An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

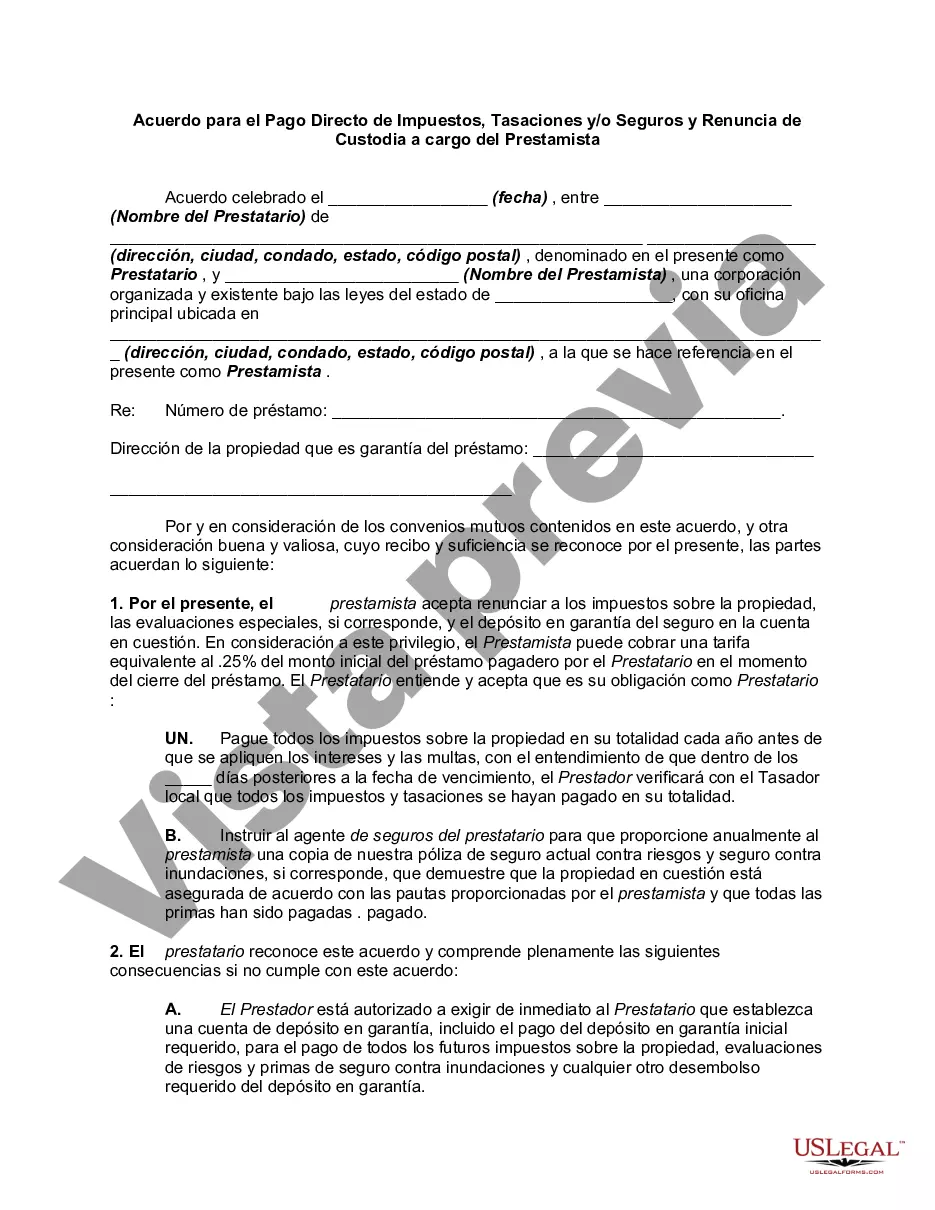

The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions regarding the direct payment of taxes, assessments, and/or insurance by the borrower, instead of having the mes crowed and paid by the lender. This agreement is applicable in the state of Missouri and is designed to provide flexibility and convenience for borrowers who prefer to handle the payment of their property taxes, assessments, and insurance directly. By signing this agreement, borrowers can waive the requirement for the lender to hold and disburse funds for these expenses from an escrow account. The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers several types, including: 1. Tax Payment Agreement: This type of agreement specifically focuses on the direct payment of property taxes. It outlines the borrower's responsibility to pay property taxes directly to the appropriate tax authority, along with any applicable penalties or interest in late payments. 2. Assessment Payment Agreement: This agreement pertains to the direct payment of assessments, such as special assessments levied by homeowners' associations, improvement districts, or other governmental entities. It details the borrower's obligation to pay these assessments directly to the designated entity. 3. Insurance Payment Agreement: This type of agreement addresses the direct payment of insurance premiums, such as homeowners' insurance or mortgage insurance, by the borrower to the respective insurance provider. The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender contains important clauses and provisions to protect the interests of both parties involved. It typically includes sections discussing the borrower's obligations, lender's rights, conditions for reinstating escrow account, and any penalties for non-compliance. Overall, this agreement empowers borrowers to manage their tax, assessment, and insurance payments directly, offering them more control over their financial obligations. However, it is important for borrowers to thoroughly understand the terms and implications of such an agreement before signing, and seek legal advice if needed.The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the terms and conditions regarding the direct payment of taxes, assessments, and/or insurance by the borrower, instead of having the mes crowed and paid by the lender. This agreement is applicable in the state of Missouri and is designed to provide flexibility and convenience for borrowers who prefer to handle the payment of their property taxes, assessments, and insurance directly. By signing this agreement, borrowers can waive the requirement for the lender to hold and disburse funds for these expenses from an escrow account. The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender offers several types, including: 1. Tax Payment Agreement: This type of agreement specifically focuses on the direct payment of property taxes. It outlines the borrower's responsibility to pay property taxes directly to the appropriate tax authority, along with any applicable penalties or interest in late payments. 2. Assessment Payment Agreement: This agreement pertains to the direct payment of assessments, such as special assessments levied by homeowners' associations, improvement districts, or other governmental entities. It details the borrower's obligation to pay these assessments directly to the designated entity. 3. Insurance Payment Agreement: This type of agreement addresses the direct payment of insurance premiums, such as homeowners' insurance or mortgage insurance, by the borrower to the respective insurance provider. The Missouri Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender contains important clauses and provisions to protect the interests of both parties involved. It typically includes sections discussing the borrower's obligations, lender's rights, conditions for reinstating escrow account, and any penalties for non-compliance. Overall, this agreement empowers borrowers to manage their tax, assessment, and insurance payments directly, offering them more control over their financial obligations. However, it is important for borrowers to thoroughly understand the terms and implications of such an agreement before signing, and seek legal advice if needed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.