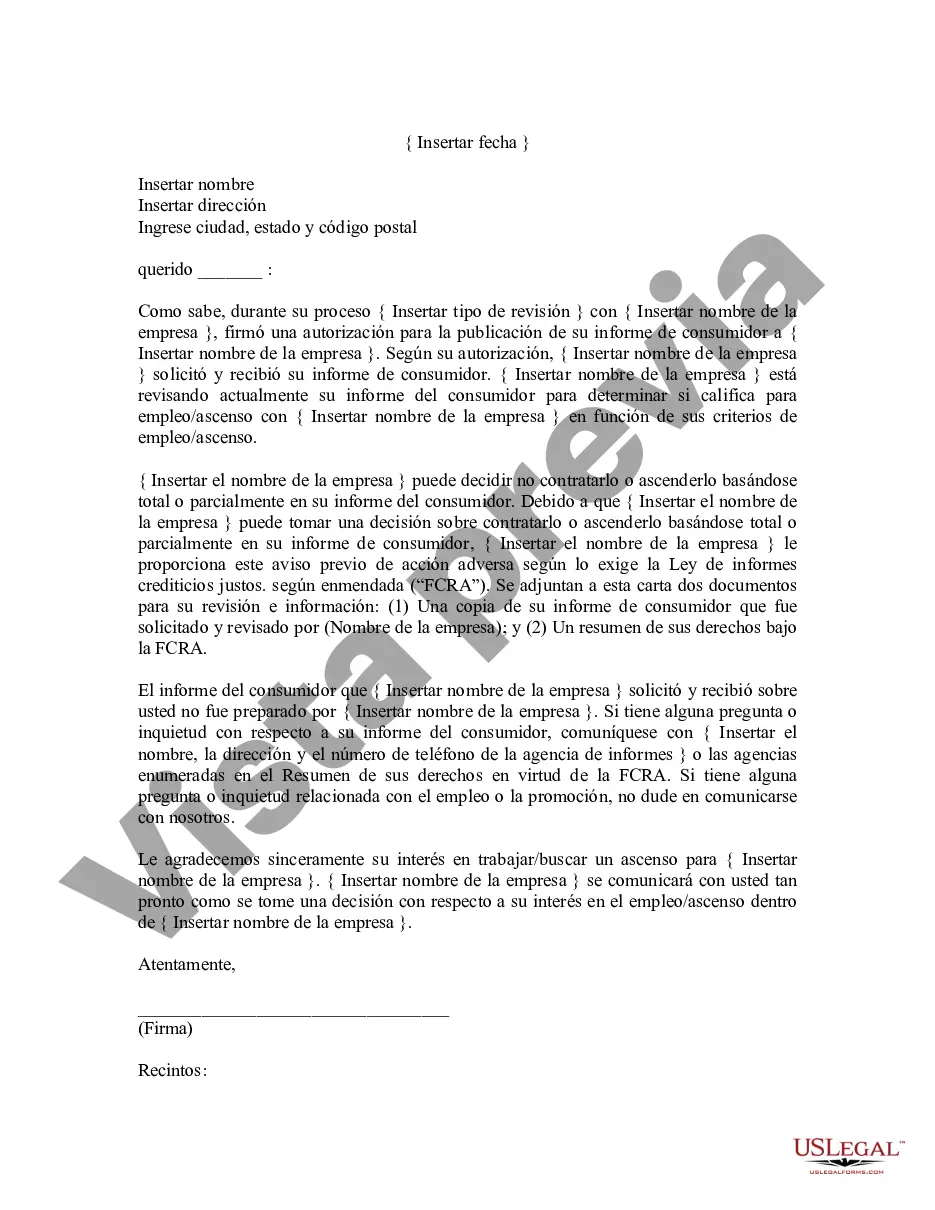

Minnesota Notification of Review of Consumer Report is a legal document that pertains to a consumer's right to access and review their personal and financial information held by credit reporting agencies. It sets forth the requirements and procedures individuals must follow to obtain and examine their consumer reports. This notification is applicable in the state of Minnesota and ensures that individuals have the opportunity to detect and correct any errors or discrepancies in their credit reports. The purpose of the Minnesota Notification of Review of Consumer Report is to promote transparency and protect consumers' privacy rights. It encompasses various important aspects regarding consumer reports, such as credit history, payment history, public records, inquiries, and other information used by lenders and employers to evaluate an individual's creditworthiness. The key elements of the Minnesota Notification of Review of Consumer Report include: 1. Access to Consumer Reports: This notification grants Minnesota residents the right to obtain copies of their consumer reports from credit reporting agencies operating in the state. Consumers can request these reports annually or whenever they suspect inaccuracies. 2. Procedure for Requesting a Report: The notification outlines the procedure consumers must follow to obtain their reports. Typically, individuals need to submit a written request, enclosing necessary identification documents, to the credit reporting agency. 3. Timeframes for Report Delivery: The notification sets forth specific timeframes within which credit reporting agencies must provide consumers with the requested reports. Generally, agencies must furnish the reports within 30 days upon receiving the request. 4. Dispute Resolution Process: In case individuals identify errors or incomplete information in their consumer reports, the notification describes the procedures for disputing the inaccurate data. Consumers can file disputes in writing and request investigations, leading to the correction or removal of erroneous information. 5. Identity Theft Protections: The Minnesota Notification of Review of Consumer Report includes provisions aimed at safeguarding consumers against identity theft. It mandates credit reporting agencies to place fraud alerts or security freezes on consumer reports upon request, helping to prevent unauthorized access and potential misuse of personal data. Some specific types of Minnesota Notifications of Review of Consumer Report may include: 1. Minnesota Notification of Review of Credit Report: This type of notification solely focuses on reviewing and correcting credit-related information, including credit scores, payment history, outstanding debts, and credit limits. 2. Minnesota Notification of Review of Employment Report: This notification is relevant in the context of employment background checks. It addresses the rights of the consumer to access and review employment-related information contained in their consumer reports, including previous employment history, income details, and any adverse action taken based on the report. 3. Minnesota Notification of Review of Tenant Report: This specific notification pertains to individuals seeking to review their tenant reports. It outlines the process for obtaining and assessing rental history and screening reports, allowing tenants to identify any inaccuracies that may impact their ability to secure housing. Overall, the Minnesota Notification of Review of Consumer Report empowers consumers by providing them with the means to access and monitor their credit and personal information. By utilizing the rights granted under this notification, individuals can proactively manage their financial reputations, correct errors, and protect themselves against potential fraud or identity theft.

