Minnesota Agreement to Form Partnership in Future to Conduct Business

Description

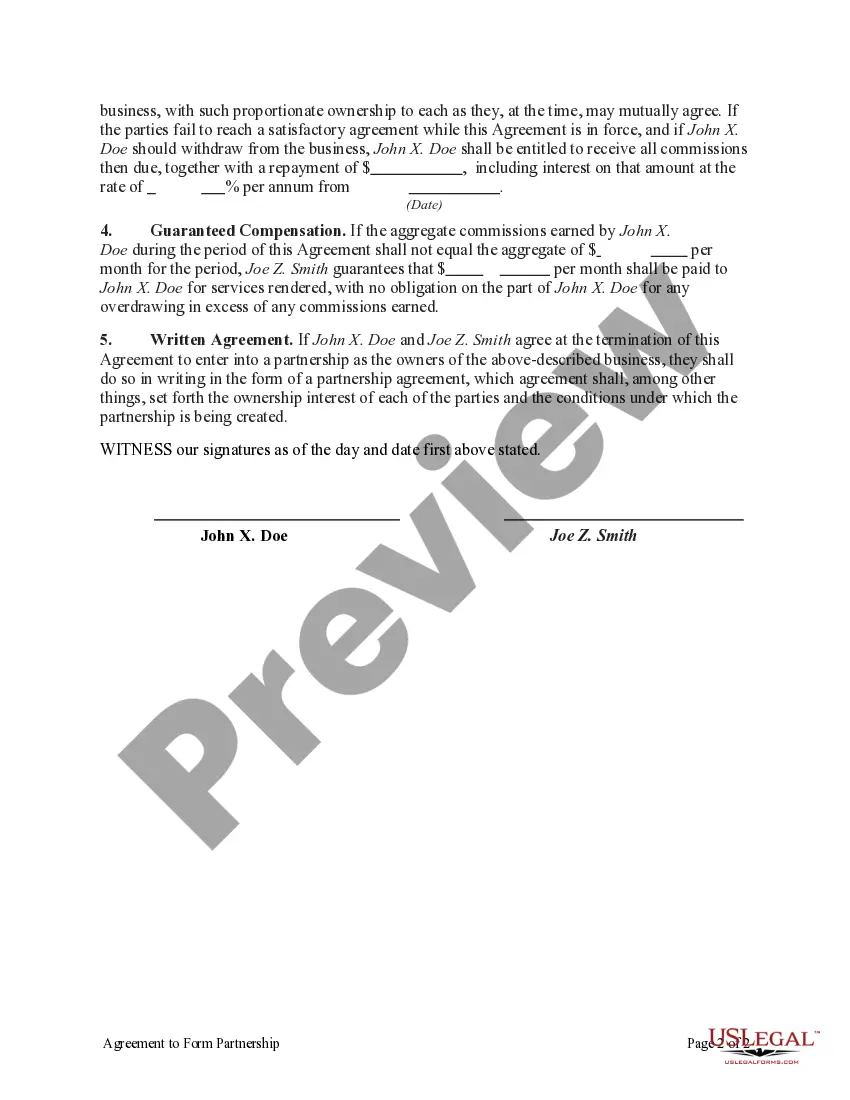

How to fill out Agreement To Form Partnership In Future To Conduct Business?

You can invest numerous hours online attempting to locate the legal document format that meets the state and federal requirements you seek.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

It is easy to download or print the Minnesota Agreement to Establish Partnership in the Future to Conduct Business from the service.

If available, use the Review option to browse through the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can complete, modify, print, or sign the Minnesota Agreement to Establish Partnership in Future to Conduct Business.

- Every legal document format you obtain is yours indefinitely.

- To obtain another copy of a purchased document, navigate to the My documents tab and click the corresponding option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your region/area of choice.

- Check the form details to confirm you have selected the appropriate document.

Form popularity

FAQ

Yes, you can write your own partnership agreement, but it is wise to ensure it meets legal standards for your state. The Minnesota Agreement to Form Partnership in Future to Conduct Business should cover key aspects, such as profit distribution, roles, and responsibilities. If you want to enhance clarity and compliance, utilizing a resource like uslegalforms can provide templates and guidance to help you draft a comprehensive agreement with ease.

A 51% to 49% partnership indicates that one partner holds a controlling interest in the business, possessing 51% ownership, while the other partner owns 49%. This ownership structure can affect decision-making authority, profit sharing, and overall management of the partnership. Understanding the implications of such a percentage is crucial when creating your Minnesota Agreement to Form Partnership in Future to Conduct Business, as it outlines responsibilities and expectations.

When forming a partnership, you may encounter various expenses related to the Minnesota Agreement to Form Partnership in Future to Conduct Business. These costs can include legal fees for drafting the agreement, filing fees for registration if applicable, and costs for initial business setup. It’s important to budget for these expenses to ensure a smooth partnership formation process. Additionally, using platforms like uslegalforms can streamline the process and reduce legal costs.

No, a written agreement is not legally required to form a partnership, but it is extremely beneficial. In Minnesota, a Minnesota Agreement to Form Partnership in Future to Conduct Business provides legal clarity and protection for all partners involved. A well-crafted agreement helps outline how the business will operate and addresses issues like profit sharing and decision-making. To ensure a smooth partnership journey, consider drafting this agreement.

Forming a partnership does not strictly require a written agreement; however, having one is highly recommended. A Minnesota Agreement to Form Partnership in Future to Conduct Business helps define each partner's roles, contributions, and expectations. This clarity can significantly reduce the risk of misunderstandings and disputes. Therefore, while you can start a partnership without a written document, it is prudent to create one for long-term success.

When there is no written agreement, disputes among partners can arise more easily. A verbal understanding may not clearly outline each partner's responsibilities or share of profits. In Minnesota, without a clear Minnesota Agreement to Form Partnership in Future to Conduct Business, you might face unexpected challenges. It's wise to document your partnership to prevent potential conflicts and ensure everyone is on the same page.

The four stages of partnership include formation, operation, growth, and dissolution. During formation, partners establish their roles and agreements, often using a Minnesota Agreement to Form Partnership in Future to Conduct Business as a guide. The operation phase focuses on day-to-day activities, while growth explores expansion strategies. Finally, the dissolution stage involves the process of ending the partnership, ideally with a clear plan in place.

The four types of business partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has unique characteristics and legal implications. By understanding these options, you can choose the most suitable form of collaboration for your business goals, supported by the Minnesota Agreement to Form Partnership in Future to Conduct Business.

Filling out a partnership agreement involves outlining the key terms and conditions governing the partnership. Start by defining the roles and responsibilities of each partner, along with how profits and losses will be shared. Reference the Minnesota Agreement to Form Partnership in Future to Conduct Business for guidance on how to address important issues like dispute resolution and exit strategies.

The four types of key partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type varies in terms of liability, management, and profit-sharing. Understanding these distinctions is crucial for selecting the right structure, especially when creating a Minnesota Agreement to Form Partnership in Future to Conduct Business.