The Minnesota Personal Financial Information Organizer is a comprehensive tool designed to help individuals effectively manage and organize their personal financial information. This organizer offers a structured framework that enables users to track and maintain all relevant financial details, making it easier to plan and make informed decisions regarding their finances. With the Minnesota Personal Financial Information Organizer, users can conveniently store and update critical information such as bank accounts, investment portfolios, insurance policies, retirement plans, debt obligations, and tax records. It provides a centralized location where individuals can consolidate and access their financial data, minimizing the risk of information loss or mismanagement. This organizer is particularly valuable when it comes to estate planning, as it allows individuals to document and categorize their assets, liabilities, and beneficiaries. By organizing estate-related documents such as wills, trusts, and powers of attorney, users can ensure a smooth transition of their financial matters to their loved ones in the event of incapacitation or death. Furthermore, the Minnesota Personal Financial Information Organizer includes sections dedicated to tracking monthly budgeting, recurring expenses, and financial goals. By utilizing these features, individuals can gain a comprehensive overview of their financial standing, identify areas for improvement, and work towards achieving their savings and investment targets. Depending on the individual's specific needs, there may be various types or versions of the Minnesota Personal Financial Information Organizer available. Some potential variations might include: 1. Basic Organizer: This version provides a simplified framework focusing on essential financial information such as bank accounts, investments, insurance policies, and debts. 2. Advanced Organizer: This more comprehensive version includes additional sections for tracking retirement plans, tax records, estate planning documents, and philanthropic contributions. 3. Digital Organizer: A digital or online version of the Minnesota Personal Financial Information Organizer enables users to store and access their information electronically, offering convenience and the ability to update and sync data across devices. 4. Business Organizer: A specialized version tailored towards entrepreneurs or small business owners, allowing them to manage personal and business finances in one convenient location. This type of organizer may include sections for business bank accounts, income and expenses, business investments, and tax records. Overall, the Minnesota Personal Financial Information Organizer serves as an invaluable tool for individuals to track, organize, and manage their financial matters effectively. By utilizing this organizer, individuals can gain a clearer understanding of their financial situation, work towards their long-term goals, and ensure the smooth handling of their finances in various circumstances.

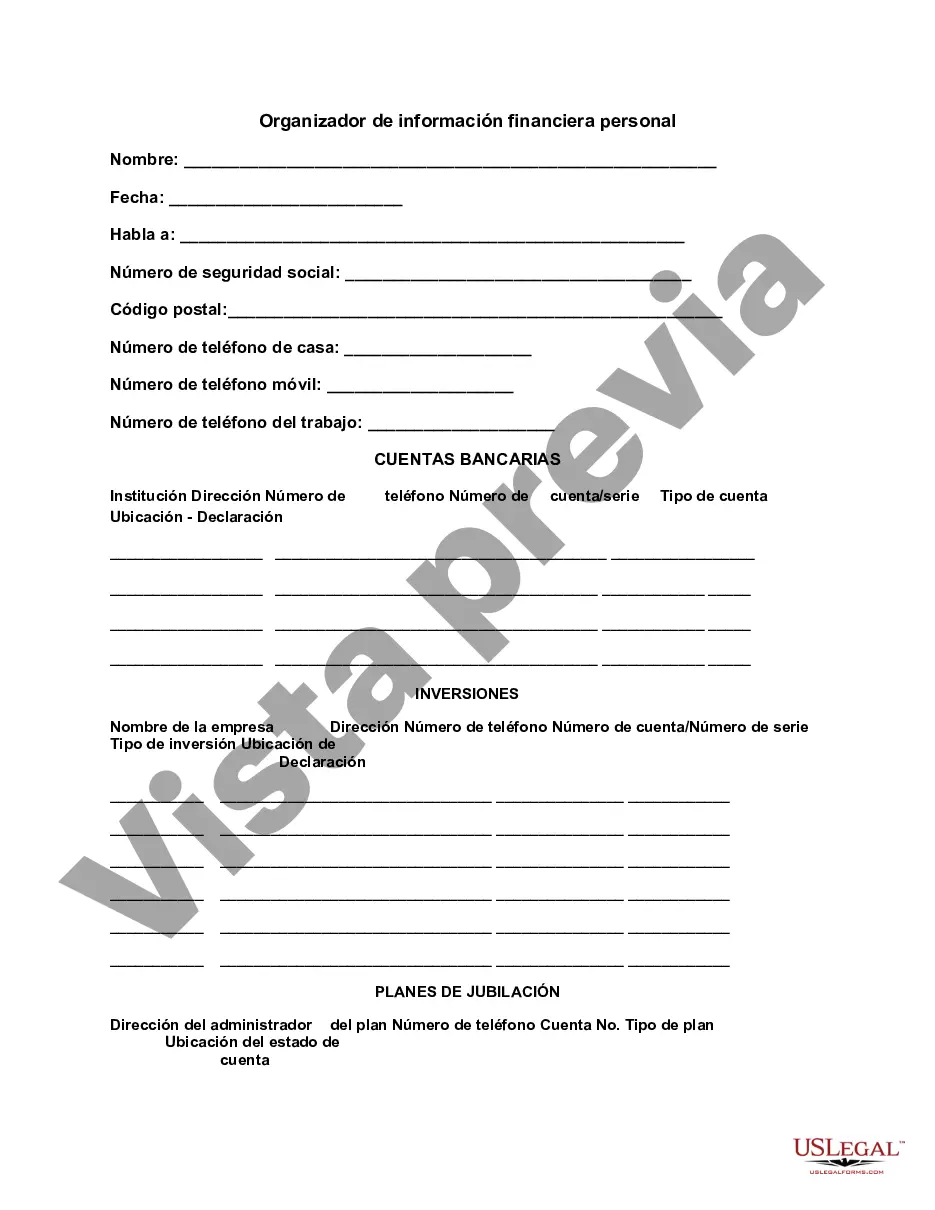

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Organizador de información financiera personal - Personal Financial Information Organizer

Description

How to fill out Minnesota Organizador De Información Financiera Personal?

Finding the right lawful record format could be a have a problem. Naturally, there are a variety of web templates available online, but how would you obtain the lawful type you need? Take advantage of the US Legal Forms web site. The assistance delivers thousands of web templates, such as the Minnesota Personal Financial Information Organizer, that can be used for company and private requirements. All the types are checked out by experts and meet up with state and federal demands.

In case you are presently authorized, log in to your account and then click the Download button to find the Minnesota Personal Financial Information Organizer. Use your account to check through the lawful types you possess bought earlier. Proceed to the My Forms tab of your respective account and get another backup of your record you need.

In case you are a whole new customer of US Legal Forms, allow me to share simple instructions that you should comply with:

- Very first, ensure you have selected the proper type for the metropolis/region. It is possible to examine the shape using the Review button and read the shape explanation to ensure it is the best for you.

- In the event the type will not meet up with your needs, take advantage of the Seach industry to get the proper type.

- When you are sure that the shape is acceptable, click on the Get now button to find the type.

- Select the rates strategy you desire and enter in the needed details. Make your account and purchase an order with your PayPal account or bank card.

- Select the file file format and download the lawful record format to your product.

- Complete, edit and produce and signal the received Minnesota Personal Financial Information Organizer.

US Legal Forms is the biggest local library of lawful types for which you can find various record web templates. Take advantage of the service to download expertly-manufactured papers that comply with condition demands.