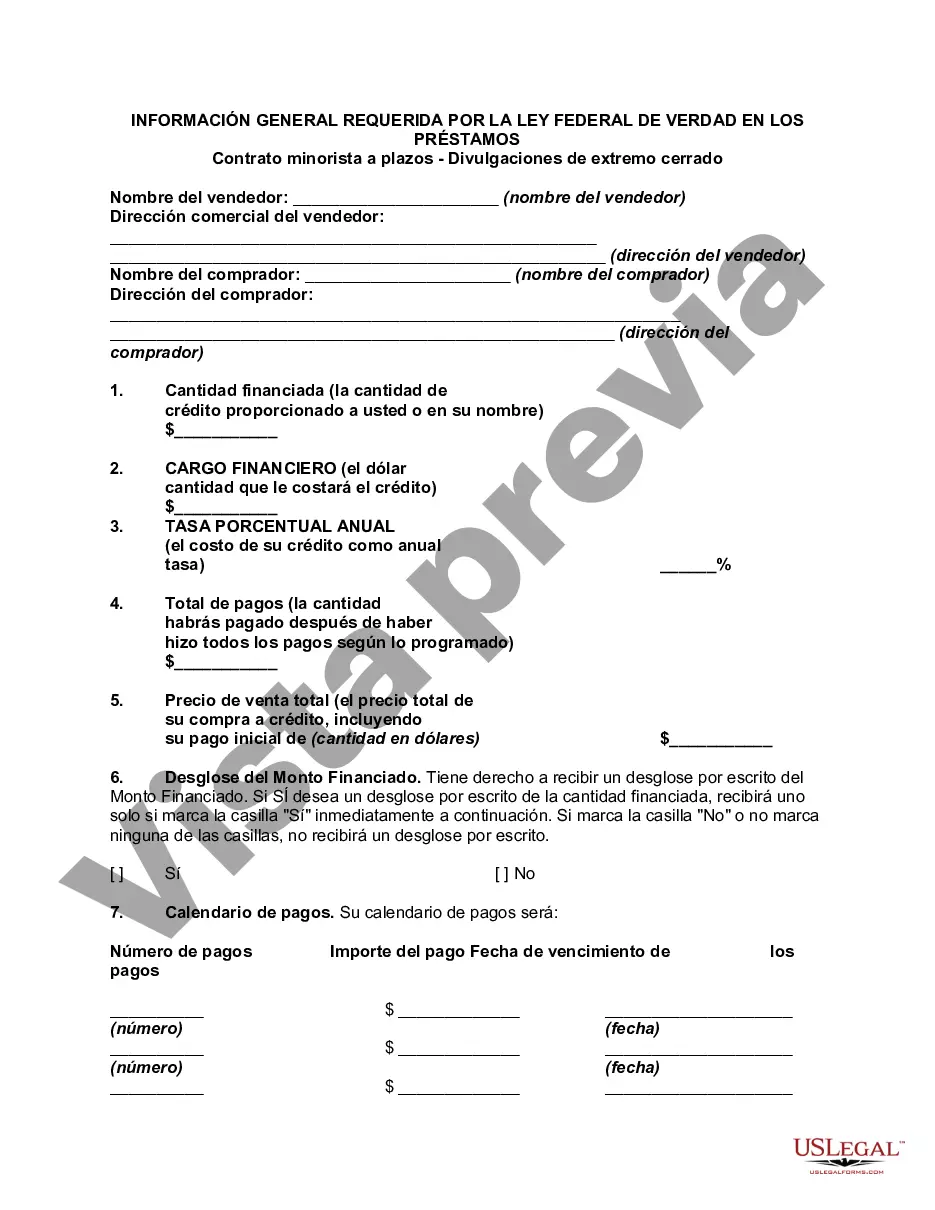

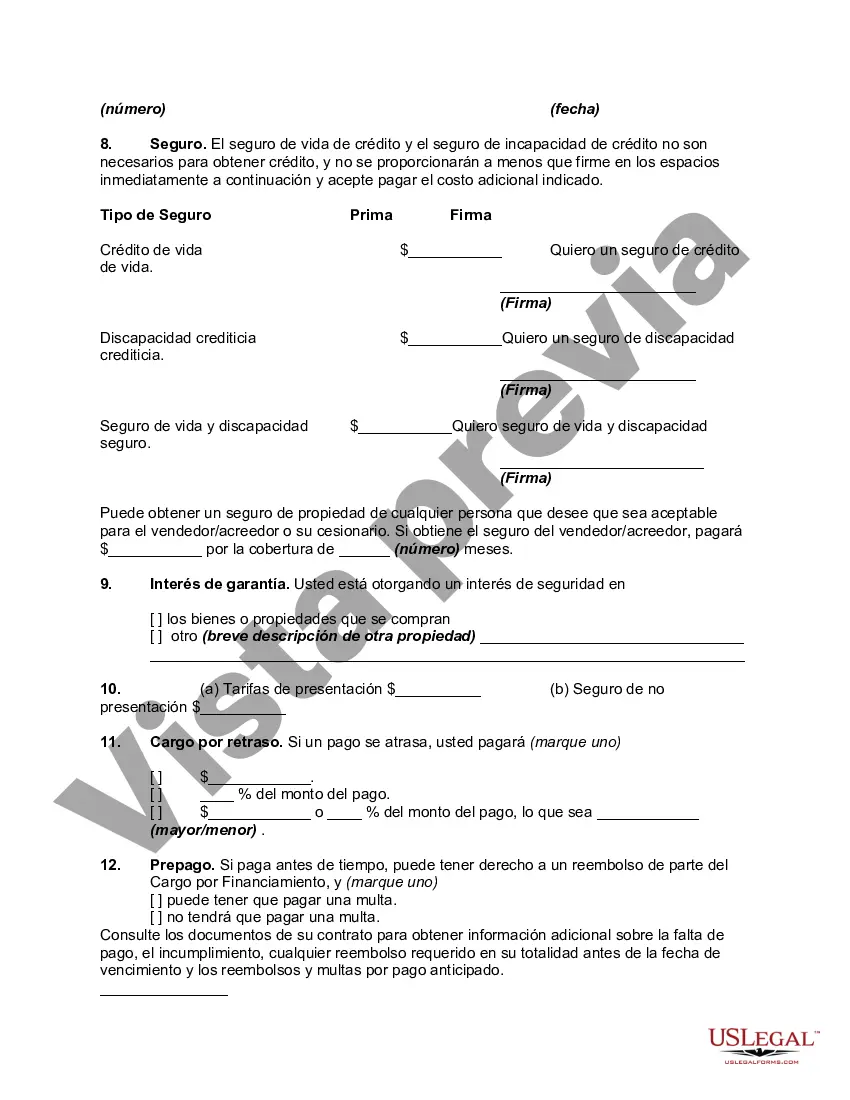

Minnesota General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures are important legal regulations that apply to consumer lending transactions in the state of Minnesota. These disclosures are mandated by the Federal Truth in Lending Act (TILL) and must be provided to borrowers before they enter into a retail installment contract. The purpose of these disclosures is to ensure that consumers have access to clear and transparent information about their loan terms, interest rates, and other important financial details. By providing these disclosures, lenders help borrowers fully understand the costs and obligations associated with their loans, allowing them to make informed decisions. There are several types of Minnesota General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures that lenders must provide: 1. Annual Percentage Rate (APR): This is a key disclosure that lenders must provide to borrowers. The APR represents the true cost of borrowing, taking into account not only the interest rate but also any additional finance charges, fees, or points associated with the loan. It allows borrowers to compare the cost of different loan offers accurately. 2. Finance Charge: This disclosure provides borrowers with information about the dollar amount they will be charged for the credit extended to them. It includes interest charges, any loan origination fees, and other finance-related charges. 3. Total of Payments: This disclosure outlines the total amount that the borrower will pay over the life of the loan, including both the principal amount borrowed and the finance charges. 4. Payment Schedule: This disclosure details the number of payments the borrower will make, the amount of each payment, and the due dates for each installment. 5. Prepayment Penalties: If applicable, this disclosure informs borrowers about any penalties or fees they may incur for paying off the loan early. 6. Security Interest: If the loan is secured by collateral, this disclosure specifies the property or assets used as security and informs the borrower of the potential consequences of defaulting on the loan. It is essential for lenders in Minnesota to ensure compliance with these Minnesota General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures. Failure to provide accurate and timely disclosures can result in legal penalties and may expose lenders to liabilities. By strictly adhering to these regulations, lenders can demonstrate their commitment to transparency and consumer protection, fostering trust with borrowers. Additionally, borrowers can use these disclosures to make well-informed financial decisions and avoid any surprises or misunderstandings regarding their obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

