Title: Minnesota Compensation Administration Checklist — A Comprehensive Guide for Employers Introduction: Minnesota Compensation Administration Checklist is a detailed and essential resource for employers operating in Minnesota. This comprehensive checklist helps employers ensure compliance with state laws and regulations, enabling them to establish fair and competitive compensation practices for their employees. By following this checklist, employers can effectively manage their compensation programs, minimize legal risks, and foster a positive work environment. Keywords: Minnesota Compensation Administration Checklist, employers, compliance, state laws, regulations, compensation practices, employees, legal risks, work environment. Types of Minnesota Compensation Administration Checklists: 1. Minnesota Compensation Administration — Employee Classification Checklist— - This specific checklist focuses on correctly classifying employees as exempt or non-exempt based on Minnesota state laws and regulations. — Employers can assess positions, job duties, pay structures, and employee information to ensure the proper classification of employees and adherence to state compensation standards. 2. Minnesota Compensation Administration — Pay Structure Compliance Checklist— - This checklist emphasizes the compliance of an organization's pay structure with Minnesota's compensation guidelines. — Employers can review salary ranges, pay grades, wage rates, and comparison data to ensure fair and equitable compensation practices, addressing potential disparities within the organization. 3. Minnesota Compensation Administration — Equal Pay Act Compliance Checklist— - With a focus on fulfilling the requirements of the Minnesota Equal Pay Act, this checklist empowers employers to ensure gender pay equity within their organizations. — Employers can examine compensation practices, job evaluation techniques, pay differentials, and employee records to minimize gender-based compensation disparities. 4. Minnesota Compensation Administration — Overtime Pay Compliance Checklist— - This checklist assists employers in adhering to Minnesota laws pertaining to overtime pay regulations. — Employers can review work hours, employee classification, overtime calculations, and payroll systems to guarantee accurate overtime compensation for eligible employees. 5. Minnesota Compensation Administration — Wage Theft Prevention Checklist— - Designed to prevent wage theft and protect employees' rights in Minnesota, this checklist helps employers comply with state laws involving payroll records, earnings statements, and final wages. — Employers can assess record maintenance, wage statement compliance, documentation, and notification processes to prevent accusations of wage theft violations. 6. Minnesota Compensation Administration — Bonuses and Incentives Compliance Checklist: — This checklist ensures the proper administration of bonuses, incentives, and commission payment practices in accordance with Minnesota compensation laws. — Employers can review bonus plan documentation, eligibility criteria, payment calculations, and timing to ensure transparency, fairness, and compliance. Conclusion: The Minnesota Compensation Administration Checklist, available in various types, serves as an invaluable guide for employers to stay compliant with Minnesota state laws and regulations regarding compensation practices. By utilizing these checklists, employers can reinforce fair pay, minimize legal risks, and foster an environment of trust and employee satisfaction. Keywords: Minnesota Compensation Administration Checklist, compliance, fair pay, legal risks, trust, employee satisfaction.

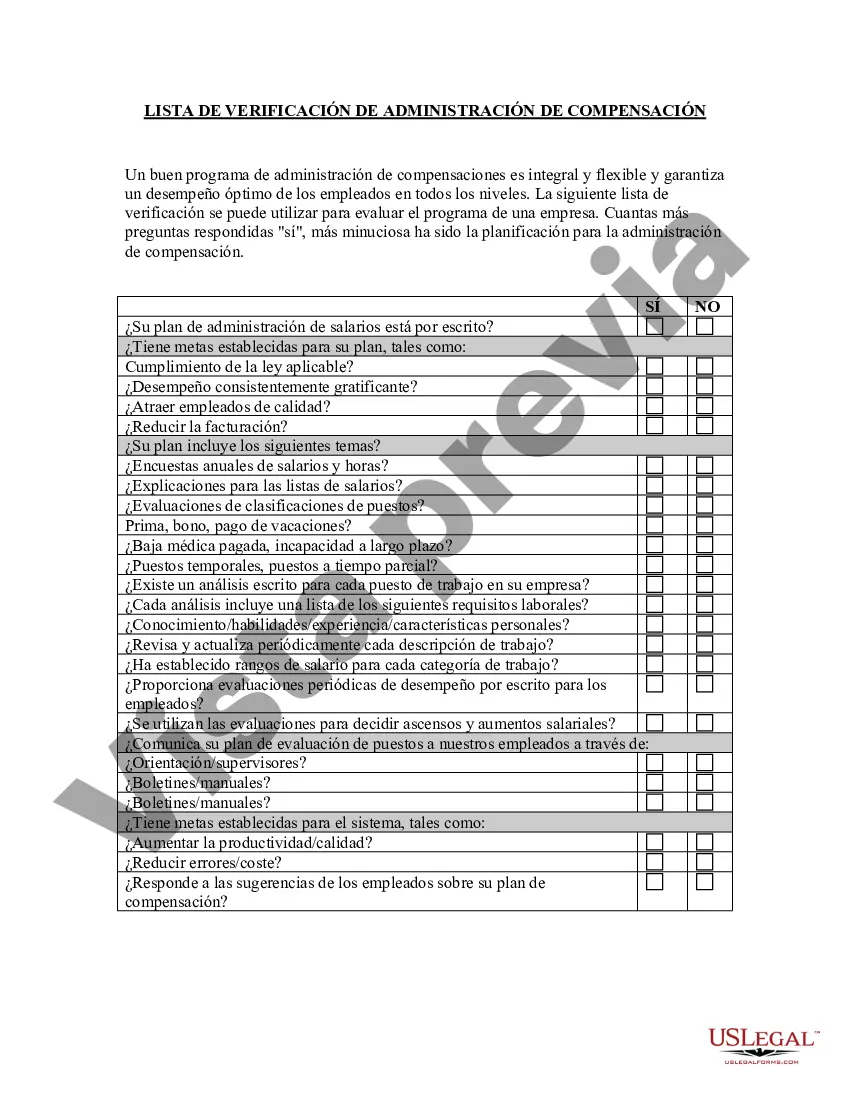

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out Minnesota Lista De Verificación De Administración De Compensación?

If you want to comprehensive, download, or print out legitimate record web templates, use US Legal Forms, the biggest assortment of legitimate types, which can be found online. Use the site`s simple and convenient look for to discover the documents you need. Different web templates for organization and person purposes are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Minnesota Compensation Administration Checklist with a few clicks.

In case you are already a US Legal Forms client, log in to the accounts and then click the Download option to get the Minnesota Compensation Administration Checklist. You can even access types you in the past downloaded inside the My Forms tab of the accounts.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the appropriate city/region.

- Step 2. Make use of the Review method to look over the form`s content material. Do not forget to see the outline.

- Step 3. In case you are not happy with all the type, make use of the Lookup area on top of the display screen to locate other types in the legitimate type web template.

- Step 4. After you have found the shape you need, click the Acquire now option. Opt for the pricing strategy you like and add your qualifications to register on an accounts.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Select the file format in the legitimate type and download it in your product.

- Step 7. Complete, revise and print out or sign the Minnesota Compensation Administration Checklist.

Each and every legitimate record web template you get is your own forever. You may have acces to every type you downloaded inside your acccount. Click the My Forms segment and pick a type to print out or download once again.

Compete and download, and print out the Minnesota Compensation Administration Checklist with US Legal Forms. There are many skilled and condition-certain types you may use for the organization or person demands.