Missouri Notice of Returned Check

Description

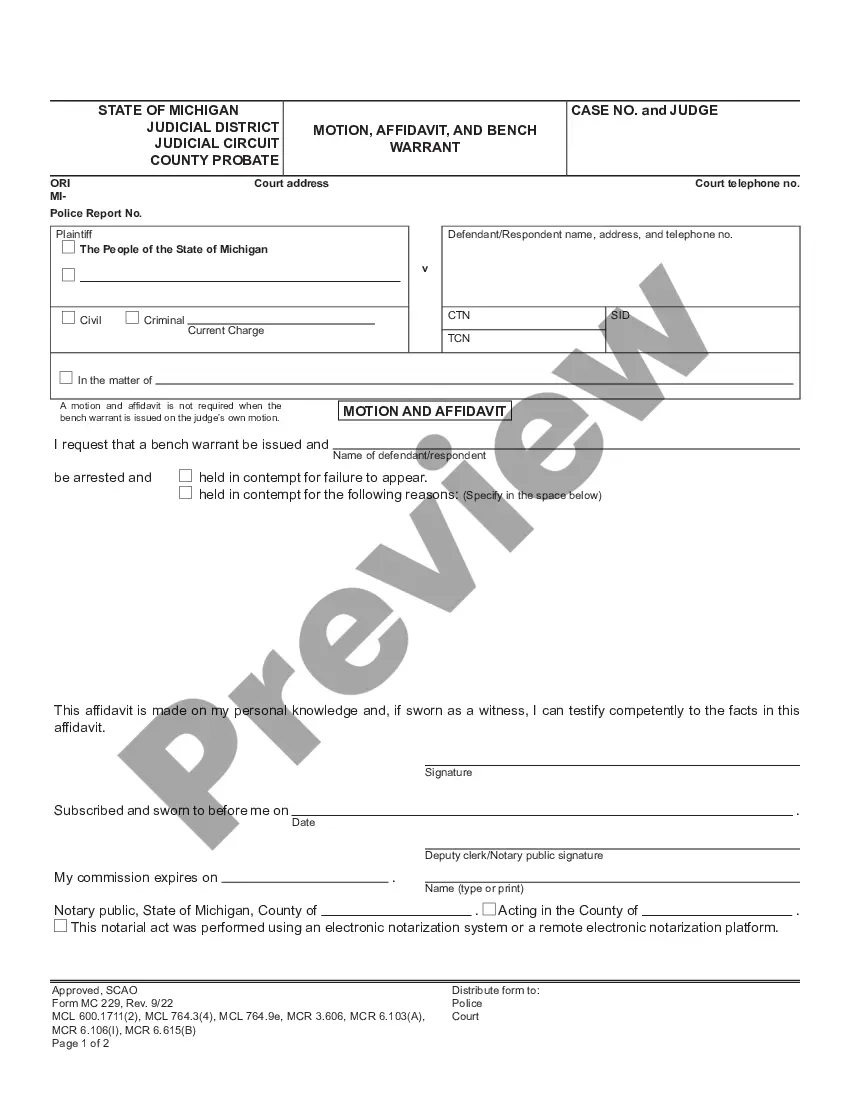

How to fill out Notice Of Returned Check?

Locating the appropriate legal document web template can be rather challenging.

Of course, there are countless designs accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers a plethora of templates, such as the Missouri Notice of Returned Check, which you can utilize for both business and personal purposes.

If the form does not meet your needs, make use of the Search field to locate the appropriate document. Once you are confident that the form is correct, click on the Purchase now button to acquire the document. Choose the pricing plan you require and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Missouri Notice of Returned Check. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally-crafted documents that adhere to state guidelines.

- All of the documents are reviewed by experts and meet state and federal requirements.

- If you are already registered, sign in to your account and click the Download button to retrieve the Missouri Notice of Returned Check.

- Use your account to browse the legal forms you have acquired previously.

- Navigate to the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

- First, ensure you have selected the correct form for your area/region. You can examine the document using the Review button and check the form details to confirm that it is indeed the right one for you.

Form popularity

FAQ

To send your federal tax return from Missouri, you need to use the address specified for returns filed from your state. Typically, you will send it to a designated IRS processing center, based on whether you're filing with a payment or expect a refund. Always verify the correct mailing address on the IRS website to avoid complications, such as a Missouri Notice of Returned Check, and ensure your filing is processed accurately.

Yes, Missouri offers e-filing options for taxpayers to easily submit their returns online. E-filing simplifies the process and ensures your documents are submitted quickly and securely, reducing the likelihood of issues like a Missouri Notice of Returned Check. You can find the available e-file forms on the Missouri Department of Revenue's website, making it convenient to comply with tax regulations.

When mailing your Missouri tax return, the address depends on whether you are sending it with or without payment. If you include payment, it’s important to use the address specified for tax payments. To prevent complications, such as delays caused by a Missouri Notice of Returned Check, always double-check the current mailing addresses listed by the Missouri Department of Revenue.

Mailing your tax return requires knowing the right address based on your circumstances. If you are sending in your Missouri tax return, ensure that you have selected the correct address for your file type. For taxpayers without payments, the mailing address may differ from that of those submitting payments. You can find this information on the Missouri Department of Revenue’s official website.

You need to send your Missouri tax return to the designated address for your specific situation. This varies depending on whether you are filing with a payment or requesting a refund. If you plan to include payment, the address may differ from the one used for refunds. Always check with the Missouri Department of Revenue for the most accurate address to avoid delays or issues, such as receiving a Missouri Notice of Returned Check.

When completing your tax return, you should use your current home address. It's essential to ensure that all correspondence, including any regarding a Missouri Notice of Returned Check, reaches you promptly. This address should match your state identification and any other legal documents. If your address changes, be sure to update it with both the Missouri Department of Revenue and the IRS.

If you need your tax refund resent, begin by contacting the IRS directly. It’s essential to provide them with accurate information to facilitate the process. In cases where a Missouri Notice of Returned Check has impacted your finances, keeping track of correspondence and documentation can prove crucial in ensuring you receive your refund without delay.

The sentence for writing a bad check can vary. Typically, minor cases may result in misdemeanor charges, while felonies can lead to imprisonment and restitution. Understanding the implications of a Missouri Notice of Returned Check can help you navigate the legal landscape and seek alternatives to avoid harsh penalties.

Dealing with a bad check starts with contacting the issuer promptly. It’s wise to adhere to legal rights and protocols outlined in a Missouri Notice of Returned Check. If necessary, consider using uslegalforms as a resource to guide you through the steps of recovery or potential legal action.

In Missouri, writing a check for $500 or more can elevate the offense to a felony. If you’re facing issues related to a Missouri Notice of Returned Check, understanding the financial thresholds is vital. Charges can become severe, making it essential to act swiftly if you find yourself in this situation.