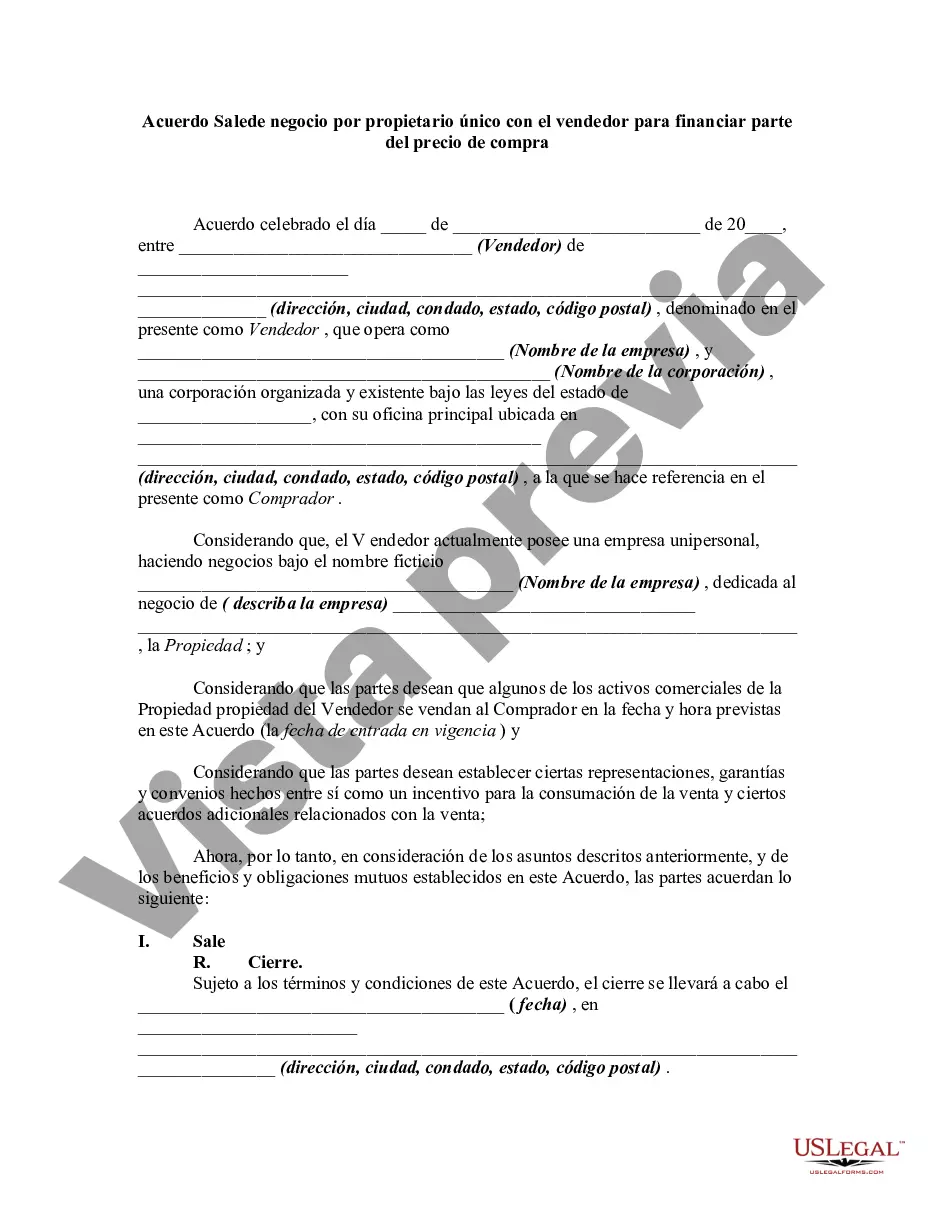

The Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legally binding contract that outlines the terms and conditions for purchasing a business from a sole proprietorship. This agreement is specifically designed for situations where the seller agrees to finance a portion of the purchase price. In this agreement, the parties involved are the seller, who is the sole proprietor of the business, and the buyer, who wishes to acquire the business. The agreement includes details such as the names and addresses of both parties, the effective date of the agreement, and a detailed description of the business being sold. Keywords: Missouri Agreement for Sale of Business, Sole Proprietorship, Seller, Finance, Purchase Price. Some variations of the Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price may include: 1. Partial financing agreement: This variation specifically focuses on the seller agreeing to finance a portion of the purchase price, usually including specific terms and conditions related to the payment schedule and interest rates. 2. Asset-based agreement: In certain cases, the buyer may only be interested in acquiring specific assets of the sole proprietorship rather than the entire business. This variation of the agreement focuses on the sale and financing terms for those specific assets. 3. Leaseback agreement: In some instances, the seller may agree to lease back certain assets or property to the buyer after the sale. This variation outlines the terms and conditions of the leaseback arrangement while also addressing the financing aspect. 4. Franchise agreement: If the sole proprietorship is operated as a franchised business, this variation of the agreement may include additional terms and conditions specific to the franchise relationship, such as royalty payments or ongoing support. 5. Non-compete agreement: In situations where the seller intends to exit the industry entirely, a non-compete clause may be included in the agreement. This clause restricts the seller from competing with the buyer's newly acquired business within a defined geographic area and time frame. Overall, the Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price provides a comprehensive framework to facilitate the smooth transfer of ownership and financing arrangements between a sole proprietor and a buyer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Missouri Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

You may spend several hours on-line searching for the legitimate file web template which fits the state and federal requirements you need. US Legal Forms gives 1000s of legitimate varieties that happen to be analyzed by professionals. It is possible to down load or print the Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price from my service.

If you currently have a US Legal Forms account, you can log in and then click the Download button. After that, you can complete, modify, print, or sign the Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price. Each legitimate file web template you buy is your own permanently. To obtain yet another duplicate of any obtained form, go to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site for the first time, adhere to the basic recommendations beneath:

- First, make certain you have selected the right file web template to the state/area of your choosing. Read the form explanation to ensure you have selected the correct form. If offered, make use of the Preview button to search from the file web template too.

- If you wish to get yet another version from the form, make use of the Research field to obtain the web template that meets your needs and requirements.

- Once you have discovered the web template you would like, just click Acquire now to proceed.

- Pick the rates prepare you would like, key in your credentials, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal account to cover the legitimate form.

- Pick the formatting from the file and down load it in your gadget.

- Make changes in your file if required. You may complete, modify and sign and print Missouri Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price.

Download and print 1000s of file themes using the US Legal Forms Internet site, that offers the most important collection of legitimate varieties. Use expert and status-certain themes to handle your company or individual needs.