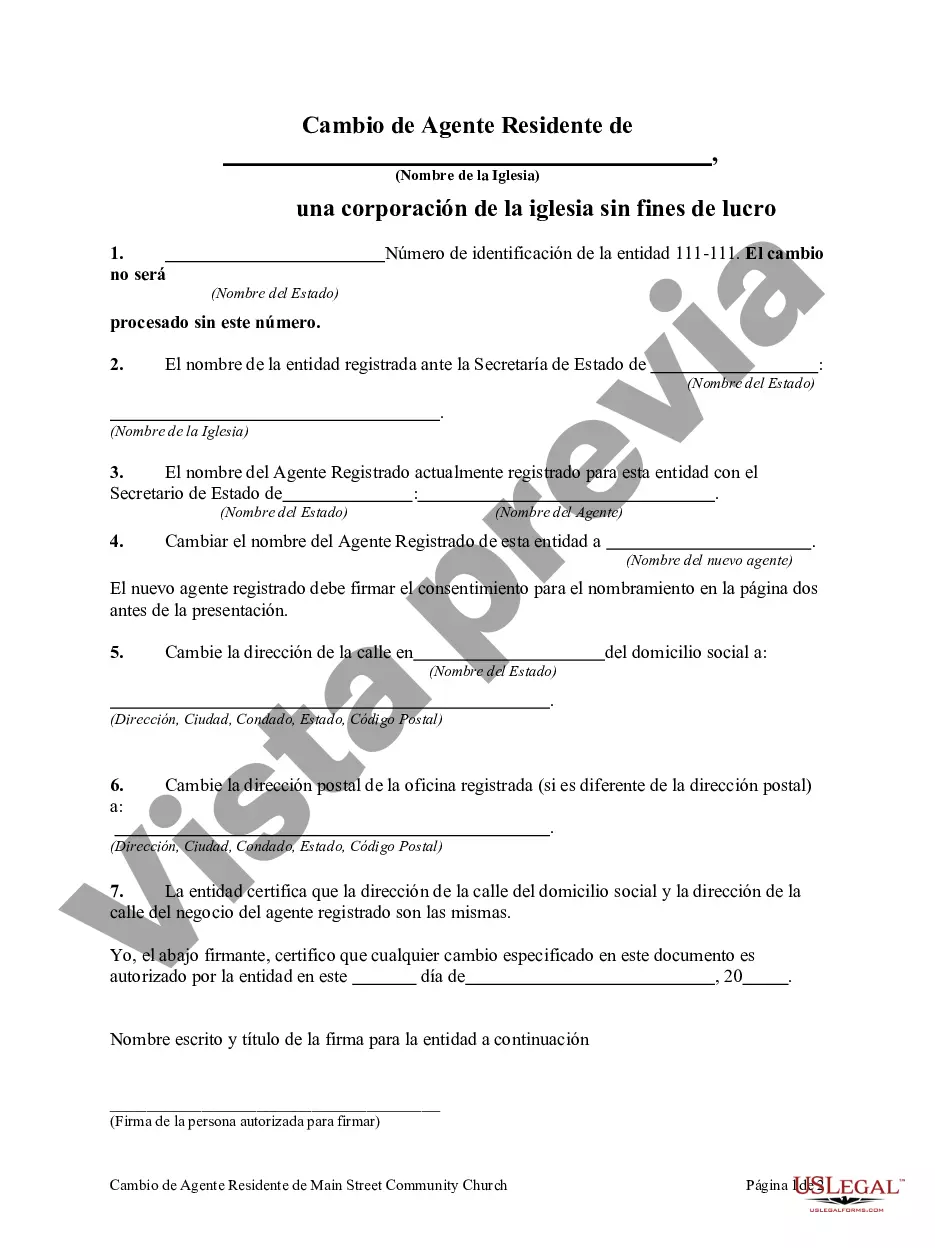

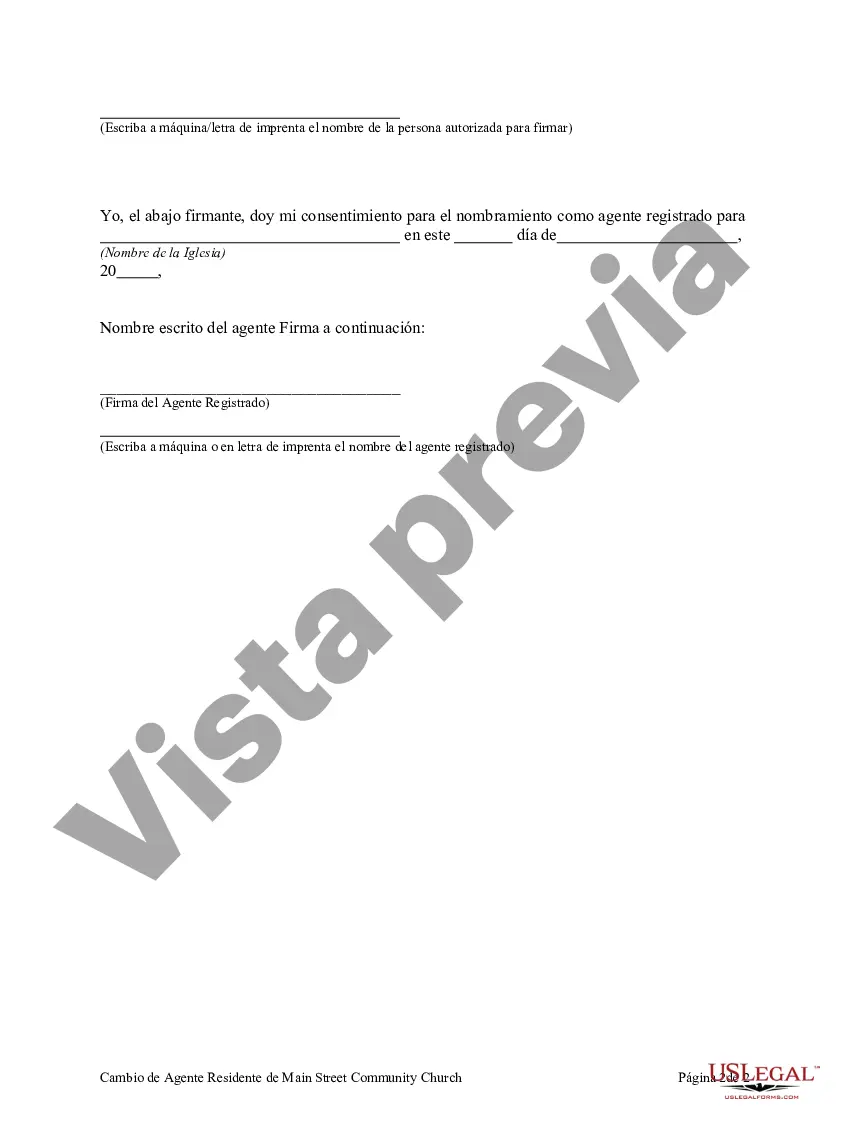

The Minnesota Change of Resident Agent of Non-Profit Church Corporation refers to the process and requirements for altering the designated resident agent of a non-profit church corporation in the state of Minnesota. A resident agent is an individual or an entity appointed by a corporation to receive legal and official documents on its behalf. This change is necessary when the current resident agent becomes unavailable, relocates, or when the non-profit church corporation desires to designate a different resident agent altogether. To proceed with the Minnesota Change of Resident Agent of Non-Profit Church Corporation, specific guidelines and procedures need to be followed. It is crucial to ensure compliance with the state laws and regulations governing non-profit corporations in Minnesota. Hiring the services of an attorney or legal professional who specializes in non-profit law is highly recommended ensuring accuracy and adherence to legal requirements. The process to change the resident agent typically involves the following steps: 1. Identify the new resident agent: The non-profit church corporation needs to select an eligible individual or entity to act as the new resident agent. This person or entity must have a physical address within Minnesota and be willing to fulfill the obligations and responsibilities associated with the role. 2. Obtain consent: The selected individual or entity should agree to act as the resident agent and provide written consent. This consent must be obtained before proceeding with the change. 3. Prepare the required documents: Prepare the necessary paperwork for the change of resident agent. This usually includes completing a specific form provided by the Minnesota Secretary of State and providing accurate information about the non-profit church corporation, both the current and new resident agent. 4. Submission and filing: Submit the completed paperwork, along with any applicable filing fees, to the Minnesota Secretary of State. It is essential to ensure all the required fields are accurately completed to avoid delays or rejections. Once the Minnesota Secretary of State approves the change of resident agent request, the non-profit church corporation will receive confirmation or an amended certificate reflecting the updated resident agent information. It is important to note that there are no different types of change of resident agent specific to non-profit church corporations