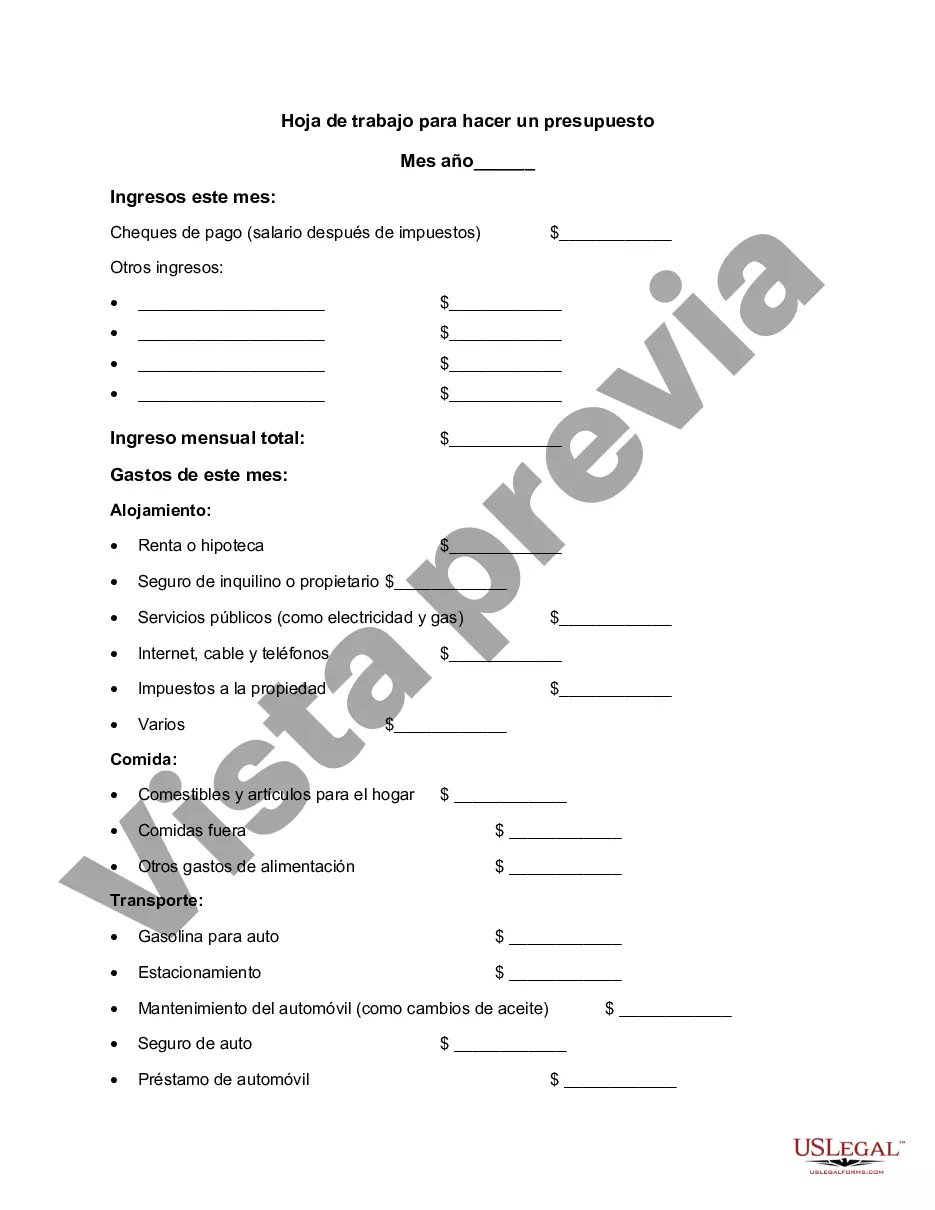

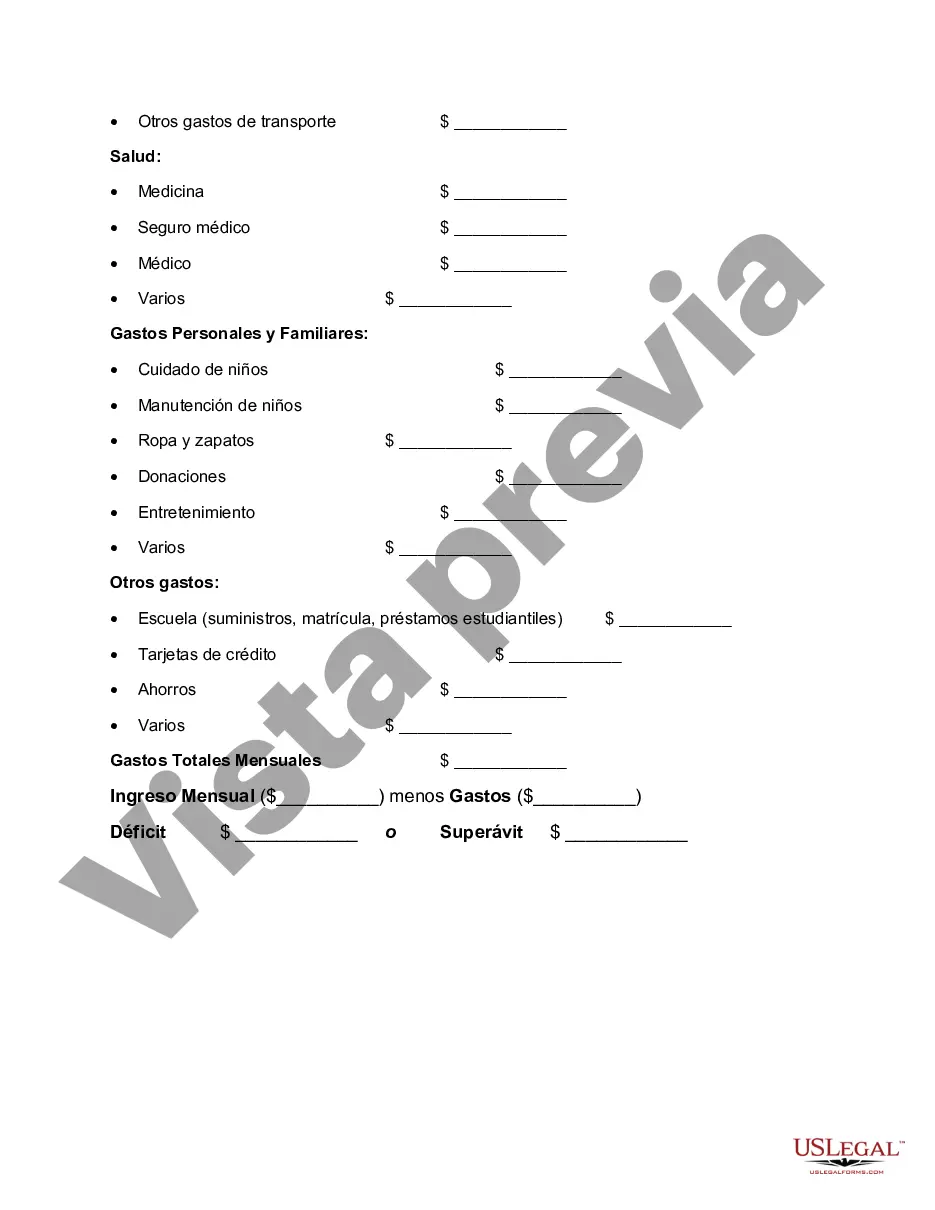

Minnesota Worksheet for Making a Budget is a tool designed to help individuals and households effectively manage their finances. This worksheet provides a detailed breakdown of income, expenses, and savings to create a comprehensive budget plan. By analyzing and organizing financial data, it enables users to make informed decisions and achieve their financial goals. The Minnesota Worksheet for Making a Budget includes several key sections such as: 1. Income: This category allows individuals to list all sources of income, including salaries, wages, tips, child support, alimony, and any other form of regular income. It helps in calculating the total monthly or annual income. 2. Expenses: In this section, individuals can track their monthly expenses, such as rent/mortgage payments, utilities, transportation costs, groceries, healthcare expenses, insurance premiums, loan repayments, entertainment, and other miscellaneous expenses. It helps in identifying areas where expenses can be reduced or optimized. 3. Savings: This category emphasizes the importance of saving money. It allows individuals to set aside a specific amount from their income and allocate it towards savings, emergency funds, retirement plans, or any other financial goals. By prioritizing savings, individuals can build a strong financial foundation and secure their future. 4. Debt Management: If an individual has existing debts such as credit card balances, student loans, or personal loans, this section assists in managing and tracking the progress of the debt repayment plan. It includes columns to record the outstanding balance, interest rates, monthly payments, and the estimated payoff timeline. This helps individuals in creating strategies to eliminate debt efficiently. 5. Financial Goals: This section enables individuals to define their short-term and long-term financial goals, such as buying a house, funding education, starting a business, or saving for a dream vacation. By setting specific targets, individuals can align their budget with their aspirations and work towards achieving them. Some variations of the Minnesota Worksheet for Making a Budget may include additional sections or categories based on specific needs or preferences. These variations could include categories such as investments, taxes, charitable donations, and other unique financial circumstances. In conclusion, the Minnesota