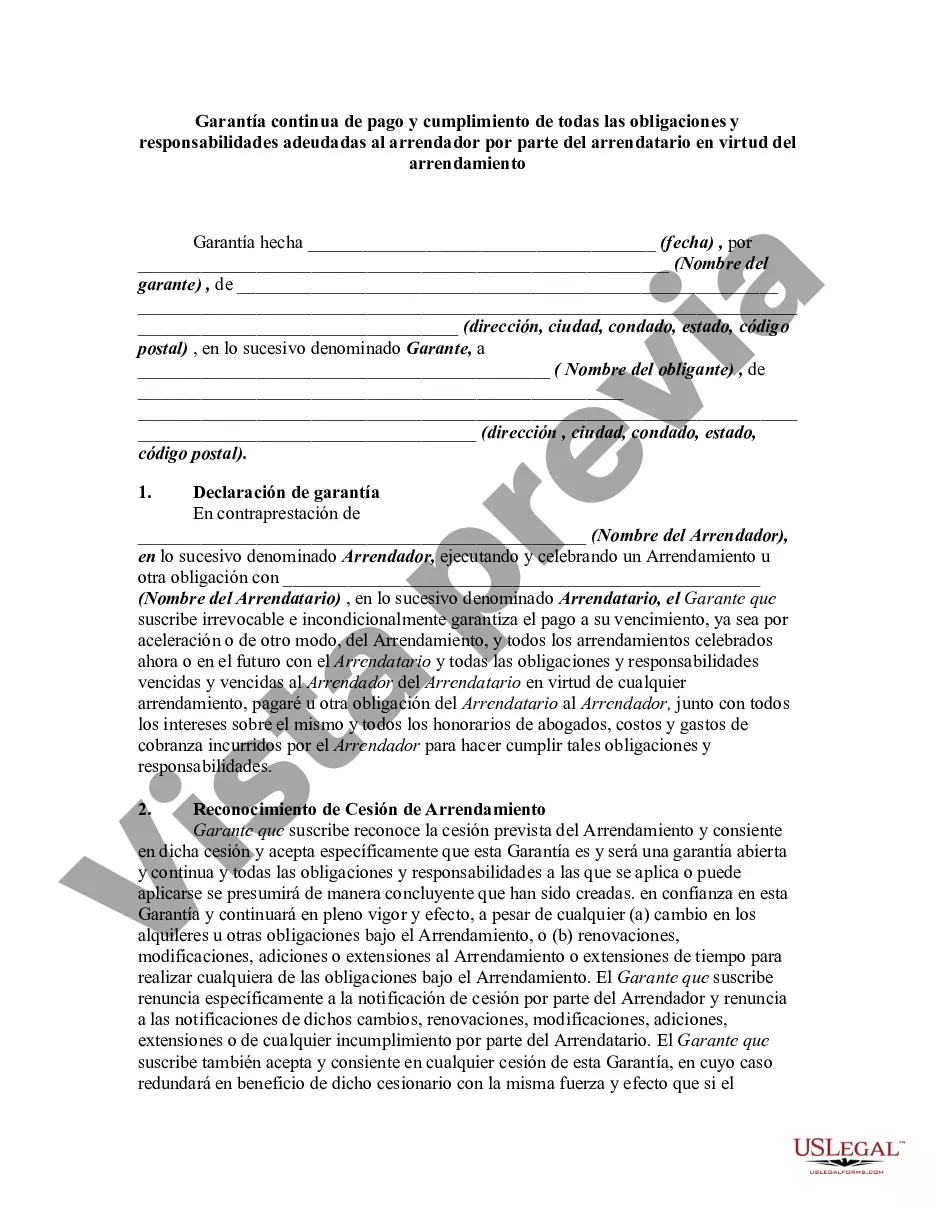

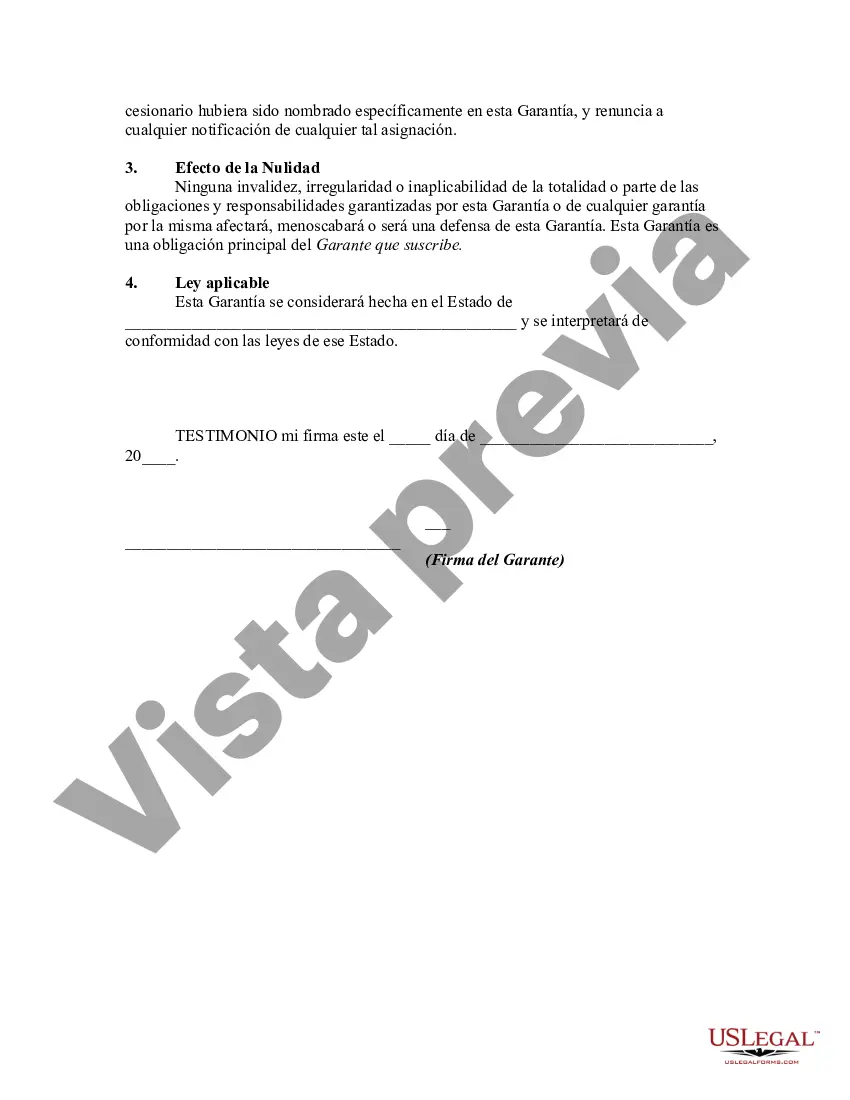

In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

The Missouri Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a legal agreement designed to provide assurances to lessors (landlords or leasing companies) that they will be paid and their rights protected in lease agreements. This guaranty is specific to the state of Missouri and ensures that the lessee (tenant or borrower) remains liable for their lease obligations in the event of default. In essence, the Missouri Continuing Guaranty of Payment and Performance serves as a form of security for lessors by introducing a third-party guarantor who will step in and fulfill the lease obligations if the lessee fails to do so. This adds an extra layer of protection for lessors, as they can pursue legal action against both the lessee and the guarantor to recover any outstanding payments or damages. The key objective of this guaranty is to ensure that lessors can fully rely on the lessees' financial stability and ability to meet their lease obligations. Therefore, it is crucial for both lessees and guarantors to thoroughly understand the terms and implications of the guaranty before signing any leases or binding agreements. Different types of Missouri Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease may include: 1. Unconditional Guaranty: This type of guaranty holds the guarantor fully responsible for all the obligations outlined in the lease agreement, leaving no room for excuses or defenses. 2. Conditional Guaranty: In contrast to an unconditional guaranty, a conditional guaranty may contain specific conditions or limitations that restrict the guarantor's liability. This could include limitations on the amount guaranteed or certain circumstances where the guarantor's liability is triggered. 3. Limited Guaranty: The limited guaranty places restrictions on the guarantor's obligations, typically in terms of the amount guaranteed or a specified period. This type of guaranty aims to limit the guarantor's liability while still providing some level of protection to the lessor. 4. Corporate Guaranty: A corporate guaranty is issued by a company on behalf of its subsidiary or affiliated entities, ensuring the lessor that the obligations will be met by the corporate entity in the event of default by the lessee. It is important for all parties involved in a lease agreement to carefully review and understand the specific terms, conditions, and limitations outlined in the Missouri Continuing Guaranty of Payment and Performance. Seeking legal advice to ensure compliance with the laws of Missouri and to clarify any questions or concerns is highly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.