A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

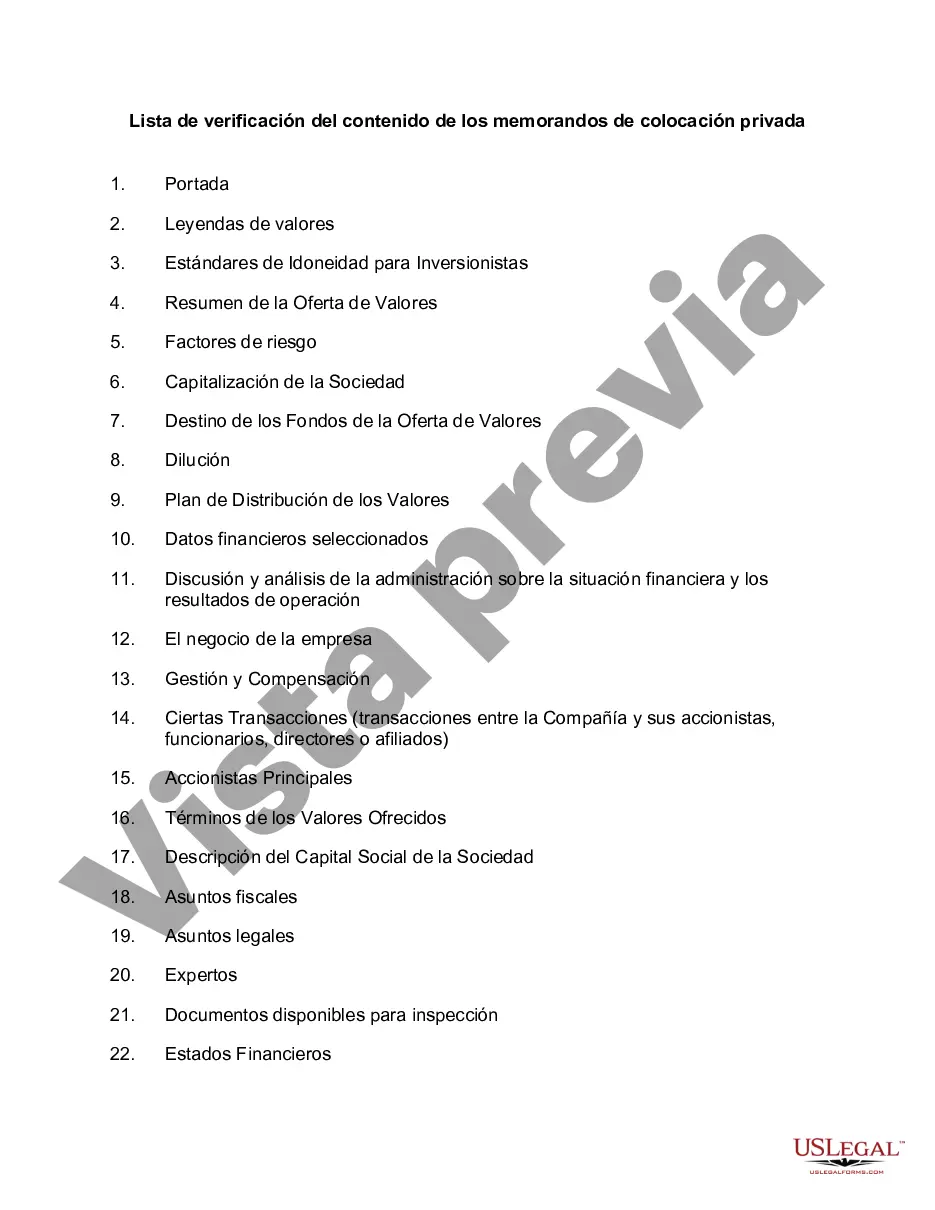

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Minnesota Checklist for Contents of Private Placement Memorandum: A Comprehensive Guide for Investors Private placement memorandums (Ppm) are crucial legal documents used by companies when seeking to raise capital from private investors. In the state of Minnesota, specific guidelines and requirements must be met to ensure compliance with securities laws. This comprehensive guide provides an in-depth description of what comprises a Minnesota Checklist for the Contents of a Private Placement Memorandum, offering valuable insights for both investors and companies alike. 1. Executive Summary: The PPM must include a concise and informative executive summary that outlines the key points and investment opportunities in the offering. 2. Description of the Issuer: Detailed information about the company must be provided, including its history, legal structure, financial statements, management team, and ownership structure. 3. Offering Terms and Specifics: This section outlines the terms of the offering, including the type and amount of the securities being offered, the purchase price, minimum investment thresholds, and any associated fees or expenses. 4. Risk Factors: Investors must be made aware of the potential risks involved in the investment. This section includes a comprehensive list of risk factors that may affect the company or the success of the offering. 5. Use of Proceeds: The PPM should clearly outline how the proceeds raised from the offering will be utilized by the company. 6. Dilution: If the investment involves the issuance of additional securities, the PPM must provide information about how the new securities will impact the ownership interests of existing shareholders. 7. Plan of Distribution: This section details how the offering will be conducted, including any arrangements with broker-dealers or placement agents, transfer restrictions, and the estimated timeline. 8. Management and Advisors: A comprehensive overview of the company's management team, their backgrounds, and relevant experience should be included, along with information on any external advisors or consultants involved in the offering. 9. Financial Information: Detailed financial statements including balance sheets, income statements, and cash flow statements must be provided, accompanied by explanatory notes and any relevant risk analyses. 10. Legal and Regulatory Matters: This section covers any legal or regulatory matters that may significantly impact the company's operations, such as pending litigation, government approvals, or intellectual property rights. Types of Minnesota Checklists for Contents of Private Placement Memorandum: 1. Equity Offerings: This checklist focuses on private placements involving equity securities, such as common stock or preferred stock. 2. Debt Offerings: Specific to debt-based investments, this checklist highlights the necessary components for private placements involving loan notes or corporate bonds. 3. Real Estate Offerings: For private placements related to real estate ventures, this checklist covers unique factors considered when investing in property-related projects. 4. Start-Up Offerings: This checklist caters to private placements for start-up companies, taking into account the specific challenges and risk factors associated with early-stage businesses. In conclusion, a Minnesota Checklist for Contents of Private Placement Memorandum is a crucial document that ensures compliance with securities laws and provides essential information for investors considering private placements. This comprehensive guide covers the essential elements of a PPM, including an executive summary, company description, offering terms, risk factors, use of proceeds, diluted ownership, and various other crucial sections. Depending on the nature of the investment, different checklists may be required, such as those for equity offerings, debt