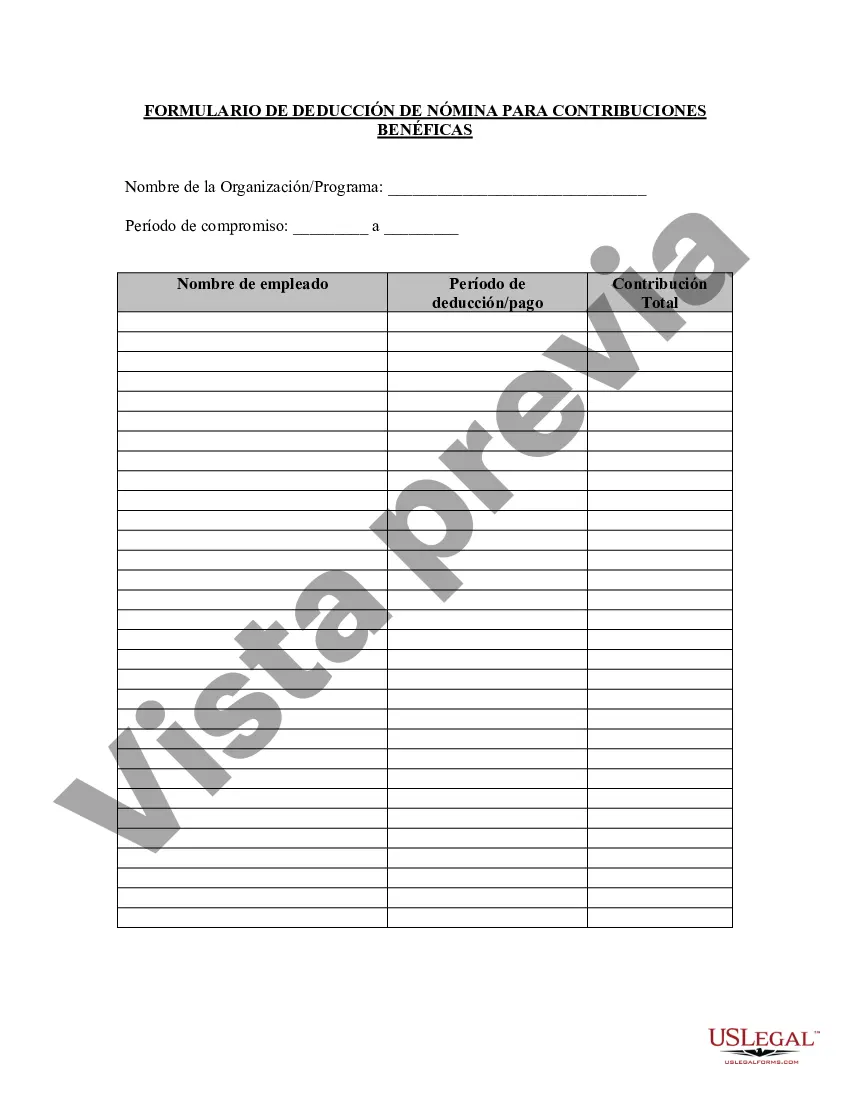

The Minnesota Charitable Contribution Payroll Deduction Form is a document used by employees in the state of Minnesota to voluntarily donate a portion of their salary to charitable organizations. This form enables employees to make regular contributions to their chosen charities through automatic deductions from their payroll. By filling out this form, individuals can support nonprofit organizations, foundations, or even specific causes that align with their personal interests and values. Employees have the flexibility to select the amount they wish to donate on a regular basis, often on a per-pay-period basis. The Minnesota Charitable Contribution Payroll Deduction Form plays a crucial role in promoting philanthropy and helping various charitable entities benefit from direct financial support. It provides a straightforward and convenient method for employees to contribute to causes important to them without the need for extensive paperwork or additional administrative steps. Some keywords relevant to the Minnesota Charitable Contribution Payroll Deduction Form include: — Minnesota charitable deduction for— - Minnesota payroll deduction form — Employee charitable giving for— - Minnesota workplace giving — Minnesota charitable contribution— - Payroll deduction for Minnesota charities Different types of Minnesota Charitable Contribution Payroll Deduction Forms could include: 1. General Charitable Contribution Payroll Deduction Form: This basic form allows employees to donate to any qualifying charitable organization they choose. 2. Specific Cause Charitable Contribution Payroll Deduction Form: This form enables employees to donate to a specific cause, such as environmental conservation, education, or poverty alleviation, rather than a specific organization. 3. Workplace Charitable Giving Program Form: Some larger organizations may offer their own charitable giving programs where employees can choose from a pre-selected list of approved charities to support. 4. Combined Charitable Contribution Payroll Deduction Form: This type of form allows employees to allocate their deductions to multiple charitable organizations simultaneously. Overall, the Minnesota Charitable Contribution Payroll Deduction Form empowers employees to make a positive impact on their communities and support their favorite causes through regular, effortless charitable donations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out Minnesota Formulario De Deducción De Nómina De Contribución Benéfica?

Are you within a position where you need to have files for sometimes company or specific functions virtually every working day? There are a variety of lawful file layouts available on the net, but finding kinds you can depend on is not straightforward. US Legal Forms delivers a large number of kind layouts, like the Minnesota Charitable Contribution Payroll Deduction Form, which can be created to satisfy federal and state specifications.

In case you are previously informed about US Legal Forms website and get a merchant account, merely log in. After that, you are able to download the Minnesota Charitable Contribution Payroll Deduction Form web template.

Unless you offer an account and want to start using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your right city/state.

- Utilize the Review switch to check the form.

- Look at the information to actually have chosen the proper kind.

- In the event the kind is not what you are looking for, use the Lookup area to discover the kind that fits your needs and specifications.

- Once you discover the right kind, just click Get now.

- Opt for the pricing plan you would like, fill out the necessary info to make your money, and pay for the order making use of your PayPal or charge card.

- Select a handy document format and download your copy.

Find all the file layouts you may have purchased in the My Forms food selection. You may get a additional copy of Minnesota Charitable Contribution Payroll Deduction Form any time, if needed. Just select the necessary kind to download or print out the file web template.

Use US Legal Forms, probably the most comprehensive collection of lawful varieties, to save some time and stay away from blunders. The services delivers skillfully created lawful file layouts which you can use for a range of functions. Generate a merchant account on US Legal Forms and commence making your way of life a little easier.