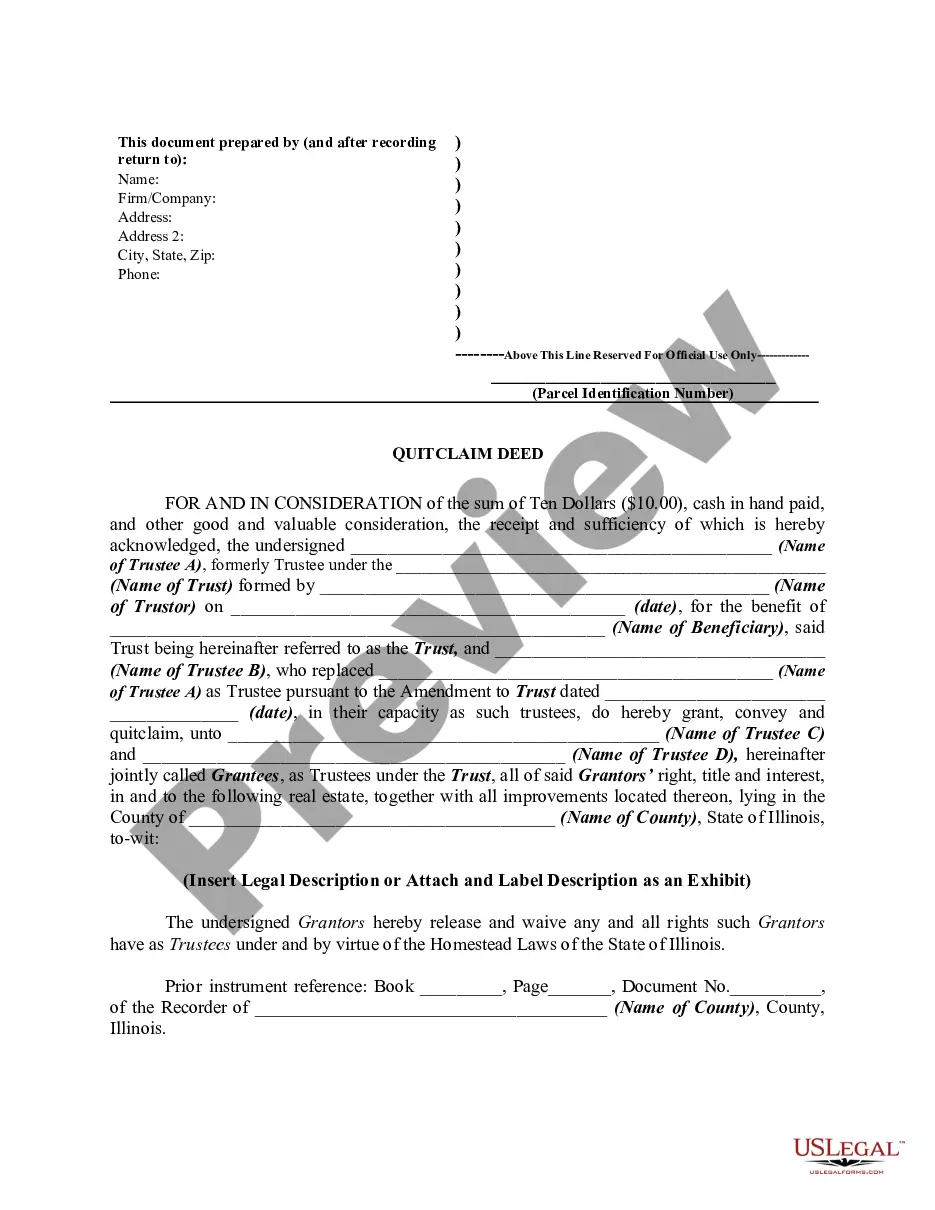

The Minnesota Comprehensive Commercial Deed of Trust and Security Agreement is a legal document that outlines the terms and conditions regarding a loan transaction secured by a commercial property in the state of Minnesota. This agreement serves as a legal instrument, safeguarding the interests of the lender against potential defaults or non-payment by the borrower. In this binding contract, the borrower (also known as the trust or) pledges their commercial property as collateral or security for the loan. By doing so, the lender (or beneficiary) gains the right to foreclose on the property and sell it to recover the outstanding debt if the borrower fails to fulfill their obligations, such as making timely payments. The Minnesota Comprehensive Commercial Deed of Trust and Security Agreement typically includes various clauses and provisions, including but not limited to: 1. Identification of Parties: This section clearly defines the parties involved, namely the lender and borrower, providing their legal names and contact information. 2. Property Description: This section provides a detailed description of the commercial property being pledged as collateral, including its address, legal description, and any associated improvements or fixtures. 3. Loan Amount and Purpose: Here, the agreement specifies the loan amount granted by the lender to the borrower, as well as the purpose for which the funds will be utilized (e.g., property acquisition, construction, improvement). 4. Loan Terms and Repayment: This clause outlines the key terms of the loan, such as the interest rate, repayment schedule, and any penalties or fees applicable for late payments or default. 5. Insurance and Tax Provisions: The agreement requires the borrower to maintain adequate property insurance coverage and pay property taxes promptly to protect the lender's collateral. 6. Default and Remedies: This section highlights the events that constitute default, such as failure to make payments or violating other terms of the agreement. It also outlines the lender's rights and remedies in case of default, including foreclosure and sale of the property. 7. Costs and Expenses: This clause details the allocation of costs and expenses related to the agreement, such as attorney fees, recording fees, and property inspections. It's important to note that there may be variations of the Minnesota Comprehensive Commercial Deed of Trust and Security Agreement depending on the specific transaction or requirements of the parties involved. It is advisable to consult legal professionals to ensure compliance with specific legal and contractual obligations.

Minnesota Comprehensive Commercial Deed of Trust and Security Agreement

Description

How to fill out Minnesota Comprehensive Commercial Deed Of Trust And Security Agreement?

It is possible to spend several hours on the Internet attempting to find the legal document web template which fits the state and federal specifications you want. US Legal Forms offers thousands of legal forms that happen to be examined by pros. It is simple to obtain or produce the Minnesota Comprehensive Commercial Deed of Trust and Security Agreement from your services.

If you currently have a US Legal Forms account, you can log in and click on the Obtain key. Next, you can full, modify, produce, or indication the Minnesota Comprehensive Commercial Deed of Trust and Security Agreement. Each legal document web template you get is your own property for a long time. To get another duplicate of the bought form, visit the My Forms tab and click on the related key.

If you work with the US Legal Forms website the first time, follow the simple recommendations listed below:

- Very first, be sure that you have chosen the right document web template for your region/city of your choosing. See the form description to make sure you have selected the correct form. If accessible, make use of the Preview key to appear from the document web template also.

- If you want to find another version in the form, make use of the Research industry to obtain the web template that meets your needs and specifications.

- After you have identified the web template you would like, click Acquire now to move forward.

- Select the rates strategy you would like, enter your accreditations, and register for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal account to pay for the legal form.

- Select the structure in the document and obtain it for your gadget.

- Make modifications for your document if possible. It is possible to full, modify and indication and produce Minnesota Comprehensive Commercial Deed of Trust and Security Agreement.

Obtain and produce thousands of document layouts using the US Legal Forms website, which provides the biggest variety of legal forms. Use expert and express-specific layouts to tackle your small business or person requires.