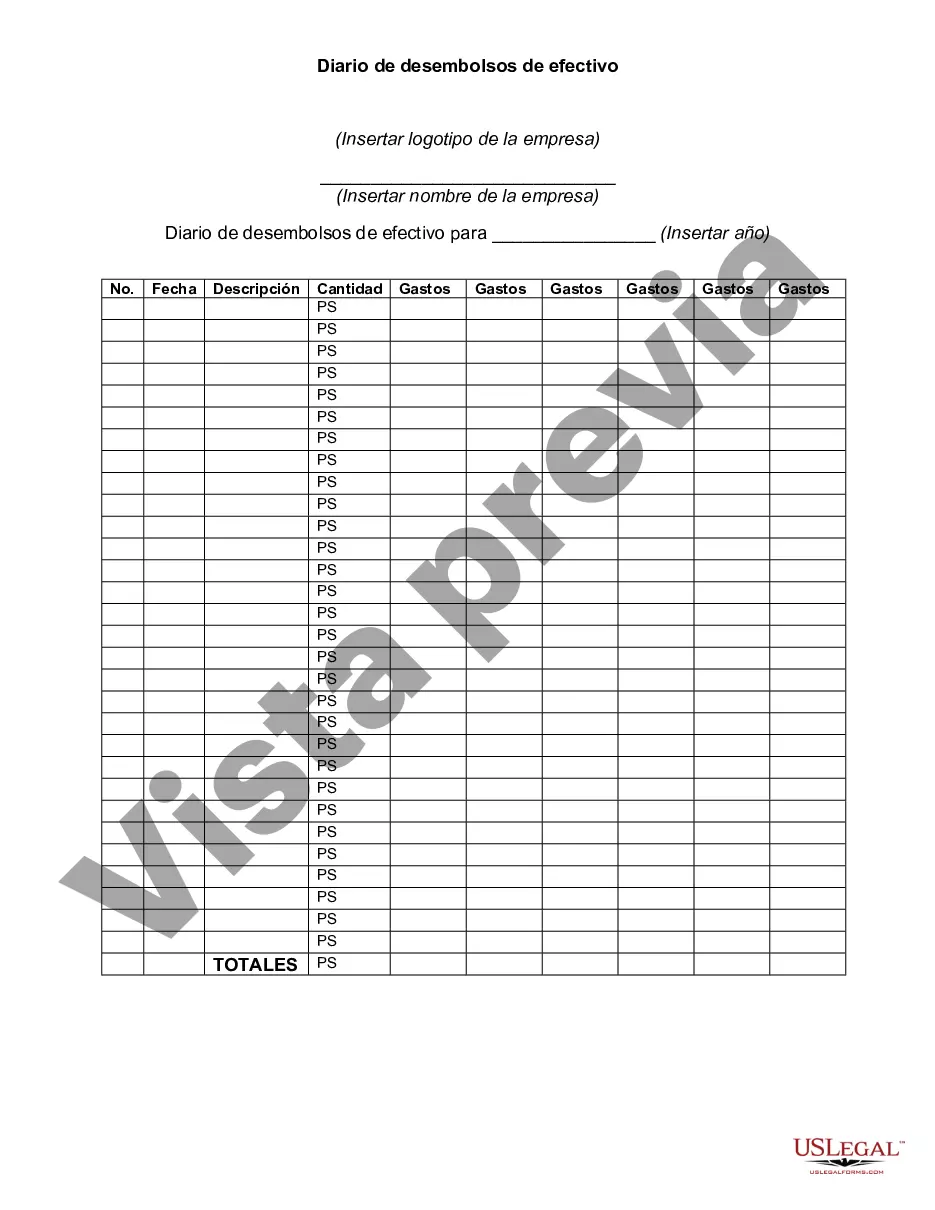

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

The Minnesota Check Disbursements Journal refers to a specific financial record that tracks and organizes the payment transactions in the state of Minnesota. This essential financial tool is utilized by businesses, organizations, and government agencies to maintain accurate records of all check disbursements made within the state. The journal provides a comprehensive overview of both outgoing payments and the corresponding details associated with each transaction. The Minnesota Check Disbursements Journal serves as a centralized repository for recording payments issued through checks. It is designed to ensure transparency and accountability in financial operations, as well as facilitate auditing procedures and internal controls. By keeping a detailed account of check disbursements, entities can maintain accurate financial records and monitor their cash flow effectively. Key information typically included in the Minnesota Check Disbursements Journal comprises the date of the transaction, the payee's name or organization, the amount disbursed, the purpose of the payment, and any additional relevant details. This information enables businesses and government entities to fulfill their obligation for accurate financial reporting, meet regulatory requirements, and enhance overall fiscal management. Different types of Minnesota Check Disbursements Journals may exist, depending on the entity and its specific needs. For instance, government agencies and non-profit organizations might maintain separate journals to comply with their unique reporting obligations. Additionally, private businesses might also have variations tailored to suit their specific accounting systems or industry requirements. In summary, the Minnesota Check Disbursements Journal is a crucial financial document utilized by organizations to record and track check payments within the state. It plays a vital role in maintaining financial transparency, facilitating auditing procedures, and ensuring accurate reporting of payment disbursements. By properly documenting all check transactions, entities can enhance their financial management practices and comply with regulatory requirements.The Minnesota Check Disbursements Journal refers to a specific financial record that tracks and organizes the payment transactions in the state of Minnesota. This essential financial tool is utilized by businesses, organizations, and government agencies to maintain accurate records of all check disbursements made within the state. The journal provides a comprehensive overview of both outgoing payments and the corresponding details associated with each transaction. The Minnesota Check Disbursements Journal serves as a centralized repository for recording payments issued through checks. It is designed to ensure transparency and accountability in financial operations, as well as facilitate auditing procedures and internal controls. By keeping a detailed account of check disbursements, entities can maintain accurate financial records and monitor their cash flow effectively. Key information typically included in the Minnesota Check Disbursements Journal comprises the date of the transaction, the payee's name or organization, the amount disbursed, the purpose of the payment, and any additional relevant details. This information enables businesses and government entities to fulfill their obligation for accurate financial reporting, meet regulatory requirements, and enhance overall fiscal management. Different types of Minnesota Check Disbursements Journals may exist, depending on the entity and its specific needs. For instance, government agencies and non-profit organizations might maintain separate journals to comply with their unique reporting obligations. Additionally, private businesses might also have variations tailored to suit their specific accounting systems or industry requirements. In summary, the Minnesota Check Disbursements Journal is a crucial financial document utilized by organizations to record and track check payments within the state. It plays a vital role in maintaining financial transparency, facilitating auditing procedures, and ensuring accurate reporting of payment disbursements. By properly documenting all check transactions, entities can enhance their financial management practices and comply with regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.