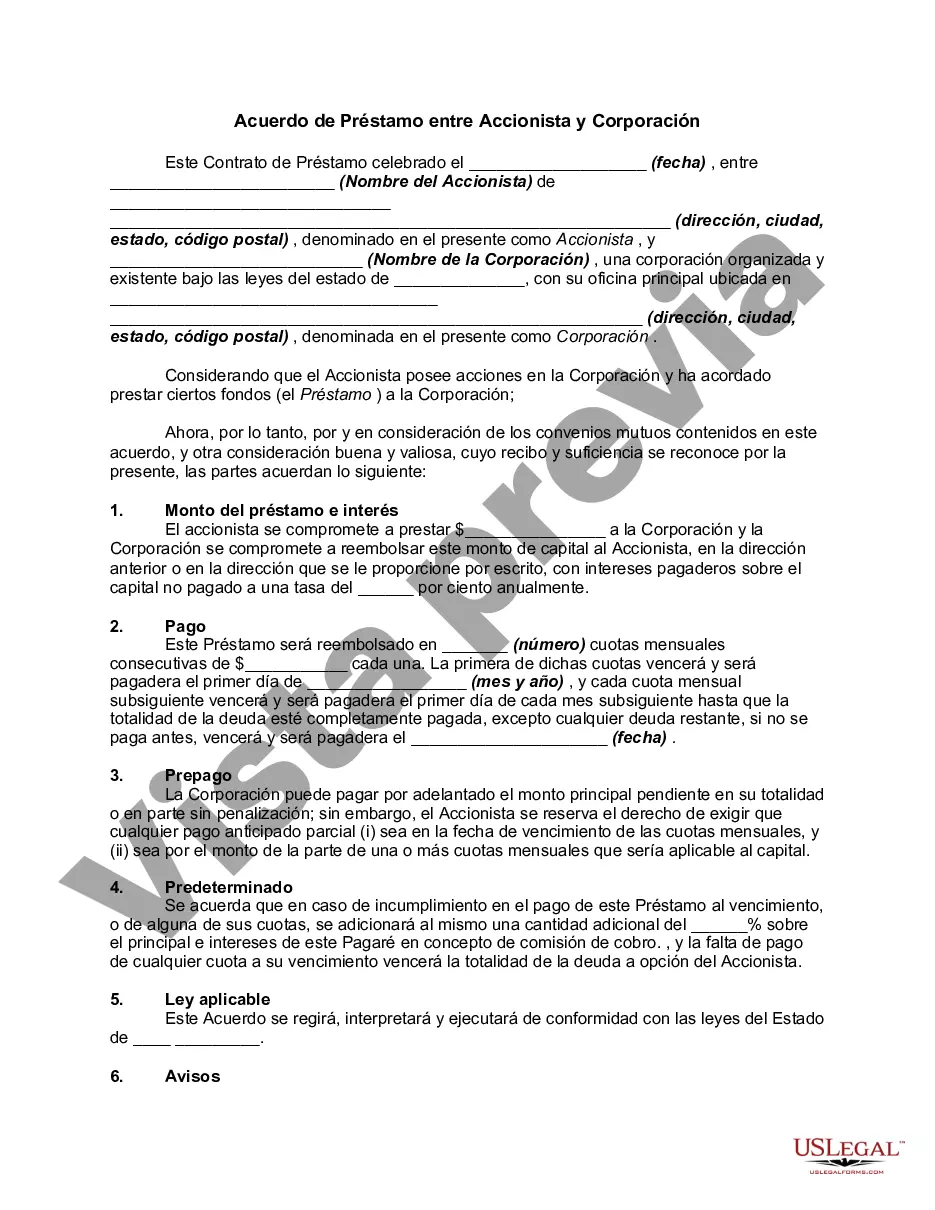

A Minnesota Loan Agreement between Stockholder and Corporation is a legally binding document that outlines the terms and conditions of a loan transaction between a stockholder(s) and a corporation based in the state of Minnesota. This agreement serves to protect the interests of both the stockholder(s) and the corporation, defining the rights, obligations, and responsibilities of each party involved. The agreement generally includes various essential details such as the names of the stockholder(s) and corporation, the principal loan amount, the interest rate, repayment terms, collateral (if any), and any additional terms and conditions specific to the loan. Keywords: Minnesota Loan Agreement, Stockholder, Corporation, loan transaction, terms and conditions, interests, rights, obligations, responsibilities, principal loan amount, interest rate, repayment terms, collateral There can be different types of Minnesota Loan Agreements between Stockholder and Corporation. Some of them are: 1. Shareholder Loan Agreement: This type of agreement is entered into when a stockholder provides a loan to the corporation in which they have ownership interest. It outlines the terms and conditions of the loan, including repayment terms, interest rates, and any additional conditions. 2. Convertible Loan Agreement: A convertible loan agreement allows the stockholder to convert their loan into equity or shares in the corporation at a later specified date. This agreement provides an option for the stockholder to become a shareholder in the corporation. 3. Demand Loan Agreement: In a demand loan agreement, the corporation has the right to demand repayment of the loan amount from the stockholder on request. This type of agreement provides flexibility to the corporation to request repayment whenever the need arises. 4. Promissory Note: A promissory note is a written promise by the corporation to repay the loan amount to the stockholder according to agreed-upon terms. While not a traditional loan agreement, it is often used in conjunction with one to formalize the loan. Keywords: Shareholder Loan Agreement, Convertible Loan Agreement, Demand Loan Agreement, Promissory Note, loan, equity, shares, repayment, interest rates, demand repayment, promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Acuerdo de Préstamo entre Accionista y Corporación - Loan Agreement between Stockholder and Corporation

