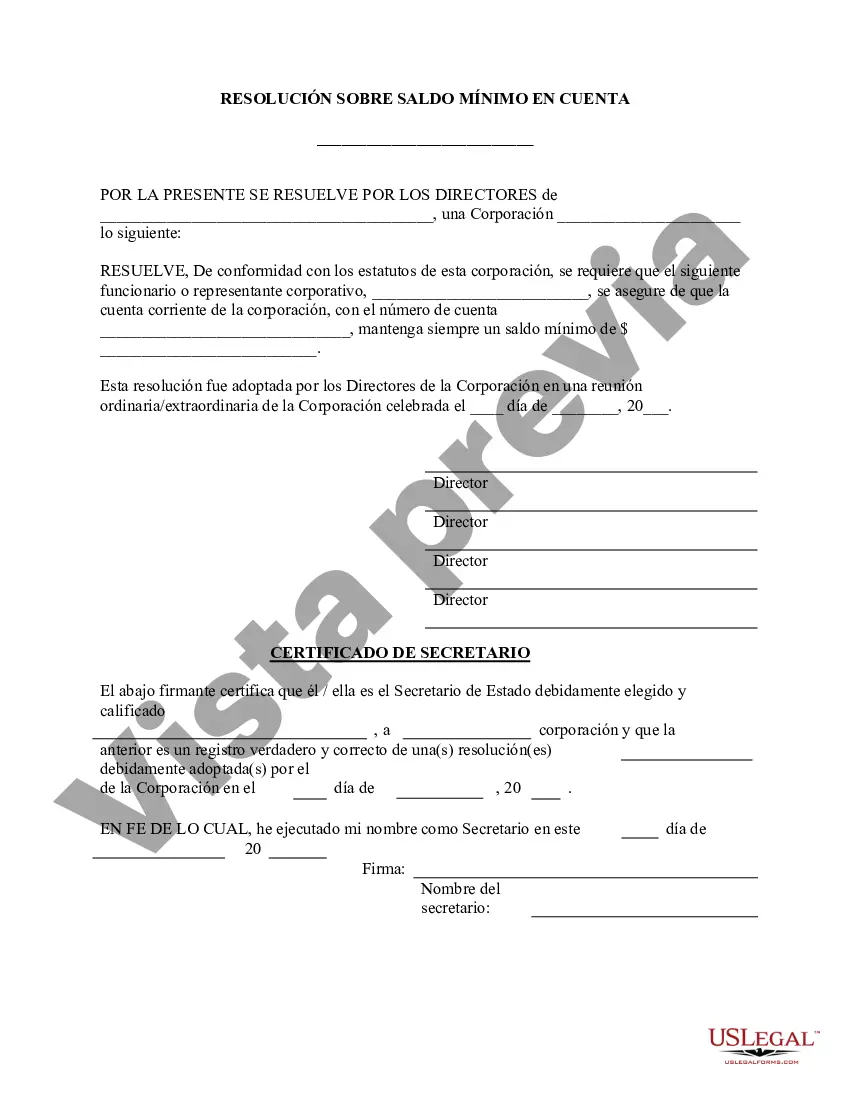

Missouri Minimum Checking Account Balance — Corporate Resolutions Form refers to a document that outlines the minimum required balance for a checking account held by corporations in the state of Missouri. This form is essential for businesses operating in Missouri as it ensures compliance with state regulations regarding minimum banking requirements. The Missouri Minimum Checking Account Balance — Corporate Resolutions Form serves as a legal agreement between the corporation and the financial institution where the account is held. It specifies the minimum balance that must be maintained in the checking account at all times. The primary purpose of this requirement is to ensure the financial stability of businesses and guarantee their ability to fulfill financial obligations promptly. By maintaining a minimum balance, corporations can avoid potential penalties or account restrictions imposed by the bank. Missouri recognizes various types of corporate resolutions forms related to minimum checking account balances, including: 1. Standard Minimum Checking Account Balance Resolution: This resolution specifies the minimum balance that must be maintained in the corporation's checking account. It outlines the consequences of failing to meet this requirement, such as additional fees or restrictions on account activity. 2. Minimum Checking Account Balance Amendment Resolution: This type of resolution is used when a corporation needs to modify the minimum balance requirement stated in an existing corporate resolution. It allows businesses to adjust the minimum balance based on their evolving financial needs. 3. Multi-Account Minimum Checking Account Balance Resolution: In cases where corporations hold multiple checking accounts, this resolution governs the total minimum balance required across all accounts. It ensures that the collective balance meets the established threshold. It is important for corporations in Missouri to carefully review and understand the terms and conditions outlined in the Missouri Minimum Checking Account Balance — Corporate Resolutions Form. Failure to comply with the minimum balance requirement may lead to financial penalties, account restrictions, or even potential legal consequences. Therefore, businesses should consult with their legal and financial advisors to ensure they complete the necessary forms accurately and maintain the minimum balance as required by the state law. By doing so, corporations can effectively manage their finances and establish a positive banking relationship that supports their ongoing operations and growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Saldo Mínimo de Cuenta Corriente - Formulario de Resoluciones Corporativas - Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Missouri Saldo Mínimo De Cuenta Corriente - Formulario De Resoluciones Corporativas?

It is possible to invest time online trying to find the authorized document web template which fits the state and federal needs you require. US Legal Forms supplies a large number of authorized kinds that happen to be analyzed by professionals. You can actually acquire or print out the Missouri Minimum Checking Account Balance - Corporate Resolutions Form from my services.

If you already have a US Legal Forms profile, you can log in and click the Down load switch. Next, you can full, modify, print out, or indication the Missouri Minimum Checking Account Balance - Corporate Resolutions Form. Every authorized document web template you acquire is the one you have for a long time. To acquire one more version associated with a purchased kind, visit the My Forms tab and click the related switch.

If you use the US Legal Forms internet site initially, follow the straightforward guidelines under:

- Initially, make certain you have selected the best document web template for your state/metropolis of your liking. See the kind description to ensure you have picked out the appropriate kind. If accessible, take advantage of the Preview switch to check through the document web template too.

- If you wish to locate one more version in the kind, take advantage of the Look for industry to obtain the web template that fits your needs and needs.

- When you have identified the web template you want, click on Buy now to move forward.

- Find the costs program you want, key in your references, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal profile to fund the authorized kind.

- Find the file format in the document and acquire it for your device.

- Make adjustments for your document if required. It is possible to full, modify and indication and print out Missouri Minimum Checking Account Balance - Corporate Resolutions Form.

Down load and print out a large number of document web templates making use of the US Legal Forms site, which offers the most important variety of authorized kinds. Use specialist and express-distinct web templates to take on your company or individual requires.