Minnesota Joint Trust with Income Payable to Trustees During Joint Lives is a specific type of trust established in Minnesota that allows the trustees, or the creators of the trust, to receive income from the trust during their joint lives. This trust structure ensures that the trustees maintain a stable and reliable source of income while also providing for the preservation and management of the trust's assets. The Minnesota Joint Trust with Income Payable to Trustees During Joint Lives offers several benefits to individuals looking to establish trusts. Firstly, it provides financial security by ensuring a steady flow of income to the trustees throughout their joint lives. This income can be utilized to cover living expenses, medical costs, or any other financial needs the trustees may have. Additionally, this trust structure allows for the preservation and management of the trust's assets. The trustees can designate a trustee who will be responsible for managing and investing the trust's assets, ensuring their growth and long-term sustainability. This helps protect the trustees' financial interests while they focus on enjoying the income generated by the trust. It is important to note that there may be different variations or subtypes of the Minnesota Joint Trust with Income Payable to Trustees During Joint Lives. These variations can be customized to cater to the unique needs and goals of the trustees. Some possible types include: 1. Revocable Minnesota Joint Trust with Income Payable to Trustees During Joint Lives: This form of the trust allows the trustees to make changes or revoke the trust's terms during their joint lives. It offers flexibility and control over the trust's assets and income distribution. 2. Irrevocable Minnesota Joint Trust with Income Payable to Trustees During Joint Lives: Unlike the revocable trust, this type of trust cannot be altered or revoked after its creation. It ensures that the trustees' income needs are met while also safeguarding the trust's assets from potential creditors or other potential threats. 3. Charitable Minnesota Joint Trust with Income Payable to Trustees During Joint Lives: This trust variation allows the trustees to designate a charitable organization as a beneficiary. While the trustees receive income during their joint lives, the remaining assets are ultimately donated to the chosen charitable cause upon their passing. This form of trust enables trustees to support causes they deeply care about. In conclusion, the Minnesota Joint Trust with Income Payable to Trustees During Joint Lives offers a secure and reliable income stream for trustees while simultaneously preserving and managing the trust's assets. The specific type of trust can vary depending on whether it is revocable, irrevocable, or charitable, allowing individuals to align the trust's structure with their unique needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Fideicomiso conjunto con ingresos pagaderos a los fideicomitentes durante la vida conjunta - Joint Trust with Income Payable to Trustors During Joint Lives

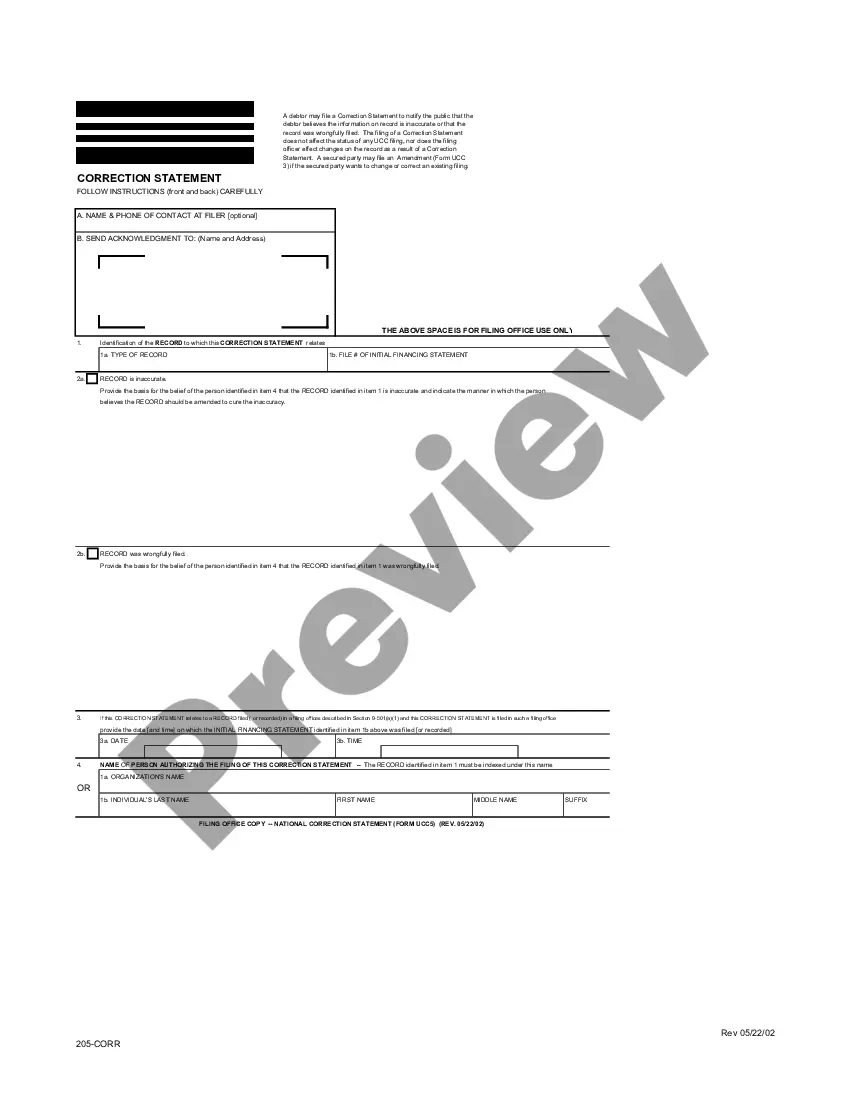

Description

How to fill out Minnesota Fideicomiso Conjunto Con Ingresos Pagaderos A Los Fideicomitentes Durante La Vida Conjunta?

You can commit time on-line searching for the legitimate record design that suits the state and federal demands you want. US Legal Forms provides a huge number of legitimate varieties that are analyzed by professionals. You can easily acquire or printing the Minnesota Joint Trust with Income Payable to Trustors During Joint Lives from the support.

If you already possess a US Legal Forms bank account, you are able to log in and click the Obtain key. Next, you are able to full, modify, printing, or signal the Minnesota Joint Trust with Income Payable to Trustors During Joint Lives. Every single legitimate record design you acquire is your own property permanently. To get an additional version for any acquired form, go to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms website the first time, adhere to the easy guidelines beneath:

- Initially, ensure that you have chosen the correct record design for your area/town that you pick. Browse the form information to ensure you have selected the proper form. If offered, take advantage of the Preview key to search through the record design at the same time.

- If you want to find an additional model of your form, take advantage of the Research discipline to find the design that meets your requirements and demands.

- After you have found the design you need, click Acquire now to proceed.

- Pick the prices program you need, enter your references, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your bank card or PayPal bank account to purchase the legitimate form.

- Pick the formatting of your record and acquire it for your product.

- Make adjustments for your record if necessary. You can full, modify and signal and printing Minnesota Joint Trust with Income Payable to Trustors During Joint Lives.

Obtain and printing a huge number of record themes utilizing the US Legal Forms web site, that offers the greatest assortment of legitimate varieties. Use specialist and state-specific themes to deal with your small business or specific requires.