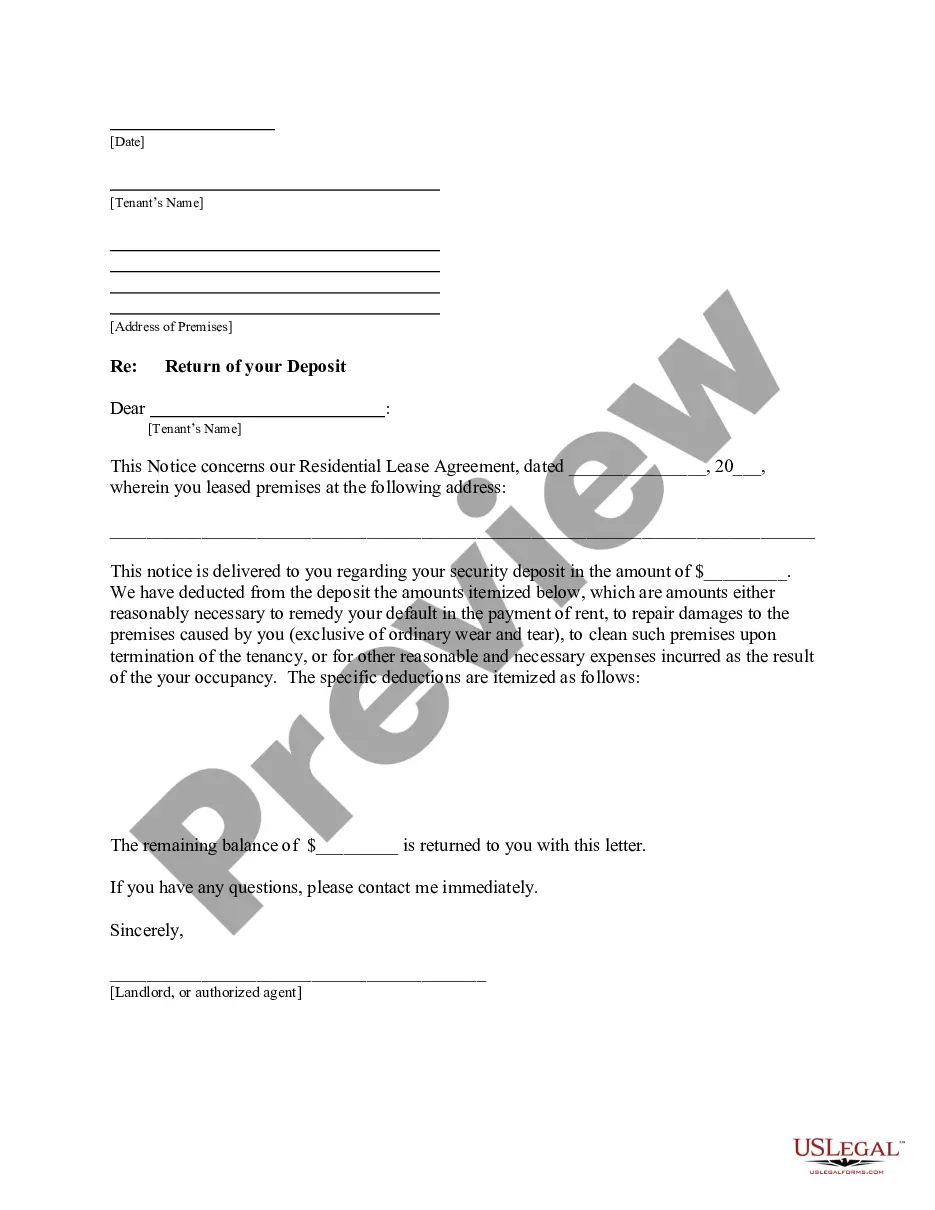

Description

How to fill out Minnesota Acuerdo De Préstamo Entre Accionista Y Corporación?

If you wish to comprehensive, download, or print out legitimate document templates, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on the web. Utilize the site`s easy and practical look for to get the documents you need. A variety of templates for organization and individual reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Minnesota Loan Agreement between Stockholder and Corporation within a handful of clicks.

If you are previously a US Legal Forms buyer, log in to your accounts and then click the Obtain key to find the Minnesota Loan Agreement between Stockholder and Corporation. Also you can accessibility kinds you previously saved inside the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for your correct area/nation.

- Step 2. Take advantage of the Review choice to look over the form`s information. Do not overlook to see the outline.

- Step 3. If you are unsatisfied with the type, use the Search area at the top of the screen to find other types in the legitimate type design.

- Step 4. Upon having identified the shape you need, select the Acquire now key. Select the prices strategy you choose and add your accreditations to register to have an accounts.

- Step 5. Procedure the deal. You should use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Pick the formatting in the legitimate type and download it on the device.

- Step 7. Complete, revise and print out or signal the Minnesota Loan Agreement between Stockholder and Corporation.

Every single legitimate document design you get is your own forever. You have acces to every type you saved within your acccount. Go through the My Forms section and pick a type to print out or download yet again.

Be competitive and download, and print out the Minnesota Loan Agreement between Stockholder and Corporation with US Legal Forms. There are millions of specialist and status-specific kinds you can utilize for the organization or individual demands.

Form popularity

FAQ

