A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

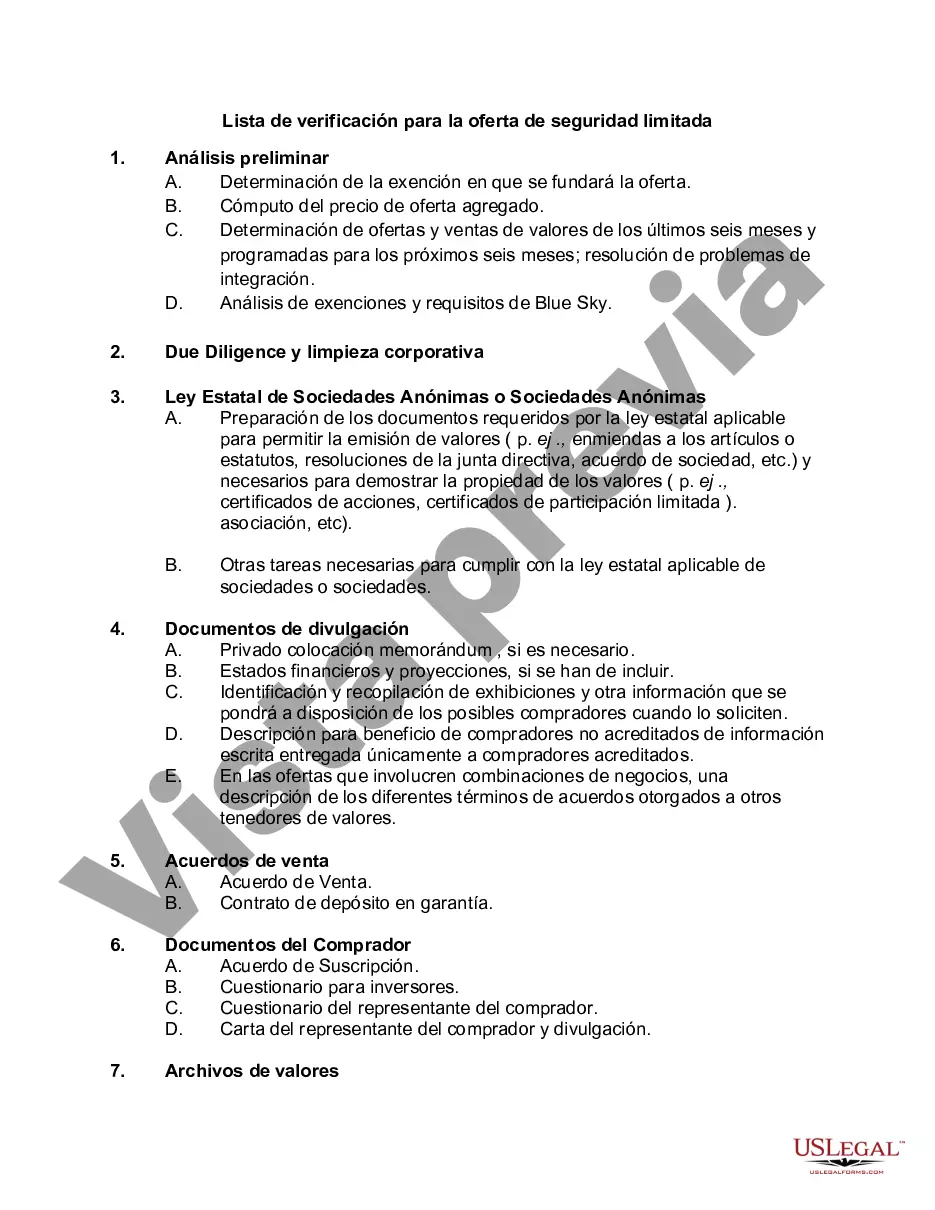

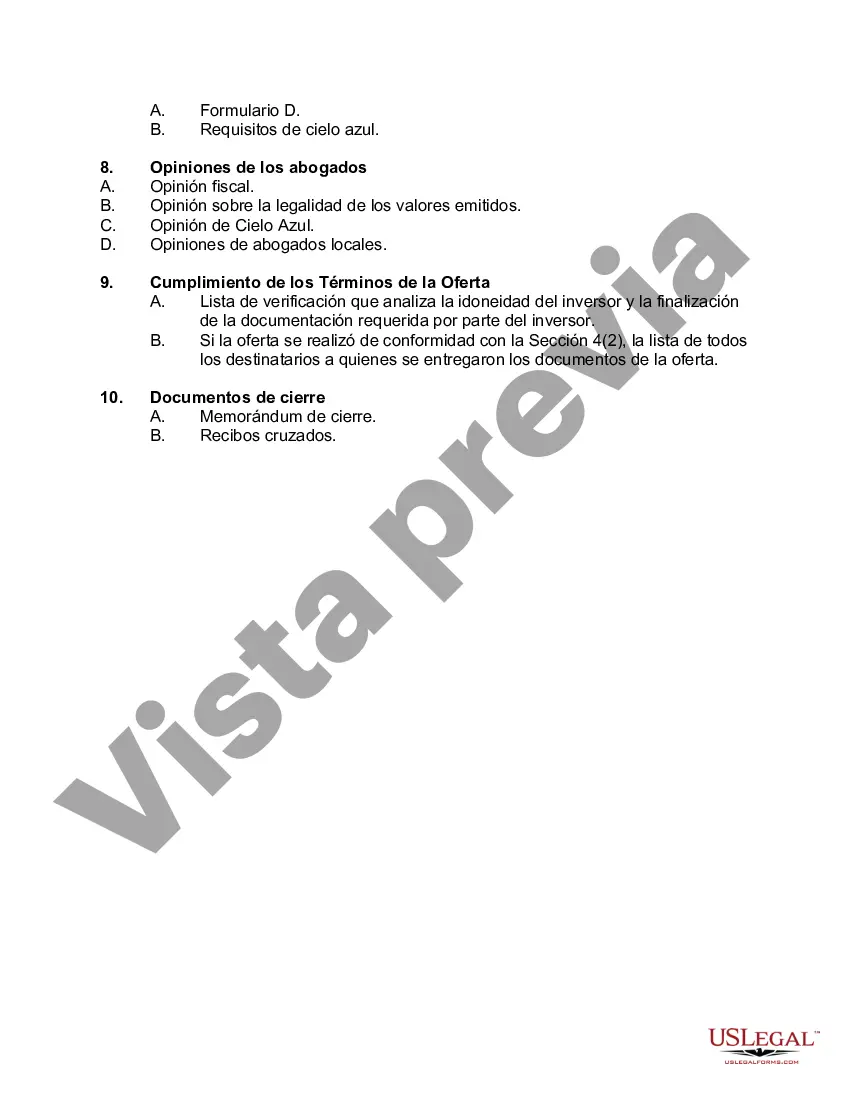

Missouri Checklist for Limited Security Offering is a necessary document that outlines the specific requirements and regulations put forth by the state of Missouri when conducting a limited security offering. This checklist is crucial for individuals or entities seeking to raise capital through the sale of securities within the state of Missouri. The Missouri Checklist for Limited Security Offering covers a wide range of areas pertaining to the offering process, all of which must be adhered to in order to ensure compliance and avoid legal repercussions. It serves as a guide for issuers, providing a step-by-step breakdown of the necessary actions and documentation needed to proceed with a limited security offering in Missouri. Key elements included in the checklist may vary depending on the type of Limited Security Offering being conducted. Some common types of limited security offerings in Missouri may include: 1. Rule 506(b) Offering Checklist: This type of offering falls under the federal exemption, commonly known as Regulation D, Rule 506(b). While federal regulations apply, this checklist ensures compliance with Missouri-specific requirements. 2. Rule 506© Offering Checklist: Similar to the previous type, this offering also falls under federal Regulation D, Rule 506, but with added requirements that issuers must satisfy to verify the accredited investor status of investors. 3. Intrastate Offering Checklist: This type of offering involves the sale of securities solely within the state of Missouri, allowing issuers to qualify for the state exemption program. The checklist provides guidance on the specific requirements set forth by the state. Regardless of the type of limited security offering being pursued, the Missouri Checklist typically includes various components such as: a. Disclosure requirements: Detailed information about the issuer, its business, management, financials, and potential risks associated with the investment. b. Filing requirements: Instructions on how to file the necessary documents with the Missouri Secretary of State and the Missouri Securities Division. c. Material agreements: Listing