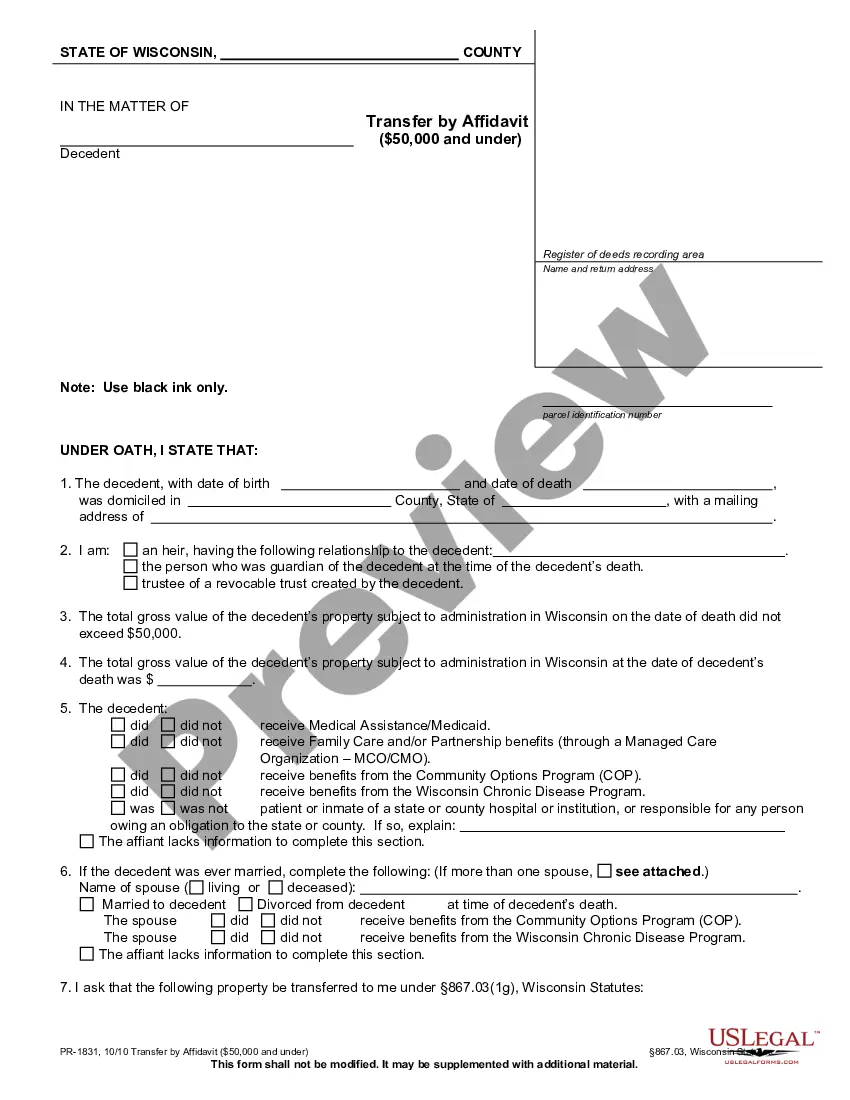

The Minnesota Agreement to Form Limited Partnership is a legal document that outlines the terms and conditions for establishing a limited partnership in the state of Minnesota. This agreement is a crucial step in forming a limited partnership and serves as a binding contract between the partners involved. One key aspect of the Minnesota Agreement to Form Limited Partnership is the definition of the limited partnership itself. A limited partnership consists of two types of partners: general partners and limited partners. The general partners have unlimited liability and manage the day-to-day operations of the partnership, while the limited partners have limited liability and contribute capital to the partnership but do not participate in its management. The agreement includes provisions regarding the contributions of each partner, outlining the amount of capital and property that each partner will contribute to the partnership. These contributions are essential in determining the equity interests and profit-sharing arrangements among the partners. Additionally, the agreement may specify any restrictions or conditions on the transfer of these partnership interests. Another critical aspect covered in the Minnesota Agreement to Form Limited Partnership is the distribution of profits and losses. The agreement will usually provide a method for determining how profits and losses will be allocated among the partners. This may be based on each partner's capital contributions or as agreed upon by the partners. The agreement also outlines the management structure of the limited partnership. It may specify the powers and responsibilities of the general partners, such as decision-making authority, signing contracts, and representing the partnership. Additionally, the agreement may establish rules for holding meetings, voting on significant matters, and resolving disputes among the partners. There are various types of limited partnerships that can be formed in Minnesota, each catering to different needs and objectives. Some common types include: 1. General Partnership: This refers to a partnership in which there is no distinction between general partners and limited partners. All partners have unlimited liability and participate in the management of the partnership. 2. Limited Liability Partnership (LLP): This type of limited partnership offers limited liability protection to all partners, unlike traditional limited partnerships where only limited partners enjoy this protection. Laps are often chosen by professional service providers, such as lawyers and accountants. 3. Limited Liability Limited Partnership (LL LP): An LL LP is similar to an LLP, but it allows for one or more general partners to also have limited liability. This structure offers greater flexibility and liability protection for general partners. In conclusion, the Minnesota Agreement to Form Limited Partnership is a crucial legal document that lays the foundation for establishing a limited partnership in the state. It outlines the roles, responsibilities, and contributions of all partners, as well as the distribution of profits and losses. The agreement also establishes the management structure and sets forth rules for decision-making and dispute resolution. Different types of limited partnerships, such as general partnerships, Laps, and Helps, cater to different needs and offer varying levels of liability protection.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Acuerdo para formar una sociedad limitada - Agreement to Form Limited Partnership

Description

How to fill out Minnesota Acuerdo Para Formar Una Sociedad Limitada?

You are able to commit hours online attempting to find the authorized papers design that meets the federal and state demands you want. US Legal Forms supplies thousands of authorized varieties which can be evaluated by experts. It is simple to obtain or print the Minnesota Agreement to Form Limited Partnership from our service.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Download switch. Afterward, it is possible to total, edit, print, or indication the Minnesota Agreement to Form Limited Partnership. Every authorized papers design you get is your own for a long time. To acquire one more backup of any acquired develop, check out the My Forms tab and then click the related switch.

If you work with the US Legal Forms website the very first time, keep to the easy instructions listed below:

- First, make sure that you have selected the best papers design for your area/area of your liking. See the develop explanation to make sure you have selected the correct develop. If accessible, utilize the Preview switch to appear through the papers design too.

- If you would like find one more version of the develop, utilize the Research industry to discover the design that suits you and demands.

- When you have found the design you would like, simply click Acquire now to continue.

- Pick the pricing program you would like, key in your accreditations, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your bank card or PayPal profile to cover the authorized develop.

- Pick the structure of the papers and obtain it to the product.

- Make adjustments to the papers if possible. You are able to total, edit and indication and print Minnesota Agreement to Form Limited Partnership.

Download and print thousands of papers templates using the US Legal Forms web site, that provides the greatest selection of authorized varieties. Use specialist and express-distinct templates to tackle your organization or personal requires.