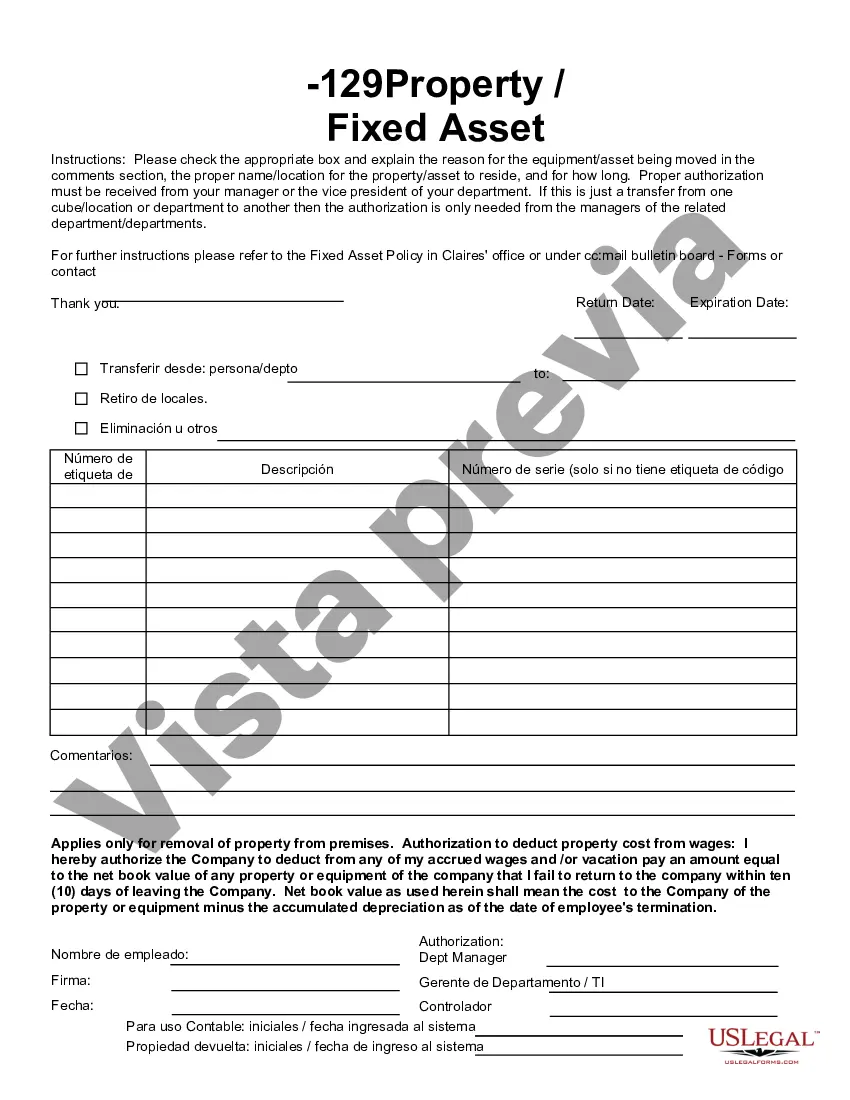

Minnesota Fixed Asset Removal Form is a document that facilitates the proper removal or disposal of fixed assets owned by individuals or organizations in the state of Minnesota. Fixed assets typically refer to long-term assets with a useful life of more than one year, such as buildings, vehicles, machinery, equipment, and furniture. This form ensures compliance with state regulations and helps maintain accurate records of the removal process. The Minnesota Fixed Asset Removal Form is designed to be used by various entities, including businesses, government agencies, non-profit organizations, educational institutions, and individuals. The form collects essential information about the asset being removed, such as its description, identification number, original cost, current value, and reason for removal. Key sections of the form may include: 1. Asset Details: This section requires the asset's specific information, such as asset type, model number, serial number, and any other unique identification details. It helps in differentiating between various fixed assets. 2. Removal Reason: The form will ask for the reason behind the asset's removal, such as old age, damage, upgrade, sale, donation, or end of lease. Properly documenting the reason prevents any confusion or ambiguity regarding the asset's disposal. 3. Depreciation Information: Since fixed assets are subject to depreciation, this section allows the filer to record the accumulated depreciation until the removal date. It is crucial for accurate financial reporting and asset valuation purposes. 4. Value Assessment: Here, individuals are required to report the current value of the asset at the time of removal. This value can align with fair market value, net book value, or any other valuation method applicable to the asset. 5. Disposal Method: The form may ask for the method of disposal chosen for the asset, whether it is through sale, auction, recycling, trade-in, scrapping, or donation. This information helps in determining the financial impact of the asset's removal. Types of Minnesota Fixed Asset Removal Forms may vary based on the entity using them or the agency responsible for overseeing the removal process. For instance, there might be specific forms for businesses, educational institutions, or state government agencies. However, the core purpose of these forms remains the same — to document and authorize the removal or disposal of fixed assets while adhering to the relevant regulations and guidelines enforced by the state of Minnesota.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Minnesota Formulario De Retiro De Activos Fijos?

You can invest hours on the Internet searching for the legitimate papers web template that suits the state and federal specifications you need. US Legal Forms provides a large number of legitimate forms which can be analyzed by professionals. You can actually acquire or print the Minnesota Fixed Asset Removal Form from the services.

If you currently have a US Legal Forms accounts, you are able to log in and click on the Download key. Following that, you are able to full, change, print, or indication the Minnesota Fixed Asset Removal Form. Every single legitimate papers web template you get is yours forever. To acquire yet another backup of any acquired kind, go to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms internet site the first time, follow the simple directions under:

- First, make certain you have chosen the proper papers web template for that region/area of your choice. Browse the kind explanation to ensure you have picked the right kind. If offered, utilize the Review key to search from the papers web template as well.

- If you want to locate yet another model of the kind, utilize the Look for industry to get the web template that meets your needs and specifications.

- When you have located the web template you would like, simply click Buy now to move forward.

- Pick the pricing prepare you would like, type your accreditations, and register for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to purchase the legitimate kind.

- Pick the format of the papers and acquire it in your system.

- Make adjustments in your papers if possible. You can full, change and indication and print Minnesota Fixed Asset Removal Form.

Download and print a large number of papers themes using the US Legal Forms web site, which offers the most important assortment of legitimate forms. Use specialist and status-distinct themes to take on your small business or personal demands.