Worksheet for Making a Budget is an invaluable tool for anyone seeking to gain control over their finances. By providing a comprehensive overview of income, expenses, savings, debt, and financial goals, this worksheet allows individuals to make informed decisions and optimize their budgeting strategies. It acts as a roadmap towards financial stability, ensuring a brighter and more secure future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Hoja de trabajo para hacer un presupuesto - Worksheet for Making a Budget

Description

How to fill out Minnesota Hoja De Trabajo Para Hacer Un Presupuesto?

Choosing the best lawful document template can be quite a battle. Naturally, there are tons of templates available on the Internet, but how would you obtain the lawful type you need? Make use of the US Legal Forms website. The assistance provides a large number of templates, including the Minnesota Worksheet for Making a Budget, that you can use for enterprise and private needs. All the kinds are inspected by pros and meet federal and state needs.

If you are already authorized, log in for your bank account and then click the Download switch to get the Minnesota Worksheet for Making a Budget. Use your bank account to appear from the lawful kinds you possess bought formerly. Proceed to the My Forms tab of the bank account and obtain another copy from the document you need.

If you are a whole new end user of US Legal Forms, allow me to share basic directions so that you can stick to:

- Very first, ensure you have selected the correct type to your town/region. You may check out the form using the Review switch and read the form outline to ensure this is basically the best for you.

- In the event the type does not meet your requirements, utilize the Seach discipline to obtain the proper type.

- When you are sure that the form is suitable, select the Acquire now switch to get the type.

- Opt for the pricing strategy you want and enter in the necessary info. Create your bank account and pay for the order with your PayPal bank account or charge card.

- Pick the data file file format and down load the lawful document template for your device.

- Full, edit and produce and indicator the received Minnesota Worksheet for Making a Budget.

US Legal Forms is definitely the greatest library of lawful kinds that you can find different document templates. Make use of the company to down load professionally-produced documents that stick to state needs.