Keywords: Missouri, Comprehensive Equipment Lease, Provision, Investment Tax, types Detailed description: A Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement that allows businesses to lease equipment while also including a provision related to investment tax. Missouri businesses often utilize this lease type to acquire necessary equipment for their operations without the burden of purchasing the equipment outright. The lease encompasses a comprehensive arrangement that outlines the terms and conditions between the lessor (the equipment leasing company) and the lessee (the business or individual). It covers various aspects, including payment schedule, lease duration, security deposits, maintenance responsibilities, and termination clauses. The key aspect that sets this lease apart is the provision regarding investment tax. Missouri offers tax incentives for businesses that make investments in certain equipment categories. By incorporating a specific provision related to investment tax, businesses can potentially claim tax deductions or credits on lease payments made for eligible equipment. This provision aims to encourage businesses to invest in equipment, promoting economic growth and development in the state. There can be different types of Missouri Comprehensive Equipment Leases with Provisions Regarding Investment Tax, tailored to meet specific business needs or equipment categories. Some common variations include: 1. Machinery and Equipment Lease: This lease type focuses on machinery and equipment necessary for manufacturing processes. It enables businesses to lease specialized machinery, automated systems, tools, and other equipment required to enhance operational efficiency. 2. Technology Equipment Lease: Geared towards businesses in the technology sector, this lease type allows for the leasing of computer hardware, software, servers, networking equipment, and other technological assets. It facilitates keeping up with rapidly evolving technology while enjoying investment tax advantages. 3. Vehicle Lease: Ideal for businesses requiring transportation assets, this lease type covers cars, trucks, vans, or fleets, enabling companies to fulfill their transportation needs without the financial burdens of upfront purchase costs. The investment tax provision applies to eligible vehicles. 4. Medical Equipment Lease: Designed for healthcare providers, this lease type focuses on leasing medical equipment such as diagnostic machines, imaging equipment, surgical tools, and patient monitoring systems. The investment tax provision can be particularly advantageous in this industry, as medical equipment expenses are typically significant. These are just a few examples of the various Missouri Comprehensive Equipment Leases with Provisions Regarding Investment Tax available. Businesses should consult legal and tax advisors to understand the specific lease terms, qualifying criteria for investment tax benefits, and compliance requirements.

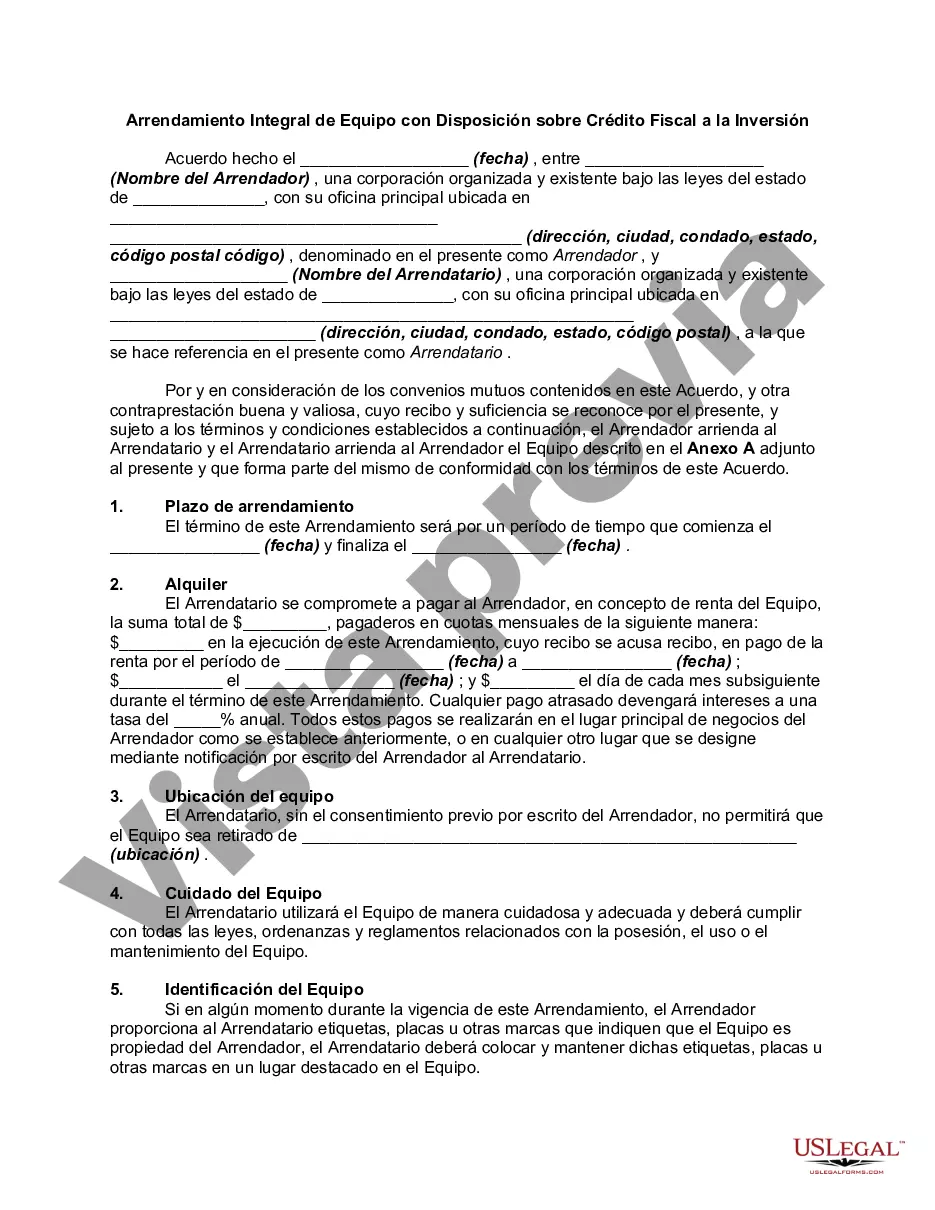

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Missouri Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Discovering the right lawful file design might be a struggle. Needless to say, there are a variety of layouts accessible on the Internet, but how will you get the lawful type you want? Take advantage of the US Legal Forms web site. The assistance offers thousands of layouts, such as the Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax, which can be used for business and private requires. Every one of the types are examined by experts and meet up with state and federal specifications.

In case you are presently signed up, log in to the account and click the Download button to get the Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax. Make use of your account to check through the lawful types you possess ordered earlier. Visit the My Forms tab of your account and get another backup of the file you want.

In case you are a fresh customer of US Legal Forms, allow me to share basic instructions so that you can comply with:

- Initial, ensure you have selected the right type for your personal area/state. You are able to look through the form using the Review button and read the form outline to ensure it is the best for you.

- When the type will not meet up with your preferences, use the Seach area to discover the proper type.

- Once you are certain that the form is acceptable, click the Get now button to get the type.

- Opt for the prices plan you need and enter in the needed details. Build your account and purchase your order using your PayPal account or bank card.

- Pick the file formatting and obtain the lawful file design to the gadget.

- Full, edit and print and indication the attained Missouri Comprehensive Equipment Lease with Provision Regarding Investment Tax.

US Legal Forms will be the biggest collection of lawful types where you can discover a variety of file layouts. Take advantage of the company to obtain appropriately-created files that comply with state specifications.