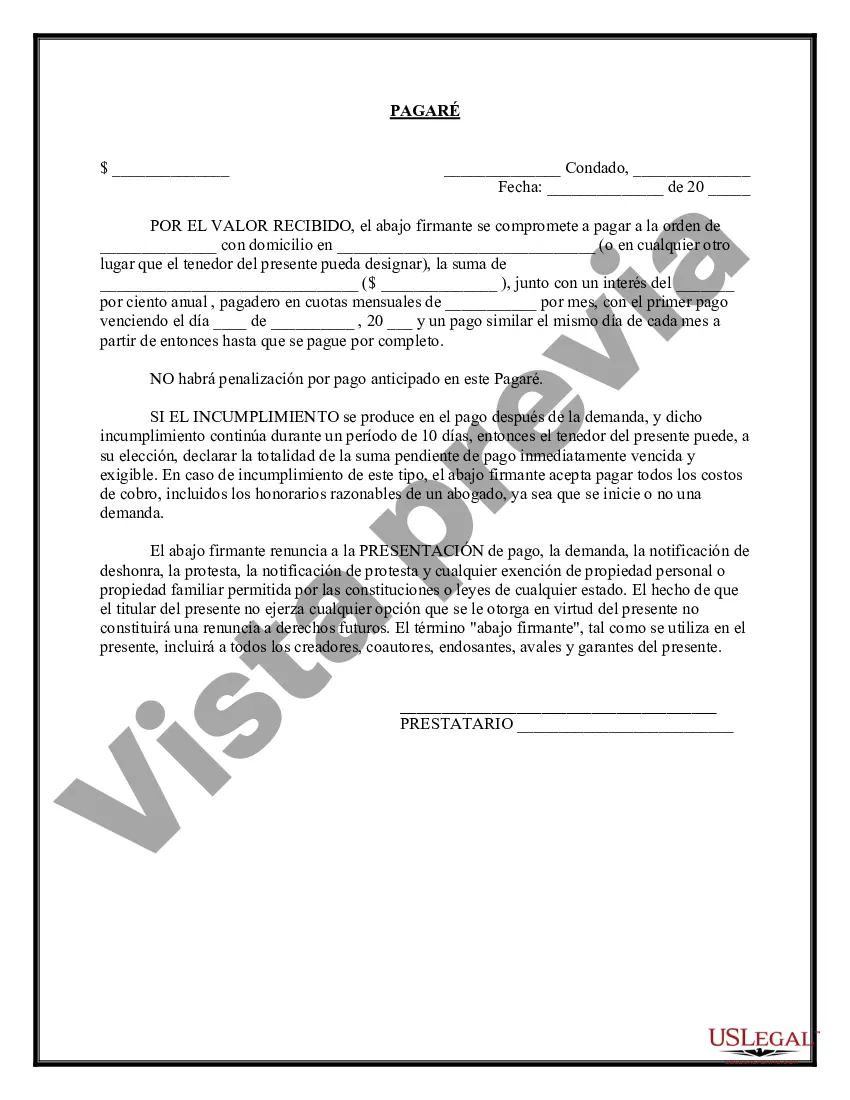

A Missouri Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Missouri. This note serves as evidence of the loan and clearly defines the repayment schedule, interest rate, and other specific terms agreed upon by both parties. The Missouri Promissory Note with Installment Payments specifies that the borrower will repay the loan amount in fixed, regular installments over a predetermined period. These installments typically include both the principal amount borrowed and the accrued interest, divided into equal payments to be made at regular intervals, such as monthly or quarterly. The note includes essential information such as the borrower's and lender's names and addresses, the loan amount, the interest rate applied, the repayment schedule, the due date of each payment, any late fees or penalties, and the consequences of defaulting on the loan. The document also addresses other important details, such as the type of security or collateral for the loan, if any. In Missouri, there might be different types of Promissory Notes with Installment Payments available, depending on the specific needs and agreements between the parties involved. Some common types include: 1. Secured Promissory Note with Installment Payments: This type of note requires the borrower to pledge collateral, such as real estate or a vehicle, to secure the loan. If the borrower fails to make the agreed-upon payments, the lender has the right to seize the collateral as repayment. 2. Unsecured Promissory Note with Installment Payments: In this case, there is no collateral involved, and the loan is solely based on the borrower's creditworthiness and promise to repay. If the borrower defaults, the lender may take legal action to recover the funds through other means. 3. Promissory Note with Balloon Payment: This type of note structure involves smaller installment payments throughout the loan term, with a larger final payment, called a balloon payment, due at the end. It is commonly used when a borrower expects to have a lump sum of money or refinances the loan before the balloon payment is due. 4. Promissory Note with Variable Interest Rate: This note allows for an interest rate that may fluctuate over the loan term, usually based on a reference index such as the prime rate or LIBOR. The note will include provisions on how the interest rate will adjust and when. Regardless of the type of Missouri Promissory Note with Installment Payments used, it is crucial for both the lender and borrower to carefully review and understand the terms before signing. Seeking legal advice or using a professional template can ensure the note accurately reflects the intentions of both parties and protects their rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Missouri Pagaré Con Pagos A Plazos?

US Legal Forms - one of many largest libraries of legitimate forms in the United States - provides a wide array of legitimate papers web templates you may down load or produce. Utilizing the web site, you may get a large number of forms for organization and specific reasons, categorized by types, suggests, or keywords and phrases.You can get the latest types of forms much like the Missouri Promissory Note with Installment Payments within minutes.

If you have a membership, log in and down load Missouri Promissory Note with Installment Payments from the US Legal Forms library. The Download button will appear on each develop you look at. You have access to all formerly saved forms within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, listed below are basic directions to get you started:

- Be sure to have picked out the best develop for your area/region. Go through the Preview button to analyze the form`s information. See the develop information to ensure that you have chosen the proper develop.

- In case the develop does not satisfy your specifications, use the Search industry near the top of the display to discover the the one that does.

- Should you be satisfied with the shape, affirm your choice by clicking on the Purchase now button. Then, pick the rates strategy you favor and give your accreditations to sign up on an accounts.

- Method the purchase. Use your Visa or Mastercard or PayPal accounts to accomplish the purchase.

- Select the structure and down load the shape on the system.

- Make alterations. Fill up, change and produce and signal the saved Missouri Promissory Note with Installment Payments.

Each web template you included in your bank account lacks an expiration particular date which is your own for a long time. So, in order to down load or produce another version, just visit the My Forms segment and click on around the develop you require.

Gain access to the Missouri Promissory Note with Installment Payments with US Legal Forms, the most substantial library of legitimate papers web templates. Use a large number of professional and express-certain web templates that meet up with your small business or specific requires and specifications.