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.

A corporation is not required to have a shareholder agreement, but due to the flexibility of this document and what it can include, it is in the interest of shareholders to legalize such an agreement so as to protect their rights and the success of the corporation.

Are Shareholder's Agreements Legally Binding? Yes. A shareholders' agreement, once signed, is a legally binding contract.

The term MOI is an abbreviation for Memorandum of Incorporation. It is a document that sets out the rights, duties and responsibilities of shareholders, directors and other persons involved in a company.

A shareholders' agreement is a legally binding contract among the shareholders of a company that sets out their rights and obligations, maps out how the company should be managed, establishes share ownership, and share transfer rules all in order to provide clear solutions to contentious scenarios that may arise in

State statutes permit corporations to freely enter into binding contracts. A corporation, like an individual, has a legal duty to fulfill its contractual promises or face a possible lawsuit. A corporation may also file a breach of contract claim if its counter-party to a contract breaks his agreement.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

The president usually has general authority to bind the corporation and the manager usually has general authority to bind the LLC, but you cannot be positive without seeing the bylaws and/or a resolution for the corporation.

Corporation Incorporated under a Special Act and Joint Stock Company. Such a corporation or company will be an artificial person formed by the law. It does not have the capacity to contract outside the powers of the Memorandum of Association or the Special Act.

Not unlike bylaws, shareholder agreements may address who can serve on the board of directors. Although bylaws often contain information regarding how many shares an organization can issue, they typically do not address founder's equity, equity shares or what owners can and cannot do with their equity.