any contracts or agreements related to the offering, such as underwriting agreements, subscription agreements, or escrow agreements. d. Investor suitability standards: Identification of the criteria that investors must meet to qualify for the investment opportunity, ensuring compliance with applicable state regulations. e. Financial statements: Requirements for providing audited or unaudited financial statements to potential investors, as per the state's guidelines. f. Marketing and solicitation restrictions: Guidance on permitted methods of marketing and solicitation, compliance with anti-fraud provisions, and ensuring no false or misleading statements are made. It is important to note that the Missouri Checklist for Limited Security Offering is subject to change and should be reviewed regularly to stay up-to-date with any regulatory modifications. By diligently following the Missouri Checklist for Limited Security Offering that aligns with the specific type of offering being pursued, issuers can ensure compliance and maintain transparency throughout the process, ultimately increasing their chances of a successful limited security offering in the state of Missouri.Missouri Checklist for Limited Security Offering is a necessary document that outlines the specific requirements and regulations put forth by the state of Missouri when conducting a limited security offering. This checklist is crucial for individuals or entities seeking to raise capital through the sale of securities within the state of Missouri. The Missouri Checklist for Limited Security Offering covers a wide range of areas pertaining to the offering process, all of which must be adhered to in order to ensure compliance and avoid legal repercussions. It serves as a guide for issuers, providing a step-by-step breakdown of the necessary actions and documentation needed to proceed with a limited security offering in Missouri. Key elements included in the checklist may vary depending on the type of Limited Security Offering being conducted. Some common types of limited security offerings in Missouri may include: 1. Rule 506(b) Offering Checklist: This type of offering falls under the federal exemption, commonly known as Regulation D, Rule 506(b). While federal regulations apply, this checklist ensures compliance with Missouri-specific requirements. 