in Minnesota. However, the process may differ if the non-profit church corporation is situated in a different state or if it has additional unique circumstances or legal considerations. Keywords: Minnesota, Change of Resident Agent, Non-Profit Church Corporation, guidelines, procedures, compliance, non-profit law, legal requirements, resident agent, eligibility, consent, paperwork, Secretary of State, filing, fees, confirmation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

Description

How to fill out Minnesota Cambio De Agente Residente De Non-Profit Church Corporation?

Are you in a placement in which you will need files for sometimes organization or person functions almost every day time? There are plenty of authorized record web templates available online, but discovering ones you can trust is not effortless. US Legal Forms offers a large number of kind web templates, like the Minnesota Change of Resident Agent of Non-Profit Church Corporation, that are published to satisfy state and federal demands.

Should you be currently acquainted with US Legal Forms website and get your account, basically log in. Following that, you are able to acquire the Minnesota Change of Resident Agent of Non-Profit Church Corporation template.

Should you not provide an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for that appropriate town/county.

- Take advantage of the Review key to analyze the form.

- See the description to ensure that you have chosen the proper kind.

- If the kind is not what you are searching for, use the Lookup area to get the kind that fits your needs and demands.

- Once you find the appropriate kind, click Get now.

- Select the pricing prepare you want, fill out the specified information and facts to make your account, and purchase the transaction with your PayPal or bank card.

- Pick a hassle-free file format and acquire your version.

Find each of the record web templates you possess purchased in the My Forms food list. You may get a additional version of Minnesota Change of Resident Agent of Non-Profit Church Corporation whenever, if necessary. Just click the required kind to acquire or produce the record template.

Use US Legal Forms, one of the most substantial variety of authorized forms, to save lots of some time and steer clear of mistakes. The services offers appropriately made authorized record web templates that can be used for a variety of functions. Create your account on US Legal Forms and initiate creating your lifestyle a little easier.