A Missouri General Letter of Credit with Account of Shipment is a financial instrument commonly used in international trade transactions. This type of letter of credit provides a guarantee to the seller (beneficiary) that they will receive payment for the goods shipped, upon presenting the required documents to the issuing bank. The Missouri General Letter of Credit with Account of Shipment is specifically designed to facilitate the smooth movement of goods, ensuring that both parties involved in the transaction are protected. It acts as a contract between the buyer (applicant) and the beneficiary, creating a level of trust and ensuring that payment is made promptly and securely. Key features of the Missouri General Letter of Credit with Account of Shipment include: 1. Payment Guarantee: The issuing bank provides an undertaking to pay the beneficiary promptly upon receipt of the necessary documents, as stated in the letter of credit. 2. Condition-based Payment: The beneficiary's compliance with the terms and conditions of the letter of credit determines the payment release. This includes the presentation of documents such as commercial invoices, bills of lading, packing lists, and insurance certificates, among others. 3. Independence from the Underlying Contract: The Missouri General Letter of Credit with Account of Shipment operates independently of the contract of sale between the buyer and the seller. It provides an added layer of security for both parties, as the payment is not contingent upon the success or failure of the underlying transaction. 4. International Acceptance: The letter of credit is recognized and accepted globally, allowing businesses engaged in international trade to confidently engage in transactions with partners in Missouri or elsewhere. While there may not be specific types of Missouri General Letter of Credit with Account of Shipment, variations within the letter of credit framework, such as Revocable or Irrevocable Letters of Credit, Standby Letters of Credit, or Transferable Letters of Credit, can be utilized based on the specific needs of the parties involved in the trade transaction. In conclusion, the Missouri General Letter of Credit with Account of Shipment provides a secure and efficient method for conducting international trade transactions. It ensures that both the buyer and seller are protected, minimizing the risks associated with non-payment or non-delivery. With global recognition and acceptance, this letter of credit serves as a valuable tool for fostering trust and facilitating smooth trade relationships.

Missouri General Letter of Credit with Account of Shipment

Description

How to fill out Missouri General Letter Of Credit With Account Of Shipment?

Are you in a position that you need to have papers for both enterprise or person uses virtually every working day? There are tons of lawful record web templates available online, but discovering kinds you can rely on is not easy. US Legal Forms gives thousands of type web templates, like the Missouri General Letter of Credit with Account of Shipment, that happen to be written to fulfill federal and state requirements.

Should you be already knowledgeable about US Legal Forms site and possess an account, merely log in. After that, you can download the Missouri General Letter of Credit with Account of Shipment web template.

Should you not offer an account and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the type you want and make sure it is for the correct metropolis/county.

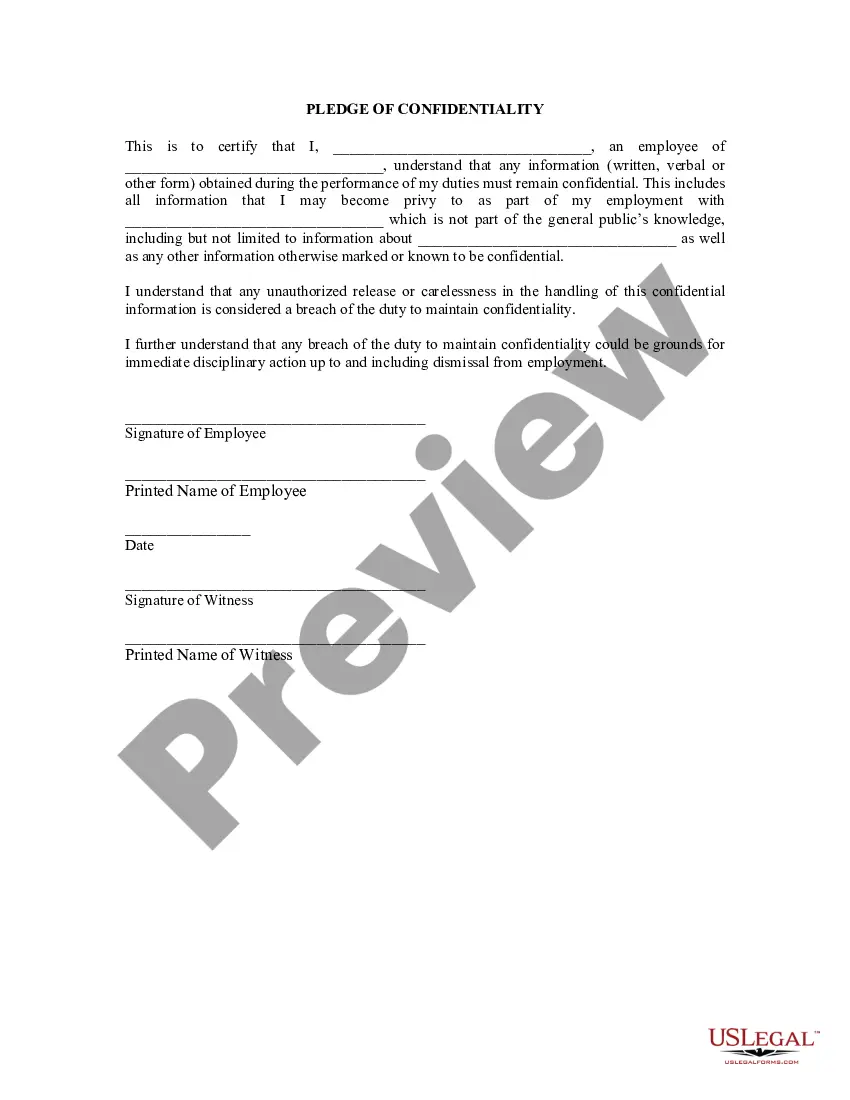

- Utilize the Preview switch to review the form.

- Look at the information to actually have chosen the appropriate type.

- If the type is not what you are seeking, take advantage of the Look for area to find the type that meets your needs and requirements.

- Once you find the correct type, click on Buy now.

- Opt for the costs program you need, fill in the necessary information and facts to produce your money, and purchase an order utilizing your PayPal or credit card.

- Choose a convenient document formatting and download your copy.

Get all of the record web templates you have purchased in the My Forms food list. You can aquire a additional copy of Missouri General Letter of Credit with Account of Shipment any time, if necessary. Just click the required type to download or print out the record web template.

Use US Legal Forms, the most extensive variety of lawful varieties, in order to save some time and avoid mistakes. The assistance gives expertly made lawful record web templates that can be used for a range of uses. Generate an account on US Legal Forms and start generating your lifestyle a little easier.