A Minnesota Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan between two parties, specifically designed for educational purposes in Minnesota. This type of promissory note is commonly used when a student borrower requires financial assistance from an individual, organization, or even a family member to cover education-related expenses. It serves as proof of the loan agreement and provides the lender with a guarantee that the borrowed amount will be repaid by the borrower according to the agreed-upon terms. This promissory note contains several important elements, including: 1. Identification of the Parties: The note begins by identifying both the lender (also known as the payee) and the borrower (also known as the maker). Their names, addresses, and contact information are typically included. 2. Principal Loan Amount: The note specifies the exact amount of money being borrowed by the student borrower from the lender to pay for educational expenses. This could include tuition fees, books, supplies, or any other school-related costs. 3. Interest Rate: The note includes the agreed-upon interest rate, if applicable. The interest rate represents the cost incurred by the borrower for borrowing the money and is typically added on top of the principal amount. 4. Repayment Terms: This section outlines how and when the borrower must repay the loan. It includes details such as the repayment schedule, which may specify monthly, quarterly, or annual payments, as well as the due dates for each installment. The note may also include provisions for late payments or penalties for non-payment. 5. Late Fees and Prepayment Terms: If the borrower fails to make timely repayments, the note may state the amount of late fees or penalties that will be imposed. Additionally, it may outline any provisions for prepayment, allowing the borrower to pay off the loan before the scheduled term without incurring additional charges. Types of Minnesota Simple Promissory Notes for School: 1. Secured Promissory Note: This type of promissory note includes a collateral agreement, where the borrower provides an asset as security for the loan. If the borrower defaults on the payments, the lender has the right to seize the asset. 2. Unsecured Promissory Note: In contrast to a secured note, an unsecured promissory note does not require any collateral. This type of note relies solely on the borrower's promise to repay the borrowed amount. 3. Graduated Repayment Promissory Note: This type of note offers graduating payment amounts over time. It allows the borrower to pay lower amounts initially, with the payments increasing incrementally as time progresses. In conclusion, a Minnesota Simple Promissory Note for School is an essential legal document that ensures transparency and protects the interests of both the lender and the borrower in educational loan agreements. Whether secured or unsecured, it is crucial that the terms and conditions are clearly defined to avoid any confusion or disputes in the future.

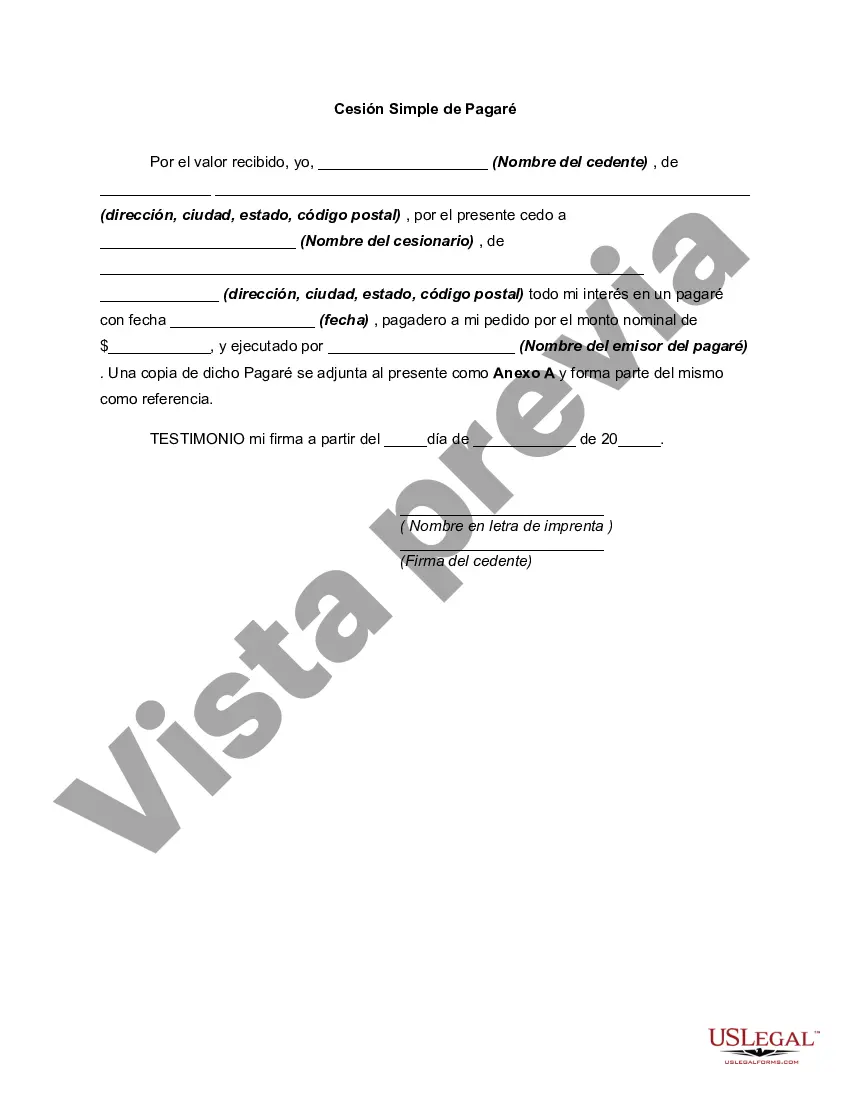

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Minnesota Pagaré Simple Para La Escuela?

Choosing the right lawful file design can be a struggle. Naturally, there are a variety of layouts available on the net, but how do you get the lawful kind you want? Use the US Legal Forms web site. The assistance offers thousands of layouts, for example the Minnesota Simple Promissory Note for School, which can be used for organization and personal demands. Every one of the forms are checked by experts and meet up with state and federal specifications.

In case you are already signed up, log in for your bank account and click the Obtain option to find the Minnesota Simple Promissory Note for School. Make use of your bank account to look throughout the lawful forms you possess ordered formerly. Check out the My Forms tab of your own bank account and get an additional backup of the file you want.

In case you are a brand new user of US Legal Forms, listed below are basic recommendations so that you can stick to:

- Very first, be sure you have chosen the appropriate kind for your personal area/state. It is possible to check out the form using the Review option and look at the form information to make certain this is the right one for you.

- In the event the kind will not meet up with your expectations, utilize the Seach field to obtain the proper kind.

- Once you are certain the form would work, select the Purchase now option to find the kind.

- Opt for the prices strategy you need and type in the needed info. Build your bank account and pay for the order using your PayPal bank account or Visa or Mastercard.

- Opt for the data file structure and obtain the lawful file design for your product.

- Complete, edit and printing and indication the acquired Minnesota Simple Promissory Note for School.

US Legal Forms is definitely the biggest library of lawful forms for which you can discover different file layouts. Use the company to obtain skillfully-created documents that stick to state specifications.