Missouri Installment Promissory Note with Bank Deposit as Collateral is a legal document that establishes a borrower's commitment to repay a loan amount in regular installments, while utilizing a bank deposit as collateral. This type of promissory note provides security for the lender in case of default by the borrower. In Missouri, there are different variations of the Installment Promissory Note with Bank Deposit as Collateral based on specific requirements and circumstances. Some common types include: 1. Secured Installment Promissory Note: This type of promissory note specifies the bank deposit as collateral, ensuring that the lender has a legal claim to the deposit in case of non-payment by the borrower. It provides an added layer of security for the lender. 2. Fixed-Rate Installment Promissory Note: This version of the promissory note involves a fixed interest rate set at the time of signing the agreement. Both the borrower and the lender agree on a specific repayment schedule and interest rate, allowing for predictable installments throughout the loan term. 3. Adjustable-Rate Installment Promissory Note: This type of promissory note includes an interest rate that is subject to change over time, usually based on an external financial index or benchmark. The rate adjustment intervals and terms are agreed upon between the borrower and the lender. 4. Balloon Payment Installment Promissory Note: This variation of the promissory note includes regular installments over a defined period but with a significant final payment known as a balloon payment. The borrower typically offsets this balloon payment by using the bank deposit as collateral. 5. Acceleration Clause Installment Promissory Note: This type of promissory note states that if the borrower fails to make the installment payments or defaults on the loan, the lender has the right to accelerate the repayment. The bank deposit collateral can be used to satisfy the outstanding loan balance. When drafting a Missouri Installment Promissory Note with Bank Deposit as Collateral, it is crucial to include all the essential details, such as the names and contact information of both parties, the loan amount, interest rate, repayment schedule, collateral description, default provisions, and dispute resolution clauses. It is advisable to consult with a legal professional to ensure compliance with Missouri laws and to customize the promissory note according to the specific requirements and preferences of both parties involved.

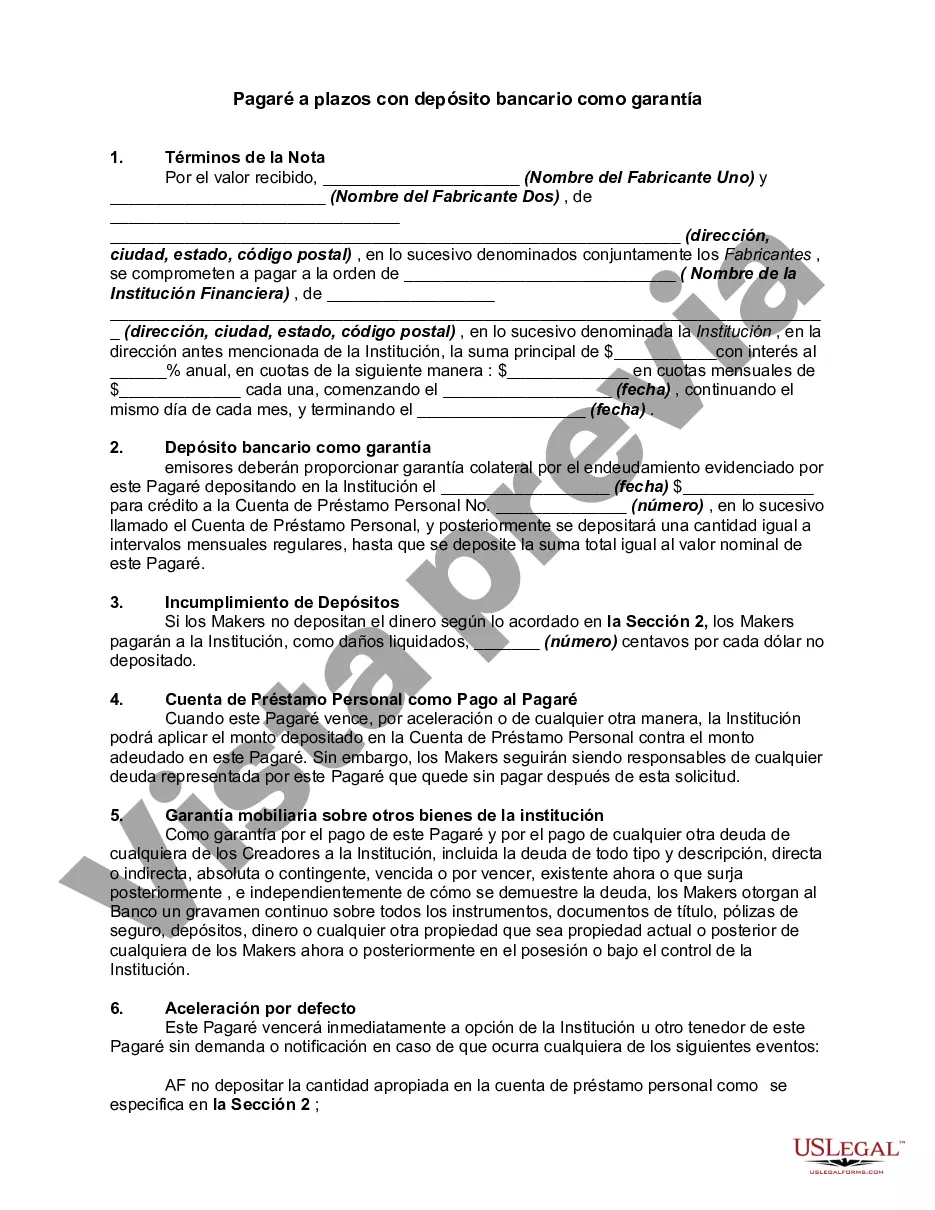

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Missouri Pagaré A Plazos Con Depósito Bancario Como Garantía?

US Legal Forms - among the most significant libraries of lawful forms in the States - delivers a wide array of lawful record layouts you can download or print out. While using website, you can find a huge number of forms for enterprise and individual purposes, categorized by types, suggests, or keywords and phrases.You will find the newest versions of forms just like the Missouri Installment Promissory Note with Bank Deposit as Collateral within minutes.

If you currently have a registration, log in and download Missouri Installment Promissory Note with Bank Deposit as Collateral in the US Legal Forms library. The Obtain key will show up on every kind you perspective. You have access to all previously delivered electronically forms inside the My Forms tab of your profile.

If you wish to use US Legal Forms initially, listed here are straightforward recommendations to help you started out:

- Be sure to have chosen the right kind to your area/state. Click on the Review key to review the form`s content material. See the kind information to ensure that you have selected the right kind.

- When the kind does not suit your needs, use the Look for area at the top of the display screen to find the one which does.

- Should you be pleased with the form, verify your option by clicking on the Acquire now key. Then, select the costs program you prefer and provide your references to sign up to have an profile.

- Method the purchase. Use your Visa or Mastercard or PayPal profile to perform the purchase.

- Choose the format and download the form on your own system.

- Make modifications. Complete, change and print out and indicator the delivered electronically Missouri Installment Promissory Note with Bank Deposit as Collateral.

Each and every format you put into your money lacks an expiration particular date and is your own for a long time. So, if you wish to download or print out one more copy, just check out the My Forms segment and click on on the kind you need.

Gain access to the Missouri Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, by far the most considerable library of lawful record layouts. Use a huge number of expert and express-specific layouts that satisfy your company or individual demands and needs.