Minnesota Yearly Expenses refer to the various costs and expenditures incurred by individuals or households living in the state of Minnesota over the course of a year. These expenses cover a range of necessities, services, and taxes necessary to sustain a comfortable standard of living in the region. Understanding the different types of Minnesota Yearly Expenses is crucial for effective financial planning and budgeting. Here are some key categories of Minnesota Yearly Expenses: 1. Housing Expenses: One of the most significant components of yearly expenses in Minnesota is housing. This includes monthly rent or mortgage payments, property taxes, and homeowner's insurance. Additionally, utility bills such as electricity, water, heating, and internet charges contribute to the overall housing expenses. 2. Transportation Expenses: Getting around in Minnesota involves costs associated with owning a vehicle or utilizing public transportation. Vehicle-related expenses include fuel costs, car insurance premiums, maintenance and repairs, and registration fees. Public transportation expenses encompass bus or train fares, parking fees, and ride-share services. 3. Healthcare Expenses: Healthcare costs in Minnesota can be substantial, especially insurance premiums, deductibles, and co-payments. Individuals and families may also need to budget for routine check-ups, vaccinations, prescription medications, and vision or dental care. 4. Education Expenses: Those who have children or are pursuing higher education need to consider educational expenses. Minnesota offers a diverse range of educational institutions, including public, private, and post-secondary schools. Costs may include tuition fees, books, uniforms, transportation to school, extracurricular activities, and educational supplies. 5. Food and Groceries: Purchasing food and groceries is an essential expense for every household. This category covers expenses like groceries, dining out, packed lunches, snacks, and beverages. The cost can vary depending on personal preferences, dietary restrictions, and the size of the household. 6. Personal and Leisure Expenses: Personal and leisure expenses consist of various discretionary expenditures aimed at recreational activities, hobbies, personal care, and entertainment. This can include gym memberships, sports activities, leisure travel, movie tickets, subscriptions, clothing, and personal grooming products. 7. Taxes and Insurance: Minnesota residents are obligated to pay various taxes, including income tax, property tax, sales tax, and vehicle registration tax. Additionally, insurance premiums for health, car, home, and life insurance also factor into yearly expenses. 8. Miscellaneous Expenses: This category encompasses a wide range of miscellaneous costs, such as pet care, child care, home maintenance and repairs, subscriptions, donations, gifts, and emergency funds. These expenses are often variable and can be unique to individuals or families. Understanding and tracking these different types of Minnesota Yearly Expenses is crucial for creating a comprehensive budget and effectively managing personal finances. It is essential to closely monitor and adapt spending habits to ensure financial stability and meet long-term financial goals in the state.

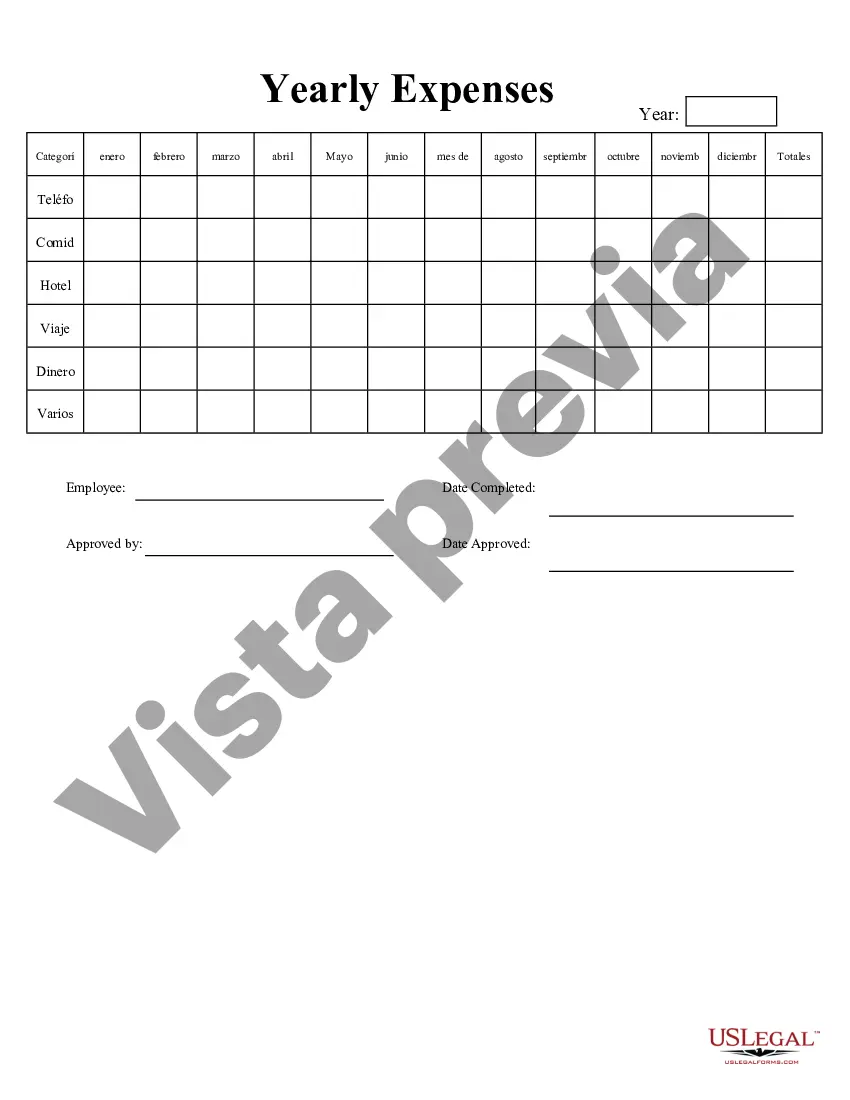

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Minnesota Gastos Anuales - Yearly Expenses

Description

How to fill out Minnesota Gastos Anuales?

If you have to total, obtain, or printing authorized papers templates, use US Legal Forms, the biggest assortment of authorized kinds, which can be found on the web. Make use of the site`s basic and hassle-free search to obtain the papers you will need. Numerous templates for enterprise and person uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Minnesota Yearly Expenses within a number of clicks.

In case you are previously a US Legal Forms buyer, log in in your profile and click on the Obtain key to obtain the Minnesota Yearly Expenses. You may also gain access to kinds you earlier acquired in the My Forms tab of the profile.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for that proper metropolis/nation.

- Step 2. Utilize the Preview option to look over the form`s articles. Never forget about to read through the description.

- Step 3. In case you are unsatisfied with all the develop, make use of the Look for discipline towards the top of the monitor to get other types of the authorized develop format.

- Step 4. Once you have discovered the form you will need, click on the Purchase now key. Pick the prices program you favor and add your credentials to register to have an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Find the structure of the authorized develop and obtain it on your own system.

- Step 7. Complete, modify and printing or indicator the Minnesota Yearly Expenses.

Every authorized papers format you acquire is your own property eternally. You may have acces to each and every develop you acquired with your acccount. Click on the My Forms section and pick a develop to printing or obtain yet again.

Contend and obtain, and printing the Minnesota Yearly Expenses with US Legal Forms. There are many specialist and status-particular kinds you may use for your personal enterprise or person demands.