Minnesota Affidavit regarding Account Access Signature Card

Description

How to fill out Affidavit Regarding Account Access Signature Card?

Finding the right authorized record format can be quite a struggle. Obviously, there are a lot of templates available on the Internet, but how will you discover the authorized kind you will need? Make use of the US Legal Forms website. The assistance gives thousands of templates, for example the Minnesota Affidavit regarding Account Access Signature Card, that can be used for enterprise and personal demands. All of the types are inspected by pros and meet federal and state requirements.

Should you be presently authorized, log in in your profile and click the Down load button to obtain the Minnesota Affidavit regarding Account Access Signature Card. Use your profile to check from the authorized types you have acquired formerly. Go to the My Forms tab of the profile and obtain an additional duplicate from the record you will need.

Should you be a whole new consumer of US Legal Forms, here are basic directions so that you can follow:

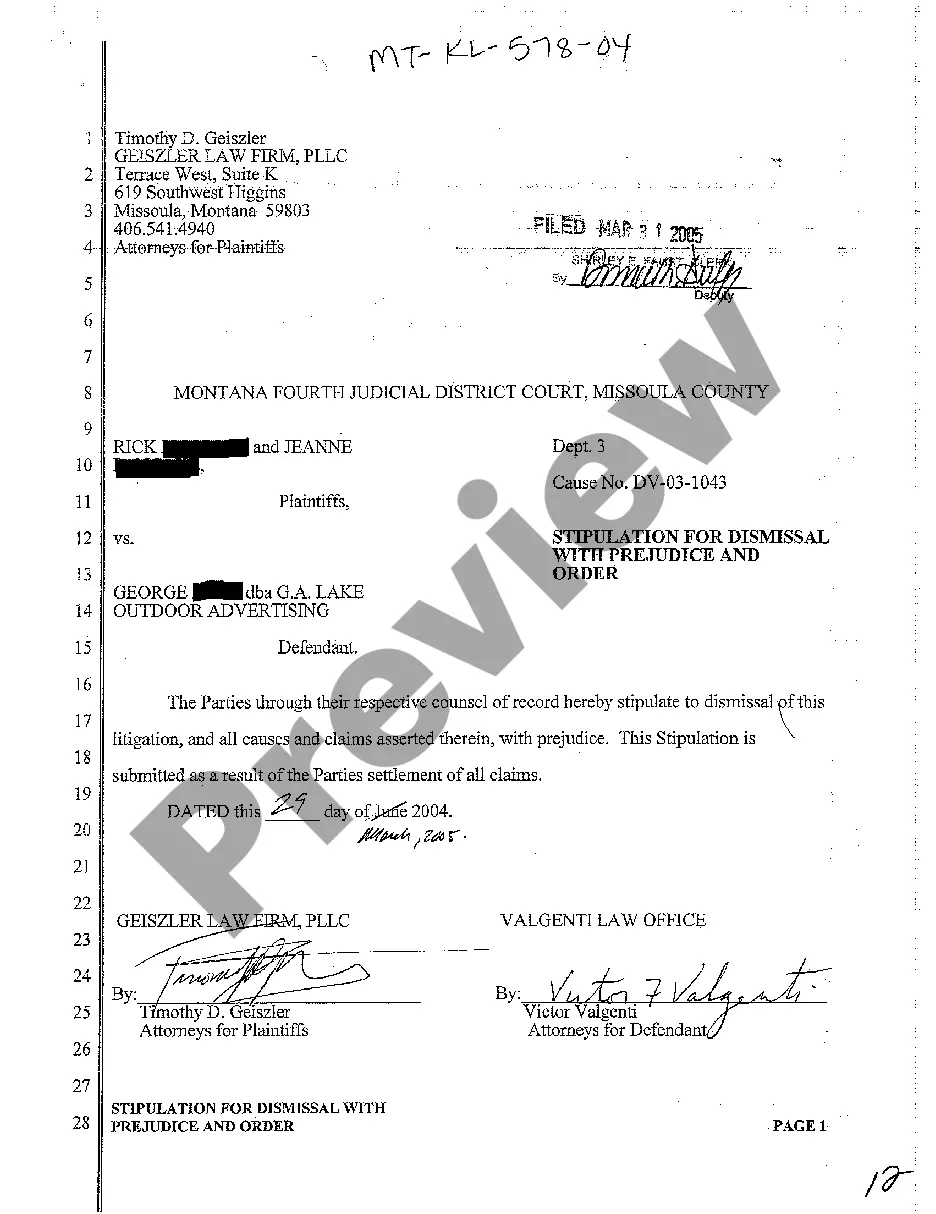

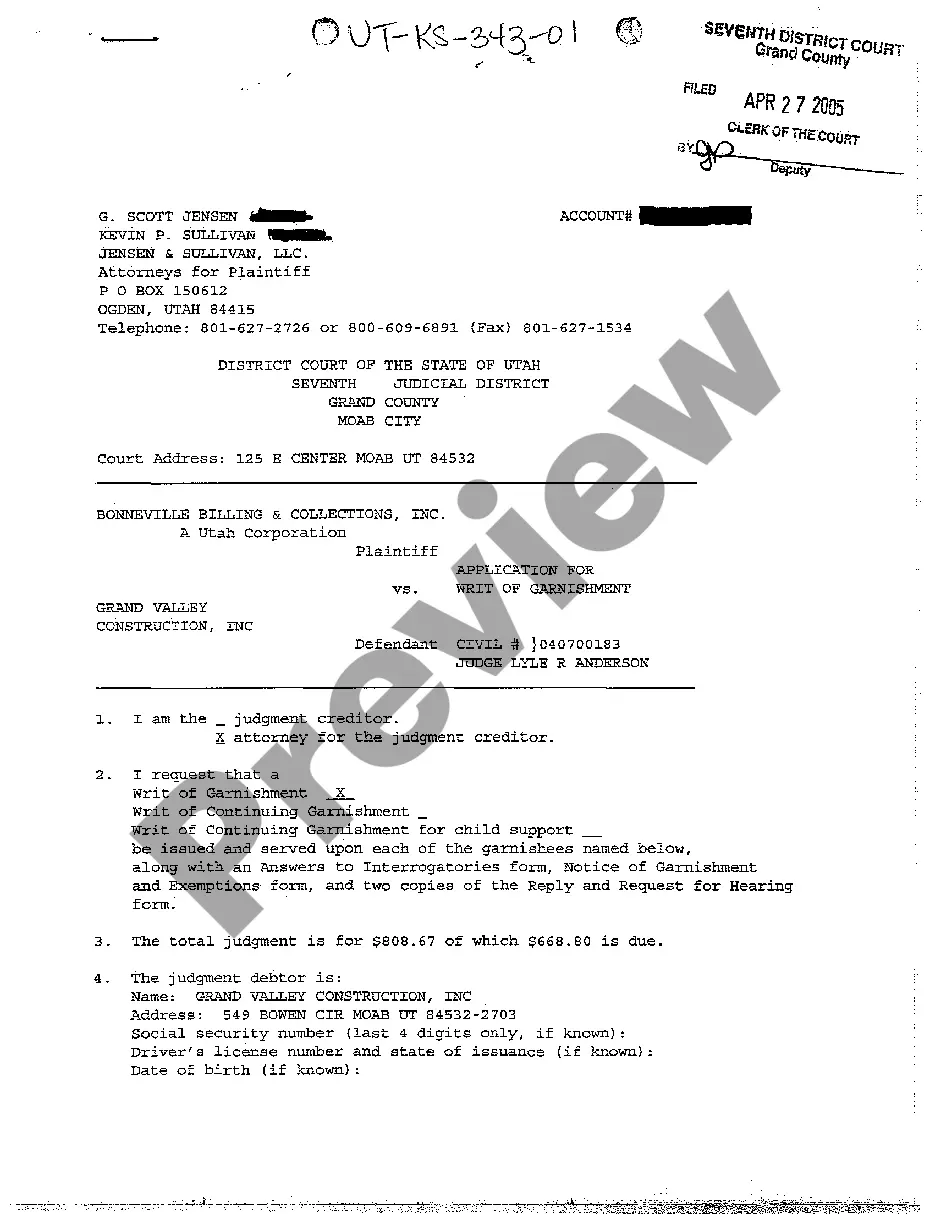

- Very first, make certain you have chosen the correct kind for the metropolis/state. You are able to look through the shape while using Preview button and read the shape explanation to guarantee it will be the best for you.

- In case the kind does not meet your needs, use the Seach field to get the appropriate kind.

- When you are positive that the shape is proper, click on the Acquire now button to obtain the kind.

- Opt for the pricing plan you desire and type in the necessary info. Design your profile and pay money for an order with your PayPal profile or Visa or Mastercard.

- Opt for the data file formatting and download the authorized record format in your system.

- Complete, modify and print and indication the received Minnesota Affidavit regarding Account Access Signature Card.

US Legal Forms is definitely the largest collection of authorized types that you can find a variety of record templates. Make use of the company to download expertly-created papers that follow status requirements.