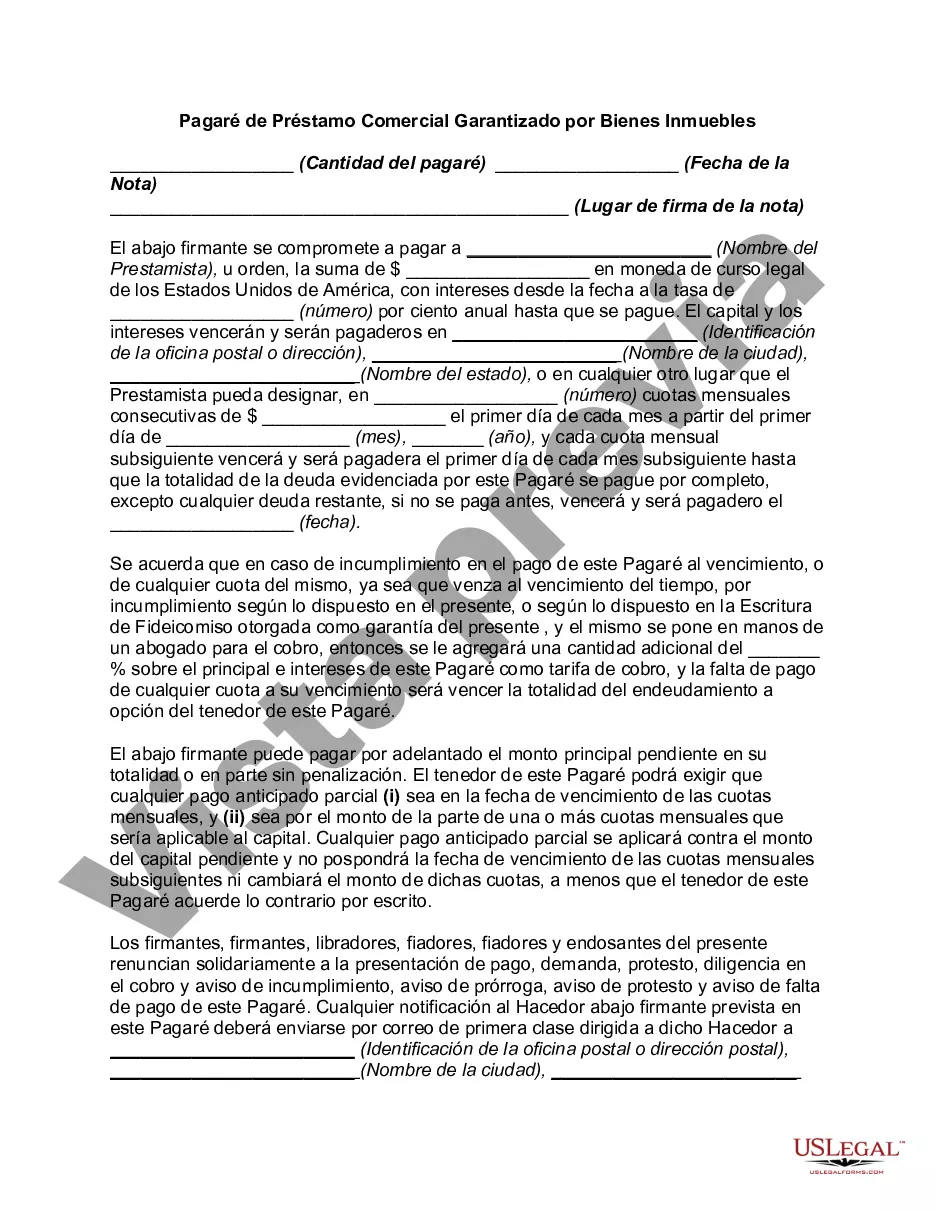

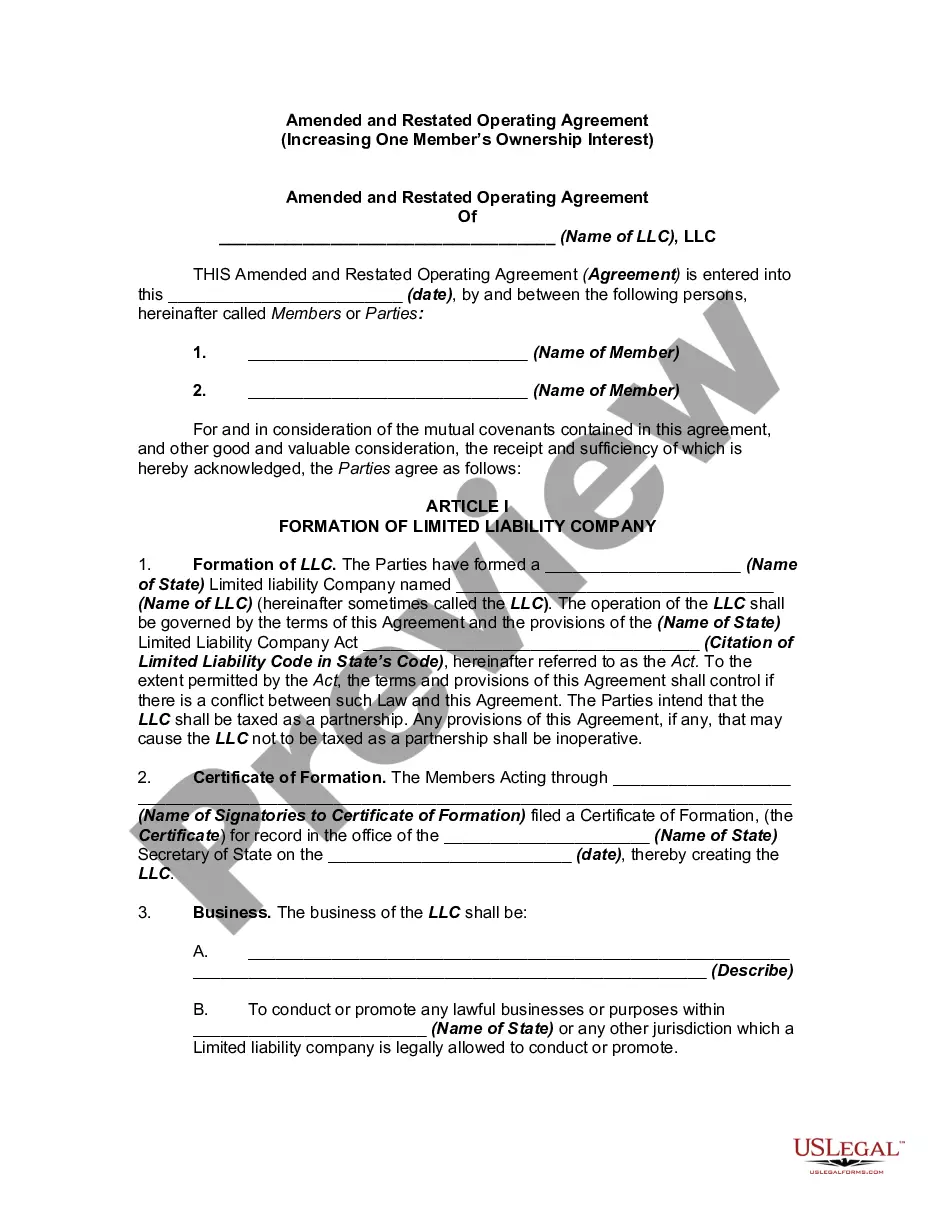

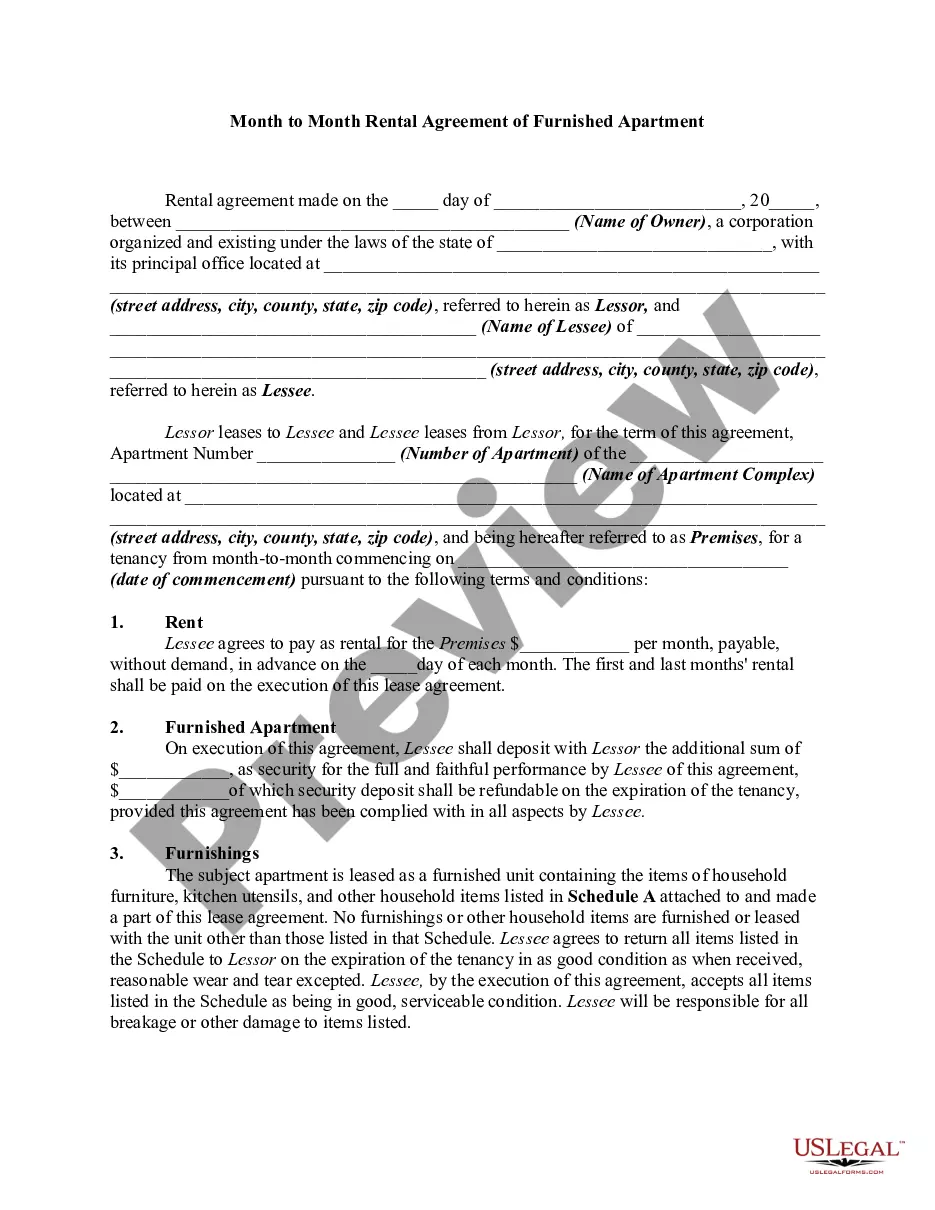

A Missouri Promissory Note for a Commercial Loan Secured by Real Property is a legally binding document used to detail the terms and conditions of a loan agreement between a lender and a borrower. This Promissory Note is specific to commercial loans that are secured by real property, meaning that the borrower offers their commercial property as collateral to ensure repayment of the loan. The Missouri Promissory Note for a Commercial Loan Secured by Real Property contains various key components that must be clearly outlined: 1. Parties involved: The Promissory Note identifies the lender, who is extending the loan, and the borrower, who is receiving the funds. 2. Loan details: The document includes the precise amount of the loan, the agreed-upon interest rate, and the term of the loan, which indicates the repayment period. It is crucial to specify the repayment schedule, whether it is in monthly installments or according to a different arrangement. 3. Security provision: Since the loan is secured by real property, the Promissory Note should describe the specific property that acts as collateral, including details such as address, legal description, and any existing liens or mortgages on the property. 4. Prepayment options: The Promissory Note may outline whether the borrower has the right to prepay the loan in full or part without penalties, or if prepayment is not allowed. 5. Default terms: It is vital to include provisions explaining the consequences of default or non-payment by the borrower. This may involve late fees, acceleration (the lender demanding immediate repayment of the full amount), or foreclosure on the secured property. 