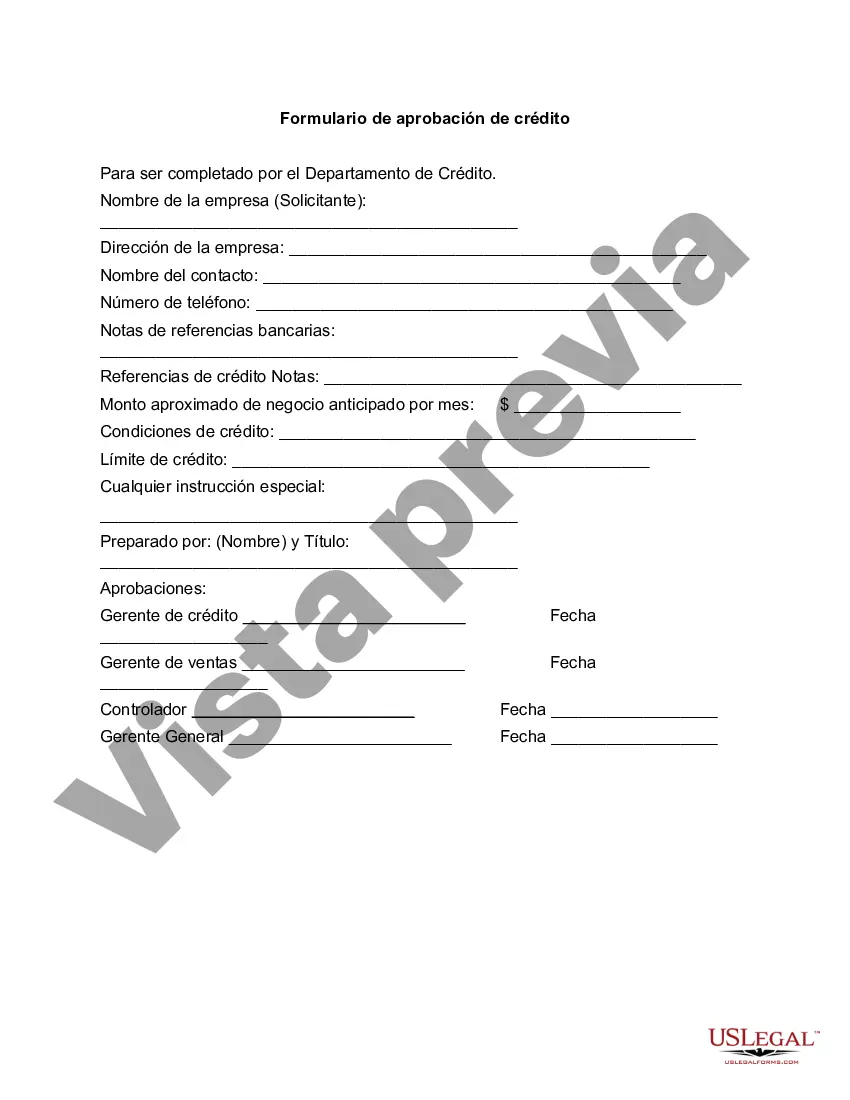

The Minnesota Credit Approval Form is a document that is utilized by financial institutions, such as banks or credit unions, to assess and approve credit applications from individuals or businesses based in the state of Minnesota. This form plays a crucial role in the credit evaluation process, as it enables financial institutions to gather necessary information about the applicant's financial situation and creditworthiness. The Minnesota Credit Approval Form is designed to obtain comprehensive details about the applicant, including their personal information, employment status, monthly income, expenses, and existing debts. The form also requests information about the purpose of the credit, whether it is for personal use, business investment, or any other specific endeavor. In addition to personal details, the form typically requires the applicant to disclose their financial history, such as their credit score, credit history, and any previous delinquencies or bankruptcy filings. This information helps the financial institution assess the individual's ability to repay the borrowed funds and determine their creditworthiness. Furthermore, the Minnesota Credit Approval Form may consist of additional sections to gather specific information depending on the type of credit being applied for. Different forms may be used for various credit types, such as auto loans, mortgages, personal lines of credit, or business loans. Each form will have tailored sections that request information relevant to the specific credit type. In the case of an auto loan credit approval form, for instance, the form may include sections for vehicle information, such as make, model, year, and identification number. Conversely, a mortgage credit approval form might have sections asking for property details, such as address, appraised value, and loan amount. The Minnesota Credit Approval Form aims to ensure that financial institutions carefully evaluate credit applications and make informed decisions regarding credit issuance. It serves as a standardized tool to streamline the credit approval process and maintain consistency in the evaluation of applicants. In conclusion, the Minnesota Credit Approval Form is an essential document utilized by financial institutions in Minnesota to evaluate and approve credit applications. By gathering comprehensive information about the applicant's financial situation, employment status, and credit history, this form enables financial institutions to assess an individual or business's creditworthiness accurately. Different types of credit, such as auto loans, mortgages, and personal lines of credit, may have specific forms tailored to gather information relevant to the particular credit type.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Minnesota Formulario De Aprobación De Crédito?

You may commit several hours on the web looking for the legal papers design which fits the federal and state demands you need. US Legal Forms gives a huge number of legal types which are analyzed by pros. It is simple to down load or produce the Minnesota Credit Approval Form from your support.

If you already possess a US Legal Forms bank account, you may log in and click the Down load key. Following that, you may total, edit, produce, or indicator the Minnesota Credit Approval Form. Each legal papers design you purchase is yours permanently. To have one more backup of the purchased develop, go to the My Forms tab and click the related key.

Should you use the US Legal Forms site the first time, keep to the basic recommendations beneath:

- Initial, make certain you have chosen the correct papers design for your region/city of your liking. See the develop information to make sure you have selected the proper develop. If available, take advantage of the Preview key to look through the papers design also.

- If you would like locate one more model of your develop, take advantage of the Search area to obtain the design that meets your requirements and demands.

- Once you have found the design you desire, just click Get now to carry on.

- Choose the pricing strategy you desire, type your qualifications, and register for a merchant account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal bank account to purchase the legal develop.

- Choose the structure of your papers and down load it for your gadget.

- Make modifications for your papers if needed. You may total, edit and indicator and produce Minnesota Credit Approval Form.

Down load and produce a huge number of papers themes utilizing the US Legal Forms web site, which offers the most important variety of legal types. Use skilled and state-distinct themes to handle your organization or personal needs.