2. Rule 506© Offering Checklist: Similar to the previous type, this offering also falls under federal Regulation D, Rule 506, but with added requirements that issuers must satisfy to verify the accredited investor status of investors. 3. Intrastate Offering Checklist: This type of offering involves the sale of securities solely within the state of Missouri, allowing issuers to qualify for the state exemption program. The checklist provides guidance on the specific requirements set forth by the state. Regardless of the type of limited security offering being pursued, the Missouri Checklist typically includes various components such as: a. Disclosure requirements: Detailed information about the issuer, its business, management, financials, and potential risks associated with the investment. b. Filing requirements: Instructions on how to file the necessary documents with the Missouri Secretary of State and the Missouri Securities Division. c. Material agreements: Listing any contracts or agreements related to the offering, such as underwriting agreements, subscription agreements, or escrow agreements. d. Investor suitability standards: Identification of the criteria that investors must meet to qualify for the investment opportunity, ensuring compliance with applicable state regulations. e. Financial statements: Requirements for providing audited or unaudited financial statements to potential investors, as per the state's guidelines. f. Marketing and solicitation restrictions: Guidance on permitted methods of marketing and solicitation, compliance with anti-fraud provisions, and ensuring no false or misleading statements are made. It is important to note that the Missouri Checklist for Limited Security Offering is subject to change and should be reviewed regularly to stay up-to-date with any regulatory modifications. By diligently following the Missouri Checklist for Limited Security Offering that aligns with the specific type of offering being pursued, issuers can ensure compliance and maintain transparency throughout the process, ultimately increasing their chances of a successful limited security offering in the state of Missouri.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.