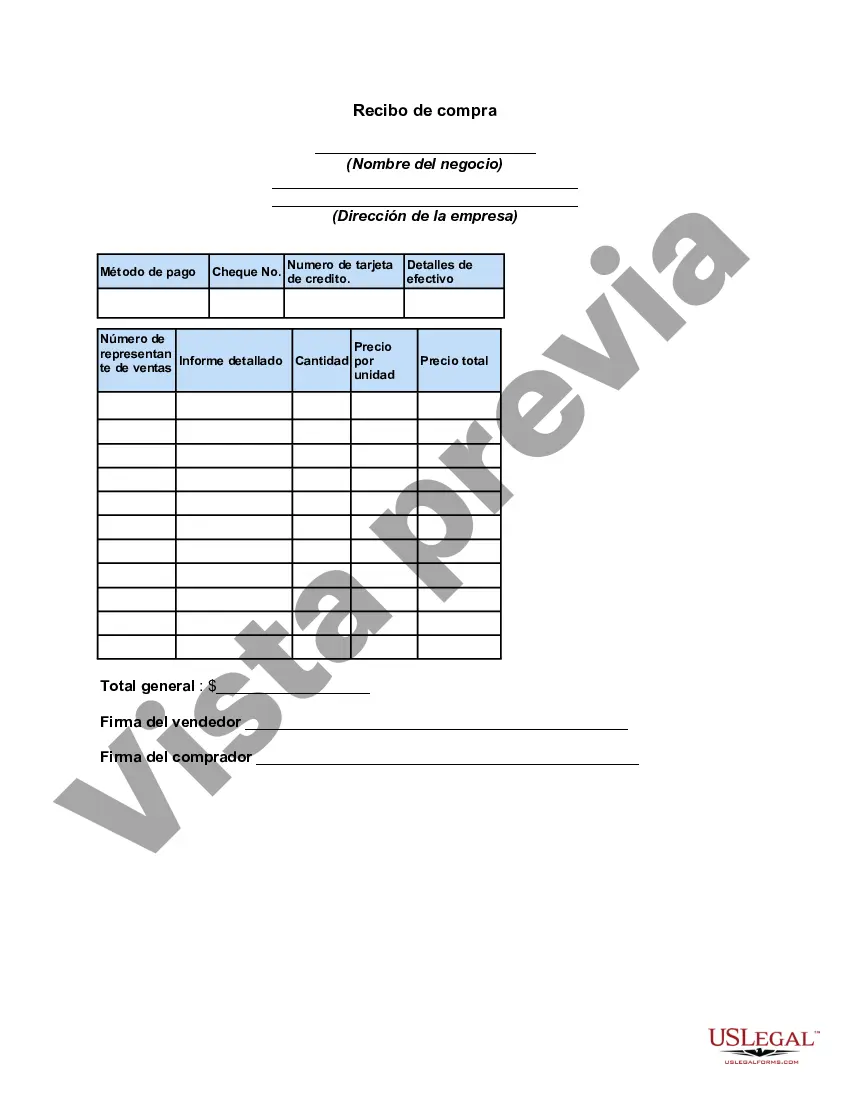

Minnesota Sales Receipt is a legal document that serves as proof of purchase for goods or services in the state of Minnesota. It contains all the necessary information required by the Minnesota Department of Revenue for tax purposes. Sales receipts are a vital part of a business's financial records and are used to track sales, calculate taxes, and provide evidence of transactions. The Minnesota Sales Receipt typically includes the following details: 1. Business Information: The name, address, and contact information of the business selling the goods or services are mentioned at the top of the receipt. This helps identify the seller for any future references. 2. Transaction Details: The receipt lists the date and time of the purchase, along with a unique receipt number. It also includes a detailed description of the items or services bought, including quantities, prices, and any applicable discounts or coupons used. 3. Payment Information: The receipt specifies the total amount paid by the customer, including any taxes or fees applied. It may also detail the payment method used, such as cash, credit card, check, or any other accepted means of payment. 4. Sales Tax Information: Minnesota requires businesses to collect and remit sales tax on taxable purchases. Hence, the receipt should clearly indicate the sales tax rate applied and the amount of sales tax charged on the transaction. This information helps the business report and pay the correct amount of sales tax. 5. Business Registration Info: Some receipts include the business's registered tax identification number or the Minnesota Sales and Use Tax Certificate of Exemption number if applicable. These numbers are crucial for tax audits and tracking purposes. In Minnesota, there are no specific types of sales receipts mentioned or mandated by the state. However, businesses may choose to design their receipts according to their specific needs, as long as they include all the required information outlined by the Minnesota Department of Revenue. In summary, a Minnesota Sales Receipt is a crucial document that provides a detailed record of a transaction between a business and its customers. It ensures compliance with tax regulations and helps businesses maintain accurate financial records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Recibo de compra - Sales Receipt

Description

How to fill out Minnesota Recibo De Compra?

Are you in a position that you will need paperwork for possibly organization or personal purposes almost every working day? There are a variety of legitimate document templates available online, but discovering kinds you can rely is not straightforward. US Legal Forms offers 1000s of type templates, such as the Minnesota Sales Receipt, that are created to meet federal and state demands.

Should you be previously acquainted with US Legal Forms internet site and also have an account, basically log in. Following that, you are able to download the Minnesota Sales Receipt template.

Should you not come with an profile and want to begin using US Legal Forms, adopt these measures:

- Find the type you require and ensure it is to the appropriate metropolis/county.

- Take advantage of the Preview switch to check the shape.

- See the description to ensure that you have chosen the proper type.

- In the event the type is not what you are looking for, take advantage of the Research industry to discover the type that meets your requirements and demands.

- When you discover the appropriate type, simply click Buy now.

- Choose the pricing plan you desire, fill in the specified details to make your account, and purchase the transaction using your PayPal or charge card.

- Pick a hassle-free file structure and download your backup.

Discover every one of the document templates you might have purchased in the My Forms menus. You may get a extra backup of Minnesota Sales Receipt anytime, if possible. Just click on the required type to download or printing the document template.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, to conserve time and avoid blunders. The services offers expertly created legitimate document templates that can be used for a selection of purposes. Make an account on US Legal Forms and commence generating your life a little easier.