6. Governing law and jurisdiction: The Promissory Note should state that it is governed by Missouri law and indicate the jurisdiction in which any legal disputes will be resolved. Different types of Missouri Promissory Notes for Commercial Loans Secured by Real Property can vary based on the specific terms and conditions set by the lender. Some variations include: 1. Fixed interest rate Promissory Note: A Promissory Note where the interest rate remains constant throughout the entire loan term. 2. Variable interest rate Promissory Note: A Promissory Note where the interest rate fluctuates and is usually tied to a benchmark index such as the prime rate. 3. Balloon payment Promissory Note: A Promissory Note that requires the borrower to make regular payments (often at a lower interest rate) for a designated period, but with a significant, lump-sum payment due at the end of the term. In conclusion, a Missouri Promissory Note for Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It is crucial to tailor the note to the specific loan agreement, ensuring accurate and comprehensive inclusion of all relevant details to protect the interests of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Missouri Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Discovering the right legitimate file format can be quite a struggle. Obviously, there are a lot of templates available on the Internet, but how will you obtain the legitimate form you will need? Take advantage of the US Legal Forms site. The support gives a huge number of templates, like the Missouri Promissory Note for Commercial Loan Secured by Real Property, which you can use for business and personal demands. All the forms are examined by experts and meet state and federal requirements.

Should you be already listed, log in in your profile and click the Down load button to find the Missouri Promissory Note for Commercial Loan Secured by Real Property. Make use of profile to look from the legitimate forms you might have bought in the past. Check out the My Forms tab of your own profile and acquire an additional copy of the file you will need.

Should you be a whole new user of US Legal Forms, allow me to share basic recommendations for you to comply with:

- Very first, make sure you have selected the proper form to your metropolis/region. You may examine the shape using the Review button and read the shape explanation to ensure it will be the right one for you.

- When the form will not meet your requirements, use the Seach field to get the correct form.

- Once you are certain that the shape would work, select the Acquire now button to find the form.

- Opt for the costs prepare you desire and enter the required information. Design your profile and pay money for your order utilizing your PayPal profile or credit card.

- Pick the submit structure and down load the legitimate file format in your device.

- Comprehensive, modify and print out and signal the attained Missouri Promissory Note for Commercial Loan Secured by Real Property.

US Legal Forms will be the most significant library of legitimate forms that you can discover different file templates. Take advantage of the service to down load skillfully-created papers that comply with express requirements.