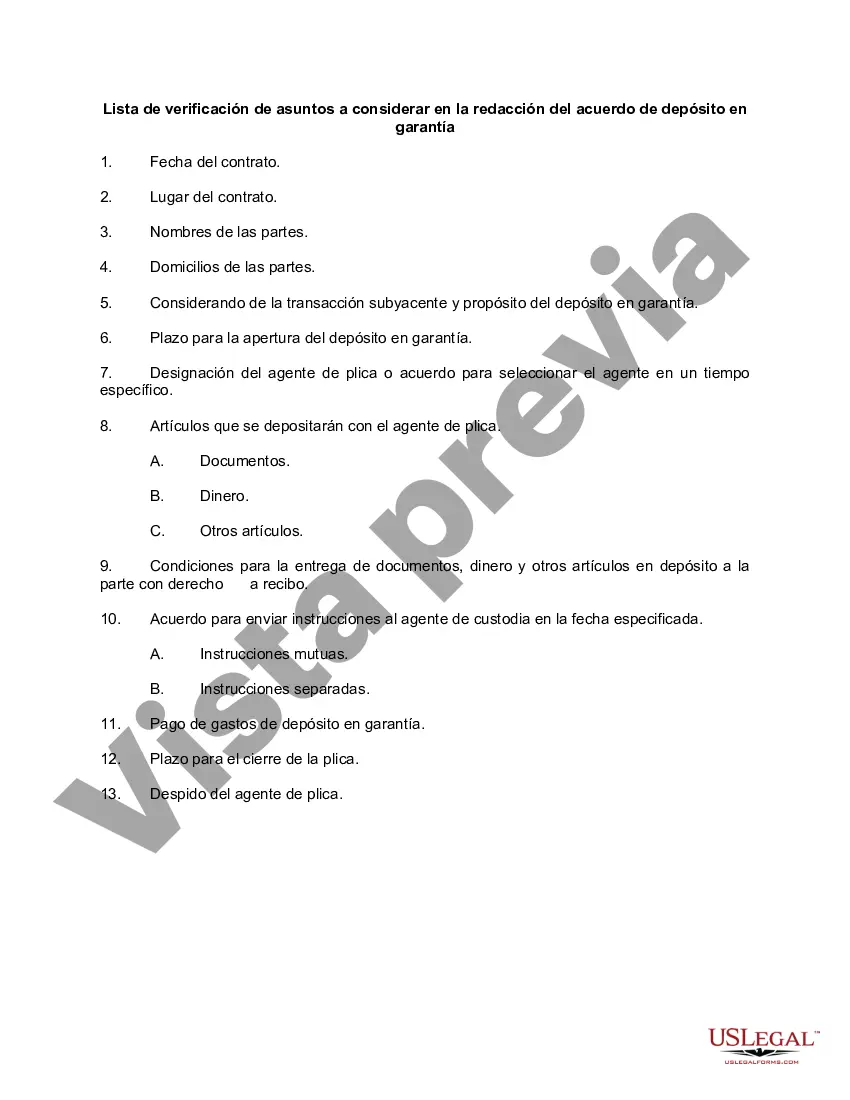

Title: Missouri Checklist of Matters to Consider in Drafting an Escrow Agreement Keywords: Missouri, escrow agreement, matters to consider, checklist, drafting Introduction: When it comes to drafting an escrow agreement in the state of Missouri, it is vital to take into account numerous factors to ensure a smooth and secure transaction. This comprehensive checklist aims to outline various matters that should be considered during the process of drafting an escrow agreement in Missouri. 1. Parties Involved: — Identify and clearly state the names and contact information of all parties involved in the escrow transaction, including the buyer, seller, and escrow agent. — Define the roles and responsibilities of each party, specifying their obligations related to the escrow agreement. 2. Agreement Terms: — Clearly articulate the purpose of the escrow, whether it is for a real estate transaction, business acquisition, or any other specific purpose. — Detail the specific terms and conditions of the escrow agreement, including the duration, funds involved, and any contingencies that may affect the release of funds. 3. Escrow Agent Responsibilities: — Outline the duties and responsibilities of the escrow agent to ensure compliance with Missouri laws and regulations. — Specify any specific qualifications or requirements expected from the escrow agent, such as licensing or certifications. 4. Disbursement of Funds: — Establish the conditions under which funds will be released from escrow to the designated parties. — Include provisions for handling contingencies and unexpected events, such as disputes, defaults, or breaches of contract. 5. Conditions for Termination: — Clearly define the circumstances under which the escrow agreement will be terminated, such as successful completion of the transaction or mutual agreement between the parties involved. — Address the procedure for distributing remaining funds and any applicable fees or penalties upon termination. 6. Confidentiality and Security: — Outline provisions to protect the confidentiality and security of sensitive information provided by the parties involved. — Consider incorporating technology safeguards to ensure the secure transfer and storage of electronic documents and funds. 7. Amendments and Modifications: — Specify the process for making amendments or modifications to the escrow agreement, including the requirements for written consent from all parties involved. — Define the method of communication and the individuals authorized to make changes to the agreement. In Conclusion: Drafting a comprehensive and detailed escrow agreement in Missouri requires careful consideration of the mentioned matters. By utilizing this checklist, parties involved can ensure that their escrow agreement is legally compliant, secure, and addresses the unique requirements of their transaction. Alternate Types: — Missouri Real Estate Escrow Agreement Checklist — Missouri Business Acquisition Escrow Agreement Checklist — Missouri Legal Escrow Agreement Checklist — Missouri Technology-Escrow AgreemenChecklist.st.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Missouri Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Are you in the placement where you require papers for possibly organization or personal uses just about every day? There are plenty of legitimate file templates available on the Internet, but getting ones you can depend on is not simple. US Legal Forms provides 1000s of develop templates, just like the Missouri Checklist of Matters to be Considered in Drafting Escrow Agreement, that are published to satisfy state and federal specifications.

If you are already knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. After that, you can obtain the Missouri Checklist of Matters to be Considered in Drafting Escrow Agreement format.

If you do not have an account and wish to begin using US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for the proper town/county.

- Take advantage of the Review key to review the shape.

- Browse the description to ensure that you have chosen the appropriate develop.

- In the event the develop is not what you are searching for, take advantage of the Look for field to discover the develop that suits you and specifications.

- Whenever you obtain the proper develop, just click Acquire now.

- Pick the prices prepare you need, fill in the required information and facts to produce your money, and buy an order making use of your PayPal or Visa or Mastercard.

- Pick a convenient data file file format and obtain your version.

Discover all of the file templates you may have bought in the My Forms food selection. You can obtain a additional version of Missouri Checklist of Matters to be Considered in Drafting Escrow Agreement at any time, if necessary. Just click the required develop to obtain or printing the file format.

Use US Legal Forms, the most comprehensive variety of legitimate forms, to conserve some time and steer clear of errors. The service provides professionally manufactured legitimate file templates which can be used for a range of uses. Make a merchant account on US Legal Forms and start making your life a little easier.