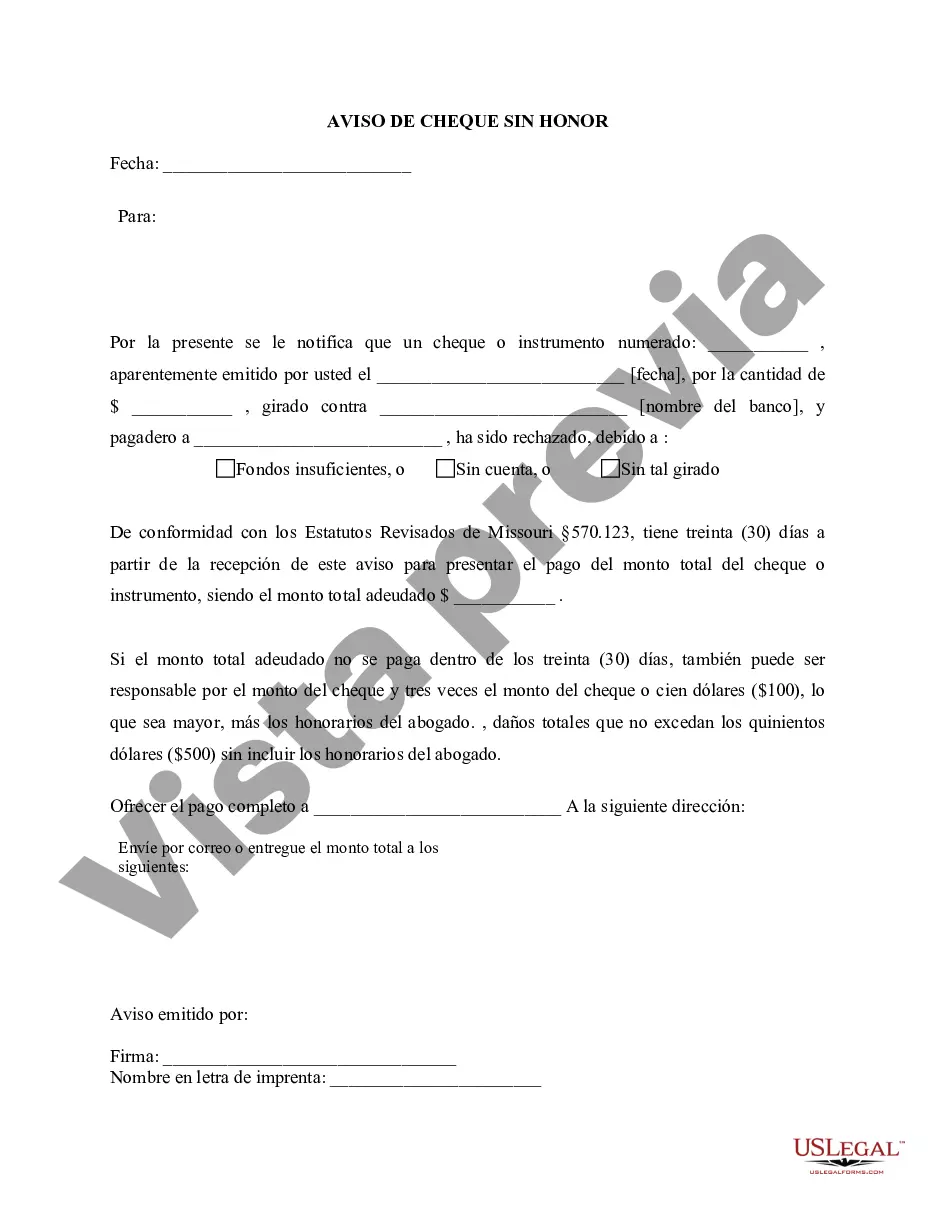

Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos

Note: This summary is not intended to be an all-inclusive summary of the law of bad checks, but does contain basic and

other provisions.

CIVIL PROVISIONS

Missouri Revised Statutes

TITLE XXXVIII - CRIMES AND PUNISHMENT; PEACE OFFICERS AND PUBLIC DEFENDERS

Chapter 570 - STEALING AND RELATED OFFENSES

Section 570.123.Until December 31, 2016--Civil action for damages for passing bad checks, only original holder may bring action--limitations--notice requirements--payroll checks, action to be against employer.

In addition to all other penalties provided by law, any person who makes, utters, draws, or delivers any check, draft, or order for the payment of money upon any bank, savings and loan association, credit union, or other depositary, financial institution, person, firm, or corporation which is not honored because of lack of funds or credit to pay or because of not having an account with the drawee and who fails to pay the amount for which such check, draft, or order was made in cash to the holder within thirty days after notice and a written demand for payment, deposited as certified or registered mail in the United States mail, or by regular mail, supported by an affidavit of service by mailing, notice deemed conclusive three days following the date the affidavit is executed, and addressed to the maker and to the endorser, if any, of the check, draft, or order at each of their addresses as it appears on the check, draft, or order or to the last known address, shall, in addition to the face amount owing upon such check, draft, or order, be liable to the holder for three times the face amount owed or one hundred dollars, whichever is greater, plus reasonable attorney fees incurred in bringing an action pursuant to this section. Only the original holder, whether the holder is a person, bank, savings and loan association, credit union, or other depository, financial institution, firm or corporation, may bring an action pursuant to this section. No original holder shall bring an action pursuant to this section if the original holder has been paid the face amount of the check and costs recovered by the prosecuting attorney or circuit attorney pursuant to subsection 6 of section 570.120. If the issuer of the check has paid the face amount of the check and costs pursuant to subsection 6 of section 570.120, such payment shall be an affirmative defense to any action brought pursuant to this section. The original holder shall elect to bring an action pursuant to this section or section 570.120, but may not bring an action pursuant to both sections. In no event shall the damages allowed pursuant to this section exceed five hundred dollars, exclusive of reasonable attorney fees. In situations involving payroll checks, the damages allowed pursuant to this section shall only be assessed against the employer who issued the payroll check and not against the employee to whom the payroll check was issued. The provisions of sections 408.140 and 408.233 to the contrary notwithstanding, a lender may bring an action pursuant to this section. The provisions of this section will not apply in cases where there exists a bona fide dispute over the quality of goods sold or services rendered.