offerings, real estate offerings, or start-up offerings.Minnesota Checklist for Contents of Private Placement Memorandum: A Comprehensive Guide for Investors Private placement memorandums (Ppm) are crucial legal documents used by companies when seeking to raise capital from private investors. In the state of Minnesota, specific guidelines and requirements must be met to ensure compliance with securities laws. This comprehensive guide provides an in-depth description of what comprises a Minnesota Checklist for the Contents of a Private Placement Memorandum, offering valuable insights for both investors and companies alike. 1. Executive Summary: The PPM must include a concise and informative executive summary that outlines the key points and investment opportunities in the offering. 2. Description of the Issuer: Detailed information about the company must be provided, including its history, legal structure, financial statements, management team, and ownership structure. 3. Offering Terms and Specifics: This section outlines the terms of the offering, including the type and amount of the securities being offered, the purchase price, minimum investment thresholds, and any associated fees or expenses. 4. Risk Factors: Investors must be made aware of the potential risks involved in the investment. This section includes a comprehensive list of risk factors that may affect the company or the success of the offering. 5. Use of Proceeds: The PPM should clearly outline how the proceeds raised from the offering will be utilized by the company. 6. Dilution: If the investment involves the issuance of additional securities, the PPM must provide information about how the new securities will impact the ownership interests of existing shareholders. 7. Plan of Distribution: This section details how the offering will be conducted, including any arrangements with broker-dealers or placement agents, transfer restrictions, and the estimated timeline. 8. Management and Advisors: A comprehensive overview of the company's management team, their backgrounds, and relevant experience should be included, along with information on any external advisors or consultants involved in the offering. 9. Financial Information: Detailed financial statements including balance sheets, income statements, and cash flow statements must be provided, accompanied by explanatory notes and any relevant risk analyses. 10. Legal and Regulatory Matters: This section covers any legal or regulatory matters that may significantly impact the company's operations, such as pending litigation, government approvals, or intellectual property rights. Types of Minnesota Checklists for Contents of Private Placement Memorandum: 1. Equity Offerings: This checklist focuses on private placements involving equity securities, such as common stock or preferred stock. 2. Debt Offerings: Specific to debt-based investments, this checklist highlights the necessary components for private placements involving loan notes or corporate bonds. 3. Real Estate Offerings: For private placements related to real estate ventures, this checklist covers unique factors considered when investing in property-related projects. 4. Start-Up Offerings: This checklist caters to private placements for start-up companies, taking into account the specific challenges and risk factors associated with early-stage businesses. In conclusion, a Minnesota Checklist for Contents of Private Placement Memorandum is a crucial document that ensures compliance with securities laws and provides essential information for investors considering private placements. This comprehensive guide covers the essential elements of a PPM, including an executive summary, company description, offering terms, risk factors, use of proceeds, diluted ownership, and various other crucial sections. Depending on the nature of the investment, different checklists may be required, such as those for equity offerings, debt offerings, real estate offerings, or start-up offerings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.