Missouri Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Discovering the right legal papers format can be quite a battle. Naturally, there are a lot of layouts available on the Internet, but how would you obtain the legal type you will need? Make use of the US Legal Forms website. The services provides 1000s of layouts, for example the Missouri Liquidation of Partnership with Sale and Proportional Distribution of Assets, which you can use for business and personal requirements. Every one of the kinds are examined by professionals and meet up with federal and state needs.

Should you be presently signed up, log in to your bank account and click the Download button to find the Missouri Liquidation of Partnership with Sale and Proportional Distribution of Assets. Use your bank account to appear throughout the legal kinds you may have purchased formerly. Proceed to the My Forms tab of the bank account and obtain yet another backup from the papers you will need.

Should you be a new user of US Legal Forms, listed here are easy directions that you should comply with:

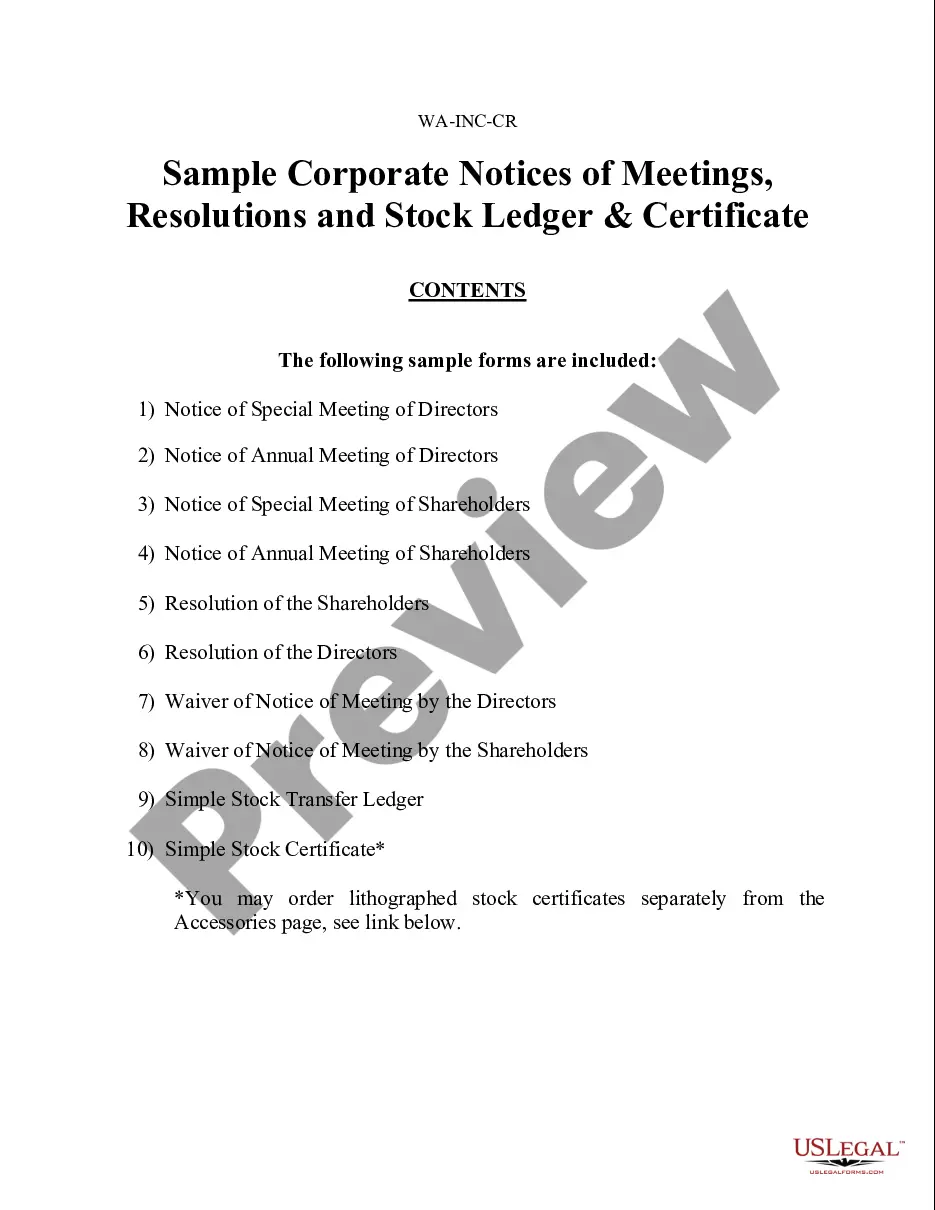

- Initially, make certain you have selected the appropriate type for your metropolis/state. You can check out the form while using Review button and look at the form description to guarantee this is basically the right one for you.

- When the type will not meet up with your expectations, utilize the Seach field to discover the proper type.

- When you are positive that the form would work, select the Purchase now button to find the type.

- Pick the rates prepare you desire and enter in the needed information. Create your bank account and purchase the transaction using your PayPal bank account or bank card.

- Select the submit formatting and obtain the legal papers format to your device.

- Complete, revise and printing and signal the attained Missouri Liquidation of Partnership with Sale and Proportional Distribution of Assets.

US Legal Forms may be the biggest catalogue of legal kinds that you can discover different papers layouts. Make use of the service to obtain appropriately-produced paperwork that comply with state needs.

Form popularity

FAQ

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

When a partnership business is terminated, partners are expected to pay taxes on the taxable gain distributed to them upon liquidation of current and fixed assets.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.