(L. 1985 S.B. 264 § 2, A.L. 1989 S.B. 310, A.L. 1993 S.B. 180, A.L. 2002 H.B. 1888, A.L. 2005 S.B. 420 & 344) Transferred 2014; now 537.123; Effective 1-01-17

Section 570.120. Beginning January 1, 2017--Crime of passing bad checks, penalty--actual notice given, when--administrative handling costs, amount, deposit in fund--use of fund--additional costs, amount--payroll checks, action, when--service charge may be collected--return of bad check to depositor by financial institution must be on condition that issuer is identifiable.

570.120. A person commits the offense of passing a bad check when he or she:

(1) With the purpose to defraud, makes, issues or passes a check or other similar sight order or any other form of presentment involving the transmission of account information for the payment of money, knowing that it will not be paid by the drawee, or that there is no such drawee; or

(2) Makes, issues, or passes a check or other similar sight order or any other form of presentment involving the transmission of account information for the payment of money, knowing that there are insufficient funds in or on deposit with that account for the payment of such check, sight order, or other form of presentment involving the transmission of account information in full and all other checks, sight orders, or other forms of presentment involving the transmission of account information upon such funds then outstanding, or that there is no such account or no drawee and fails to pay the check or sight order or other form of presentment involving the transmission of account information within ten days after receiving actual notice in writing that it has not been paid because of insufficient funds or credit with the drawee or because there is no such drawee.

2. As used in subdivision (2) of subsection 1 of this section, "actual notice in writing" means notice of the nonpayment which is actually received by the defendant. Such notice may include the service of summons or warrant upon the defendant for the initiation of the prosecution of the check or checks which are the subject matter of the prosecution if the summons or warrant contains information of the ten-day period during which the instrument may be paid and that payment of the instrument within such ten-day period will result in dismissal of the charges. The requirement of notice shall also be satisfied for written communications which are tendered to the defendant and which the defendant refuses to accept.

3. The face amounts of any bad checks passed pursuant to one course of conduct within any ten-day period may be aggregated in determining the grade of the offense.

4. The offense of passing bad checks is a class A misdemeanor, unless:

(1) The face amount of the check or sight order or the aggregated amounts is seven hundred fifty dollars or more; or

(2) The issuer had no account with the drawee or if there was no such drawee at the time the check or order was issued, in which case passing a bad check is a class E felony.

5. In addition to all other costs and fees allowed by law, each prosecuting attorney or circuit attorney who takes any action pursuant to the provisions of this section shall collect from the issuer in such action an administrative handling cost. The cost shall be twenty-five dollars for checks of less than one hundred dollars, and fifty dollars for checks of one hundred dollars but less than two hundred fifty dollars. For checks of two hundred fifty dollars or more an additional fee of ten percent of the face amount shall be assessed, with a maximum fee for administrative handling costs not to exceed seventy-five dollars total. Notwithstanding the provisions of sections 50.525 to 50.745, the costs provided for in this subsection shall be deposited by the county treasurer into the administrative handling cost fund, established under section 559.100. Notwithstanding any law to the contrary, in addition to the administrative handling cost, the prosecuting attorney or circuit attorney shall collect an additional cost of five dollars per check for deposit to the Missouri office of prosecution services fund established in subsection 2 of section 56.765. All moneys collected pursuant to this section which are payable to the Missouri office of prosecution services fund shall be transmitted at least monthly by the county treasurer to the director of revenue who shall deposit the amount collected pursuant to the credit of the Missouri office of prosecution services fund under the procedure established pursuant to subsection 2 of section 56.765.<br />

<br />

6. Notwithstanding any other provision of law to the contrary:<br />

<br />

(1) In addition to the administrative handling costs provided for in subsection 5 of this section, the prosecuting attorney or circuit attorney may collect from the issuer, in addition to the face amount of the check, a reasonable service charge, which along with the face amount of the check, shall be turned over to the party to whom the bad check was issued;<br />

<br />

(2) If a check that is dishonored or returned unpaid by a financial institution is not referred to the prosecuting attorney or circuit attorney for any action pursuant to the provisions of this section, the party to whom the check was issued, or his or her agent or assignee, or a holder, may collect from the issuer, in addition to the face amount of the check, a reasonable service charge, not to exceed twenty-five dollars, plus an amount equal to the actual charge by the depository institution for the return of each unpaid or dishonored instrument.<br />

<br />

7. When any financial institution returns a dishonored check to the person who deposited such check, it shall be in substantially the same physical condition as when deposited, or in such condition as to provide the person who deposited the check the information required to identify the person who wrote the check.<br />

<br />

(L. 1977 S.B. 60, A.L. 1989 S.B. 310, A.L. 1992 S.B. 705, A.L. 1993 S.B. 180, A.L. 2001 H.B. 80, A.L. 2002 H.B. 1888, A.L. 2005 H.B. 353, A.L. 2013 H.B. 215, A.L. 2014 S.B. 491) Effective 1-01-17 CROSS REFERENCE: Taxes paid with bad checks, penalty, 139.235