Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories Keywords: Missouri resolution, selecting depository bank, corporation, account signatories Description: The Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories is a legally binding document that outlines the process for a corporation in the state of Missouri to choose a depository bank and designate signatories for their accounts. This resolution is an essential part of establishing the financial infrastructure of a corporation and ensuring proper management and control over its funds. The resolution typically begins with an introduction, stating the name of the corporation, the date of adoption, and the purpose of the resolution. It may also include any relevant legal references or statutes. The first section of the resolution involves the selection of a depository bank. The corporation's board of directors or the authorized officers are responsible for researching and evaluating potential banks. Factors such as reputation, financial stability, services offered, fees, and location may be considered during the evaluation process. Once a suitable depository bank is chosen, the resolution should specify its name, address, and any additional requirements or conditions. The next section of the resolution is devoted to the designation of account signatories. These individuals are granted the authority to access and manage the corporation's accounts. The resolution should clearly identify who can act as a signatory, which may include members of the board of directors, officers, or other authorized individuals. It may also outline any restrictions or limitations on signatory powers. To ensure accountability and transparency, the resolution may require multiple signatories for certain transactions above a specified threshold. This helps prevent any single individual from having unilateral control over the corporation's finances. The resolution should also specify the process for adding or removing signatories, including any required documentation or board approval. In addition to the main resolution, there may be different types or variations depending on the specific needs of the corporation: 1. Single-Signatory Resolution: This type of resolution designates only one individual as the signatory for all corporate accounts. It is typically used for small companies with limited financial transactions or in situations where a single authorized individual has complete financial control. 2. Multi-Signatory Resolution: This resolution designates multiple individuals as signatories, requiring their collective approval for financial transactions. It is often used by larger corporations to ensure checks and balances within their financial systems. 3. Revocable Resolution: This type of resolution allows for the removal or amendment of signatories and depository bank selection at any time by adopting a new resolution. It provides flexibility to adjust bank relationships and authorized individuals as needed. It is crucial for corporations to carefully draft and adopt a Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories to establish a sound financial framework and mitigate any potential risks associated with fund management. Furthermore, it is advisable to consult with legal professionals familiar with corporate banking regulations and the specific requirements of Missouri law.

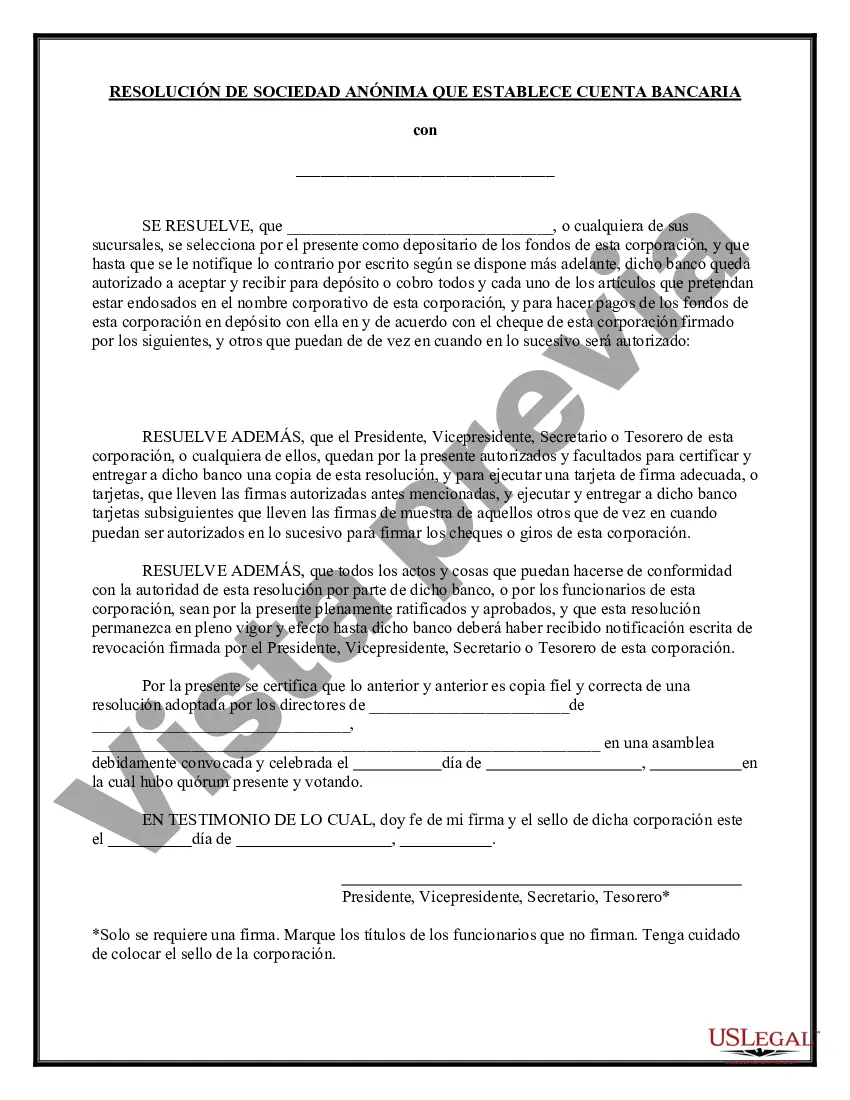

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Missouri Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

If you have to total, acquire, or produce legitimate document layouts, use US Legal Forms, the most important variety of legitimate varieties, which can be found online. Utilize the site`s basic and handy research to get the files you will need. Numerous layouts for enterprise and person purposes are categorized by groups and claims, or keywords. Use US Legal Forms to get the Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories with a number of clicks.

In case you are presently a US Legal Forms client, log in to the account and click on the Down load option to get the Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories. You can also entry varieties you in the past saved from the My Forms tab of the account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right town/nation.

- Step 2. Make use of the Review choice to look through the form`s articles. Do not overlook to see the explanation.

- Step 3. In case you are not satisfied together with the kind, use the Search industry at the top of the monitor to locate other models of your legitimate kind template.

- Step 4. Once you have found the form you will need, click the Get now option. Select the pricing program you prefer and add your references to register to have an account.

- Step 5. Method the transaction. You can use your bank card or PayPal account to accomplish the transaction.

- Step 6. Pick the formatting of your legitimate kind and acquire it in your system.

- Step 7. Full, revise and produce or sign the Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories.

Every single legitimate document template you buy is your own property permanently. You possess acces to each and every kind you saved inside your acccount. Select the My Forms section and pick a kind to produce or acquire once more.

Be competitive and acquire, and produce the Missouri Resolution Selecting Depository Bank for Corporation and Account Signatories with US Legal Forms. There are millions of skilled and condition-distinct varieties you may use for the enterprise or person needs.