Minnesota Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock

Description

How to fill out Investment Intent Letter And Appointment Of The Representative Agreement Regarding Issued Shares Of Common Stock?

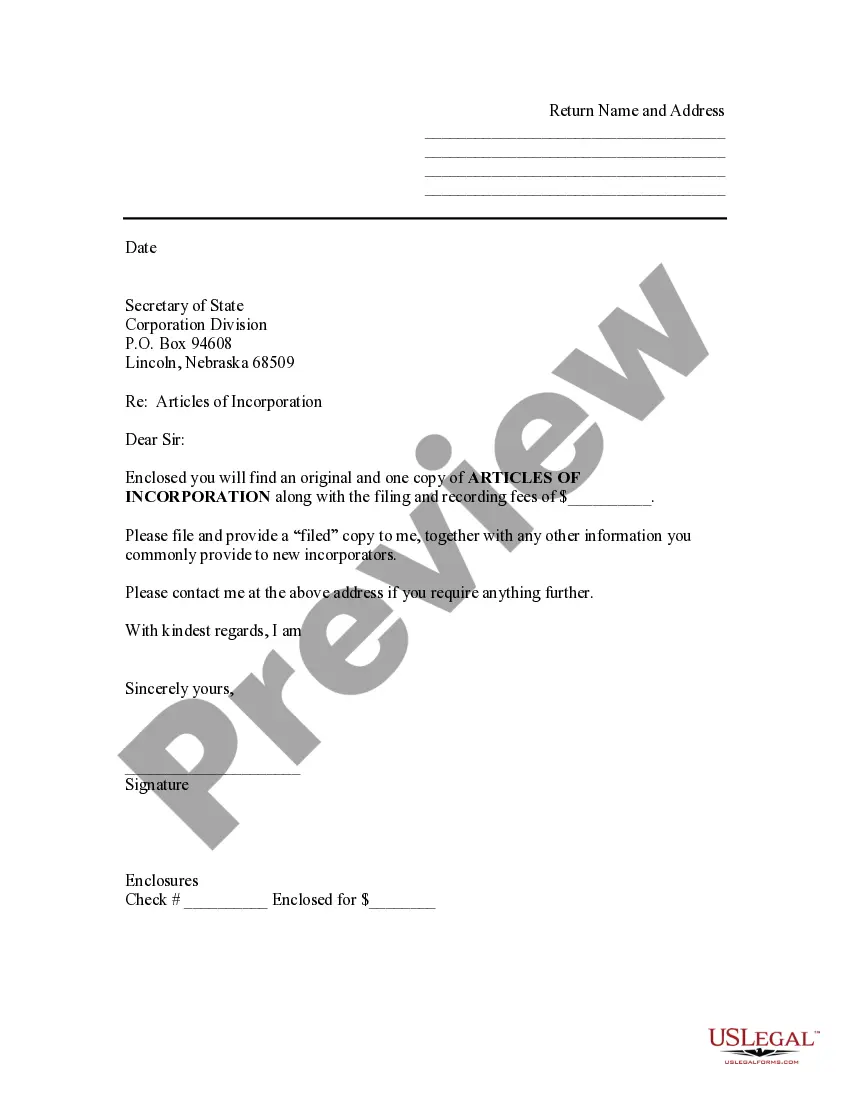

You can devote hours on-line searching for the authorized file web template that meets the federal and state demands you want. US Legal Forms gives 1000s of authorized types that happen to be analyzed by pros. It is simple to download or printing the Minnesota Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock from my support.

If you currently have a US Legal Forms account, it is possible to log in and then click the Acquire key. After that, it is possible to complete, modify, printing, or indicator the Minnesota Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock. Every single authorized file web template you buy is your own property for a long time. To obtain another version for any acquired form, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms site initially, stick to the simple recommendations under:

- Very first, make certain you have selected the proper file web template to the region/metropolis of your choosing. Read the form outline to make sure you have picked out the proper form. If available, take advantage of the Review key to appear throughout the file web template too.

- If you wish to locate another model of the form, take advantage of the Research discipline to discover the web template that meets your needs and demands.

- When you have identified the web template you desire, just click Purchase now to carry on.

- Pick the prices program you desire, key in your references, and register for an account on US Legal Forms.

- Full the deal. You may use your credit card or PayPal account to pay for the authorized form.

- Pick the file format of the file and download it to your system.

- Make adjustments to your file if possible. You can complete, modify and indicator and printing Minnesota Investment Intent Letter and Appointment of the Representative Agreement regarding issued shares of common stock.

Acquire and printing 1000s of file themes utilizing the US Legal Forms website, which provides the largest variety of authorized types. Use professional and condition-particular themes to tackle your small business or individual needs.

Form popularity

FAQ

A letter of intent for investment is used between a corporation and an organization and/or person who plans to invest in the company in return for purchasing a set number of shares in the company.

An investment letter of intent (LOI) is used to express interest in purchasing partial ownership in a company or real estate. The letter presents the basic terms of the investor's proposal and acts as a mark of their commitment to proceed through negotiations to reach a formal agreement.

Components of a LOI Opening Paragraph: Your summary statement. ... Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1?2 paragraphs; before or after the Project Activity) ... Credentials (1?2 paragraphs) ... Budget (1?2 paragraphs) ... Closing (1 paragraph) ... Signature.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

A letter of intent between the issuer of new securities and the buyer, in the private placement of these new securities. The letter of intent establishes that the securities are being bought for a minimum time period and are treated as an investment, not for resale.

A letter of intent is a document between two businesses that declares a preliminary commitment to doing business. The letter of intent should outline the terms of any future agreement and can be used to record negotiations and discussions.

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date.

A letter of intent (LOI) is a document declaring the preliminary commitment of one party to do business with another. The letter outlines the chief terms of a prospective deal. Commonly used in major business transactions, LOIs are similar in content to term sheets.