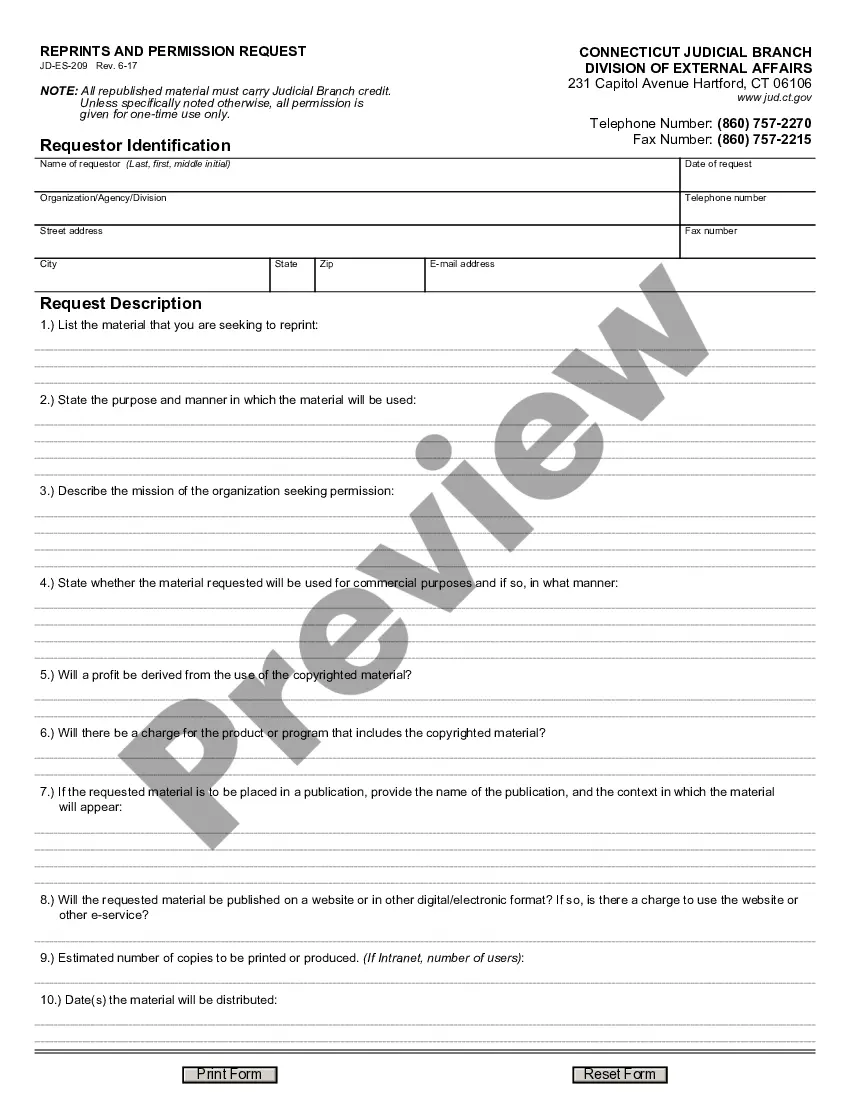

How to fill out Minnesota Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

If you need to comprehensive, down load, or printing legal file templates, use US Legal Forms, the biggest selection of legal types, that can be found on the Internet. Utilize the site`s simple and hassle-free search to discover the documents you want. Numerous templates for company and individual purposes are sorted by groups and states, or key phrases. Use US Legal Forms to discover the Minnesota General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with a handful of click throughs.

When you are currently a US Legal Forms customer, log in for your profile and click on the Acquire key to find the Minnesota General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. You can also gain access to types you previously downloaded from the My Forms tab of the profile.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for your proper area/region.

- Step 2. Take advantage of the Review method to examine the form`s information. Don`t forget to read through the information.

- Step 3. When you are not satisfied with all the form, make use of the Lookup area at the top of the monitor to find other models of your legal form template.

- Step 4. Upon having discovered the form you want, go through the Acquire now key. Choose the rates prepare you favor and add your credentials to register on an profile.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal profile to finish the financial transaction.

- Step 6. Pick the format of your legal form and down load it on your device.

- Step 7. Comprehensive, modify and printing or signal the Minnesota General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Each and every legal file template you buy is the one you have permanently. You have acces to each form you downloaded within your acccount. Select the My Forms portion and pick a form to printing or down load once more.

Remain competitive and down load, and printing the Minnesota General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with US Legal Forms. There are many skilled and state-particular types you may use to your company or individual needs.