Minnesota Notification of Review of Consumer Report is a legal document that pertains to a consumer's right to access and review their personal and financial information held by credit reporting agencies. It sets forth the requirements and procedures individuals must follow to obtain and examine their consumer reports. This notification is applicable in the state of Minnesota and ensures that individuals have the opportunity to detect and correct any errors or discrepancies in their credit reports. The purpose of the Minnesota Notification of Review of Consumer Report is to promote transparency and protect consumers' privacy rights. It encompasses various important aspects regarding consumer reports, such as credit history, payment history, public records, inquiries, and other information used by lenders and employers to evaluate an individual's creditworthiness. The key elements of the Minnesota Notification of Review of Consumer Report include: 1. Access to Consumer Reports: This notification grants Minnesota residents the right to obtain copies of their consumer reports from credit reporting agencies operating in the state. Consumers can request these reports annually or whenever they suspect inaccuracies. 2. Procedure for Requesting a Report: The notification outlines the procedure consumers must follow to obtain their reports. Typically, individuals need to submit a written request, enclosing necessary identification documents, to the credit reporting agency. 3. Timeframes for Report Delivery: The notification sets forth specific timeframes within which credit reporting agencies must provide consumers with the requested reports. Generally, agencies must furnish the reports within 30 days upon receiving the request. 4. Dispute Resolution Process: In case individuals identify errors or incomplete information in their consumer reports, the notification describes the procedures for disputing the inaccurate data. Consumers can file disputes in writing and request investigations, leading to the correction or removal of erroneous information. 5. Identity Theft Protections: The Minnesota Notification of Review of Consumer Report includes provisions aimed at safeguarding consumers against identity theft. It mandates credit reporting agencies to place fraud alerts or security freezes on consumer reports upon request, helping to prevent unauthorized access and potential misuse of personal data. Some specific types of Minnesota Notifications of Review of Consumer Report may include: 1. Minnesota Notification of Review of Credit Report: This type of notification solely focuses on reviewing and correcting credit-related information, including credit scores, payment history, outstanding debts, and credit limits. 2. Minnesota Notification of Review of Employment Report: This notification is relevant in the context of employment background checks. It addresses the rights of the consumer to access and review employment-related information contained in their consumer reports, including previous employment history, income details, and any adverse action taken based on the report. 3. Minnesota Notification of Review of Tenant Report: This specific notification pertains to individuals seeking to review their tenant reports. It outlines the process for obtaining and assessing rental history and screening reports, allowing tenants to identify any inaccuracies that may impact their ability to secure housing. Overall, the Minnesota Notification of Review of Consumer Report empowers consumers by providing them with the means to access and monitor their credit and personal information. By utilizing the rights granted under this notification, individuals can proactively manage their financial reputations, correct errors, and protect themselves against potential fraud or identity theft.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.