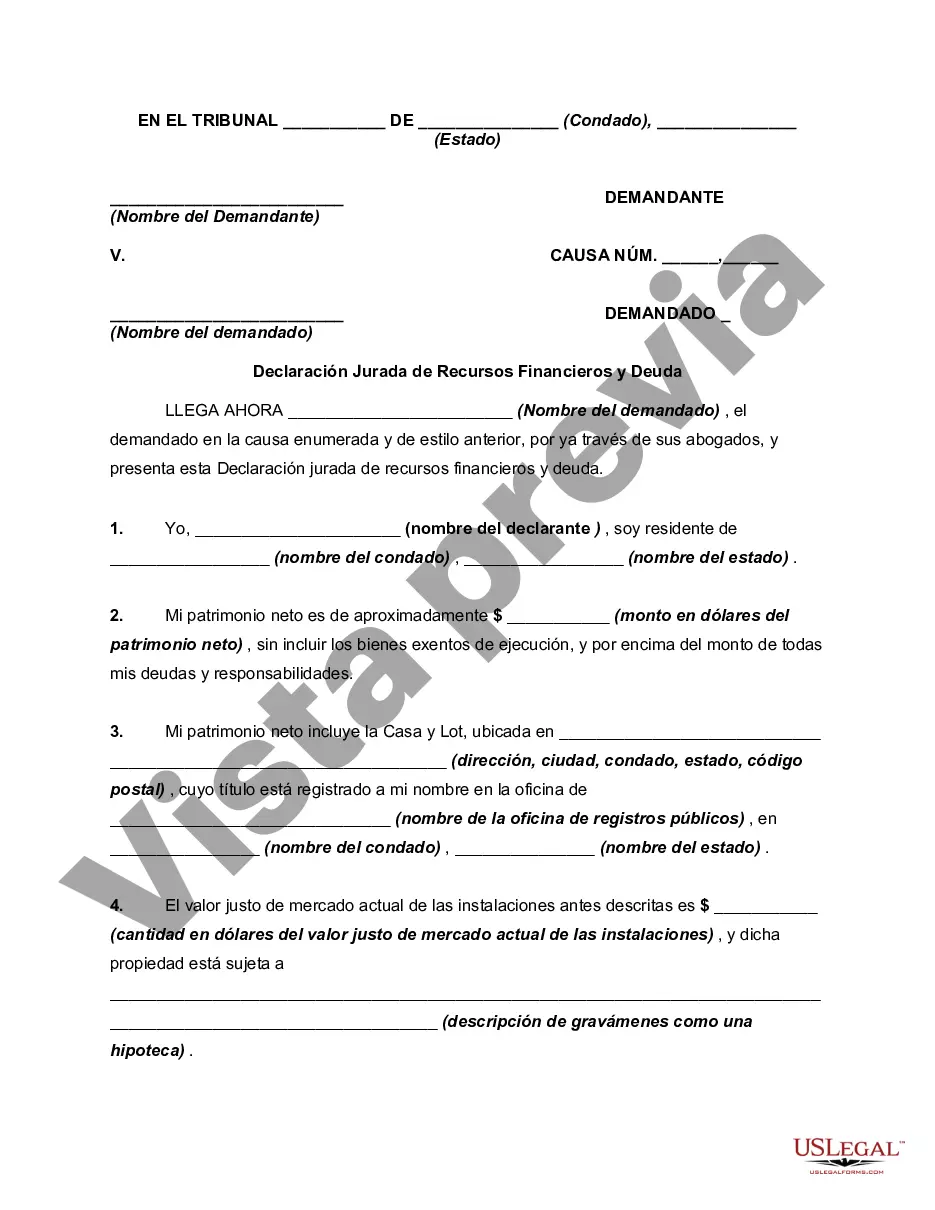

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.