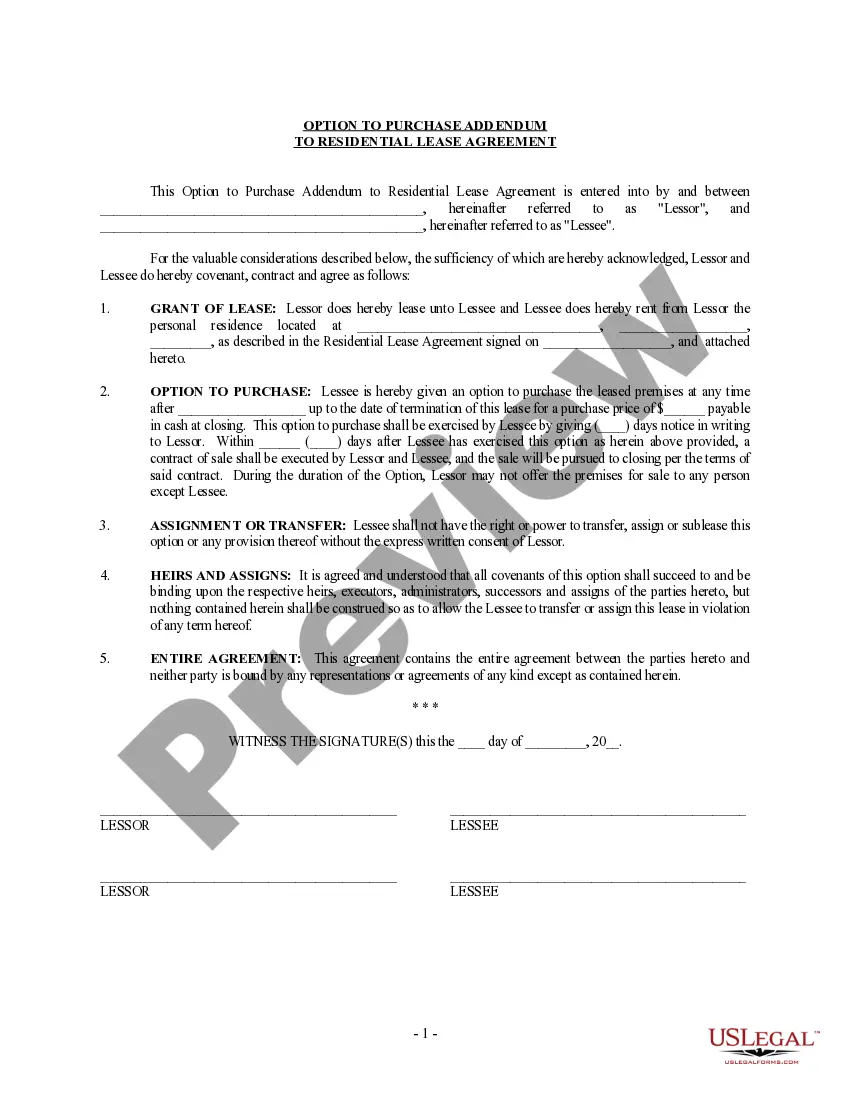

Minnesota Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

Choosing the best legitimate file format could be a have a problem. Naturally, there are plenty of web templates available online, but how do you find the legitimate form you want? Utilize the US Legal Forms internet site. The support offers a large number of web templates, including the Minnesota Term Nonparticipating Royalty Deed from Mineral Owner, that you can use for company and private needs. All of the types are checked out by professionals and meet up with state and federal demands.

Should you be presently listed, log in to your accounts and click the Down load option to have the Minnesota Term Nonparticipating Royalty Deed from Mineral Owner. Make use of your accounts to search throughout the legitimate types you possess purchased earlier. Check out the My Forms tab of your own accounts and get another version in the file you want.

Should you be a fresh end user of US Legal Forms, listed here are straightforward instructions for you to follow:

- First, ensure you have chosen the proper form for the area/county. It is possible to examine the shape utilizing the Review option and read the shape description to ensure this is basically the best for you.

- When the form fails to meet up with your needs, utilize the Seach discipline to get the proper form.

- Once you are sure that the shape is acceptable, select the Get now option to have the form.

- Choose the costs strategy you want and enter in the essential details. Create your accounts and pay money for your order utilizing your PayPal accounts or charge card.

- Select the file structure and acquire the legitimate file format to your device.

- Total, modify and print out and indication the received Minnesota Term Nonparticipating Royalty Deed from Mineral Owner.

US Legal Forms may be the greatest collection of legitimate types that you can find different file web templates. Utilize the service to acquire professionally-manufactured documents that follow express demands.