A Minnesota Irrevocable Pot Trust Agreement is a legal document that establishes a trust in the state of Minnesota where the settler (creator of the trust) transfers assets to the trust to be managed by a trustee for the benefit of one or more beneficiaries. This type of trust is typically created to provide long-term financial protection and asset management for the beneficiaries. The term "irrevocable" implies that once the trust is established, the settler cannot make changes or revoke the trust without the consent of all involved parties. This ensures that the assets held within the trust remain protected and are distributed according to the terms specified in the agreement. It also helps in estate planning to minimize potential estate taxes or other obligations. In a Minnesota Irrevocable Pot Trust Agreement, the term "pot trust" refers to a flexible provision where the trustee has the authority to distribute income and assets from the trust to multiple beneficiaries based on their needs. The trustee has discretion to allocate funds based on factors such as age, health, education, and overall financial situation. This allows for a fair and tailored distribution of trust assets among beneficiaries. There may exist different types or variations of Minnesota Irrevocable Pot Trust Agreements depending on the specific needs and goals of the settler. Some examples include: 1. Special Needs Pot Trust Agreement: This type of trust is designed for individuals with disabilities who may be eligible for government benefits. By creating a special needs pot trust, the settler ensures that the beneficiary's eligibility for public assistance is preserved while providing additional financial support and quality of life improvements. 2. Dynasty Pot Trust Agreement: A dynasty pot trust is set up to pass wealth and assets down through multiple generations, potentially spanning many years. This type of trust can help protect family wealth from estate taxes, creditors, and other potential risks. 3. Charitable Pot Trust Agreement: This trust type is created with the purpose of benefiting a charitable organization or cause. The settler can direct the trustee to distribute income or assets to the chosen charity while also providing for the financial needs of other beneficiaries. In summary, a Minnesota Irrevocable Pot Trust Agreement is a legal tool that allows for the establishment of a flexible and long-term trust to protect and manage assets for the benefit of beneficiaries. It offers various customization options, including special needs pot trusts, dynasty pot trusts, and charitable pot trusts, to suit the specific requirements and goals of the settler.

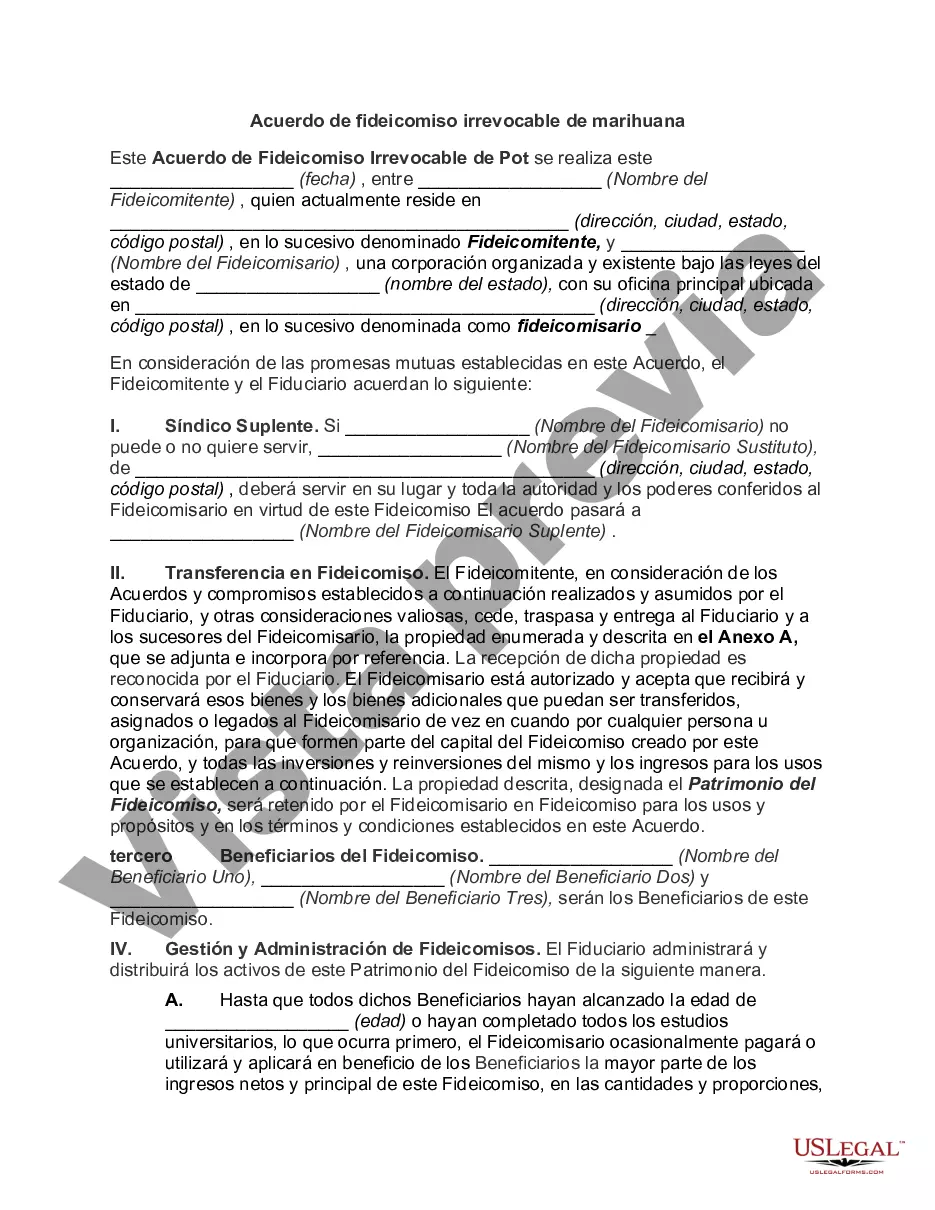

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Acuerdo de fideicomiso irrevocable de marihuana - Irrevocable Pot Trust Agreement

Description

How to fill out Minnesota Acuerdo De Fideicomiso Irrevocable De Marihuana?

Are you currently in a situation that you need paperwork for both enterprise or individual functions virtually every time? There are a variety of legitimate record web templates accessible on the Internet, but discovering versions you can depend on is not simple. US Legal Forms offers a huge number of kind web templates, just like the Minnesota Irrevocable Pot Trust Agreement, that happen to be published to satisfy state and federal demands.

When you are presently knowledgeable about US Legal Forms web site and also have your account, basically log in. Afterward, you are able to download the Minnesota Irrevocable Pot Trust Agreement format.

Should you not provide an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the kind you want and make sure it is for that correct city/county.

- Utilize the Preview key to check the form.

- Look at the outline to ensure that you have chosen the correct kind.

- In case the kind is not what you are searching for, take advantage of the Research industry to get the kind that meets your requirements and demands.

- Once you discover the correct kind, just click Buy now.

- Pick the rates strategy you need, submit the specified info to make your money, and purchase the transaction making use of your PayPal or credit card.

- Pick a practical paper format and download your copy.

Discover every one of the record web templates you may have purchased in the My Forms menu. You can aquire a further copy of Minnesota Irrevocable Pot Trust Agreement whenever, if needed. Just select the necessary kind to download or printing the record format.

Use US Legal Forms, by far the most comprehensive selection of legitimate forms, to save lots of efforts and steer clear of errors. The services offers skillfully manufactured legitimate record web templates which can be used for a range of functions. Create your account on US Legal Forms and begin creating your daily life easier.