This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Gift of Entire Interest in Literary Property

Description

How to fill out Gift Of Entire Interest In Literary Property?

Are you in a situation where you require documents for occasional business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms provides thousands of template forms, such as the Minnesota Gift of Entire Interest in Literary Property, which are designed to satisfy federal and state regulations.

Once you find the appropriate form, click on Acquire now.

Choose the payment plan you prefer, enter the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Gift of Entire Interest in Literary Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/county.

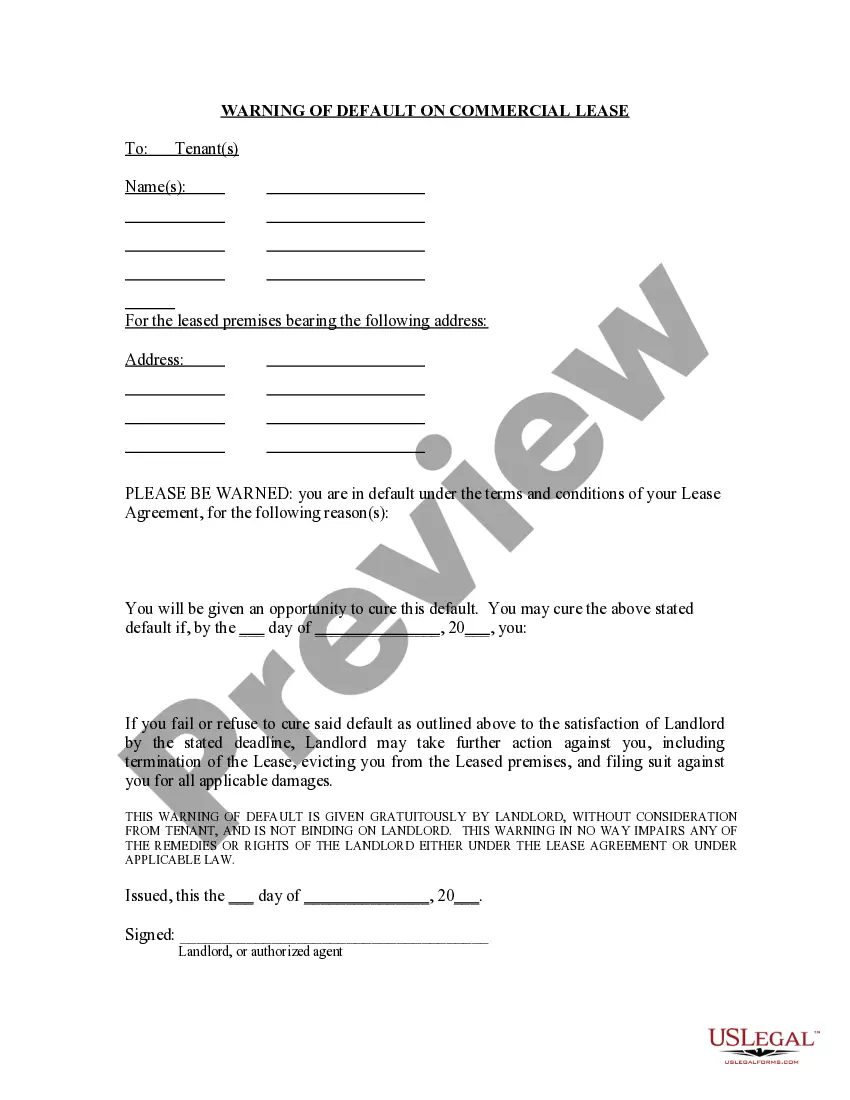

- Utilize the Preview button to review the form.

- Read the details to ensure that you have picked the correct form.

- If the form isn't what you're looking for, take advantage of the Search box to find the form that meets your needs and criteria.

Form popularity

FAQ

The annual exclusion for present interest gifts allows individuals to give up to a certain amount each year without incurring gift tax. For 2023, this exclusion amount is $17,000 per recipient. For those considering a Minnesota Gift of Entire Interest in Literary Property, utilizing the annual exclusion can be an effective strategy. By gifting literary property within these limits, you can preserve your estate and offer significant benefits to your recipients.

To document a Minnesota Gift of Entire Interest in Literary Property for the IRS, prepare a written record that includes the names of both the donor and recipient, the date of the gift, and a description of the property. This documentation is essential, especially if the amount exceeds the annual exclusion limit. Utilizing resources like US Legal Forms can simplify this process by providing templates specifically designed for gifting scenarios.

Documenting a Minnesota Gift of Entire Interest in Literary Property involves keeping detailed records of the transaction. You should maintain a copy of any written agreements, receipts, and correspondence related to the gift. Additionally, consider using platforms like US Legal Forms to create formal documentation that can serve as proof for the IRS when needed.

Generally, the recipient of a Minnesota Gift of Entire Interest in Literary Property does not have to report the gift to the IRS. However, if the gift generates income, such as royalties from the literary property, the recipient will need to report that income. It's wise for recipients to stay informed about their tax responsibilities regarding gifted property.

To declare a Minnesota Gift of Entire Interest in Literary Property on your taxes, you must complete IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. This form allows you to report any gifts made during the year, including literary property gifts. Additionally, consult your state tax guidelines, as they may have specific requirements for documenting such gifts.

Minnesota statute 326B.35 covers issues related to licensing and regulation of certain professions and occupations. This statute is essential for professionals to understand their legal responsibilities and compliance requirements. When managing a Minnesota Gift of Entire Interest in Literary Property, being compliant with relevant statutes like this can help safeguard your rights.

In Minnesota, the statute of limitations for negligence claims is typically six years. This means that if you believe you have a negligence claim, you must file it within that timeframe. Knowing this timeframe is important when dealing with any potential legal claims surrounding a Minnesota Gift of Entire Interest in Literary Property, especially if there are disputes over ownership or rights.

Statute 325F.075 in Minnesota deals with the regulation of automatic contract renewals. This law requires clear disclosure of renewal terms and gives consumers the right to cancel automatic renewals easily. For those drafting agreements involving a Minnesota Gift of Entire Interest in Literary Property, being aware of this statute can help avoid legal complications.

Yes, Minnesota has taken measures to ban PFAS substances in food packaging. The state recognizes the need to protect public health and the environment from harmful chemicals. If you are involved with a Minnesota Gift of Entire Interest in Literary Property project related to food packaging, understanding these regulations could be crucial.

The statute of transfer on death deed in Minnesota allows individuals to transfer real estate property without going through probate. This deed can simplify the process of passing on your property to heirs after your death. If you're considering a Minnesota Gift of Entire Interest in Literary Property, this statute may also apply to the transfer of related rights to your literary works.