Title: Exploring Missouri Demand for a Shareholders Meeting: Types and Considerations Introduction: In Missouri, the demand for a shareholders meeting holds significant importance in corporate governance and decision-making processes. This article aims to provide a comprehensive understanding of what a Missouri demand for a shareholders meeting entails, exploring its significance, legal requirements, and different types. We will delve into the key keywords such as Missouri, demand, shareholders meeting, and their variations to shed light on this topic. 1. Overview of Missouri Demand for a Shareholders Meeting: — A Missouri demand for a shareholders meeting refers to a formal request made by shareholders, exercising their rights to convene a meeting and address concerns or propose resolutions. — The demand aims to foster transparency, accountability, and encourage shareholder engagement in a company's decision-making processes. — It serves as a mechanism allowing shareholders to voice their opinions and promote corporate governance in accordance with Missouri state laws. 2. Legal Considerations: — Missouri statutes provide guidelines and legal requirements that dictate the process of making a demand for a shareholders meeting. Compliance with these regulations is crucial to ensure a valid demand. — Specifically, refer to Missouri Revised Statutes, Chapter 351, Section 351.370, for detailed legal provisions on shareholders meetings and requirements. — It is advisable for shareholders seeking to make a demand to consult legal counsel or refer to the relevant provisions to ensure adherence to legal obligations. 3. Types of Missouri Demand for a Shareholders Meeting: a. Statutory Demand: — This form of demand follows the requirements outlined in the Missouri Revised Statutes and adheres strictly to the legal guidelines pertaining to demanding a shareholders meeting. — It ensures compliance with statutory provisions, including the minimum notice period, shareholder identification, and voting requirements. b. Defective Notice Demand: — If a shareholders meeting was previously held with a defective notice, shareholders may demand a new meeting to address the same or related matters with proper notice. — The demand highlights the need to rectify any potential violation of notification requirements and addresses the concerns raised during the previous meeting, ensuring a fair and valid decision-making process. c. Special Topics Demand: — This type of demand is made when shareholders desire to address specific matters or propose resolutions that require dedicated attention. — Shareholders may demand a special meeting to discuss key topics such as mergers, acquisitions, major policy changes, or executive compensation. — Such demands focus on critical issues that merit additional discussion and decision-making beyond regular meetings. 4. Conclusion: Missouri demand for a shareholders meeting is an essential tool for shareholders to participate in corporate decision-making processes and increase transparency within a company. By adhering to legal requirements and understanding the different types of demands, shareholders can assert their rights and contribute to the overall governance of the company. Awareness of these keywords — Missouri, demand, shareholders meeting — and their variations can assist shareholders in navigating through the complex landscape of corporate governance within the state.

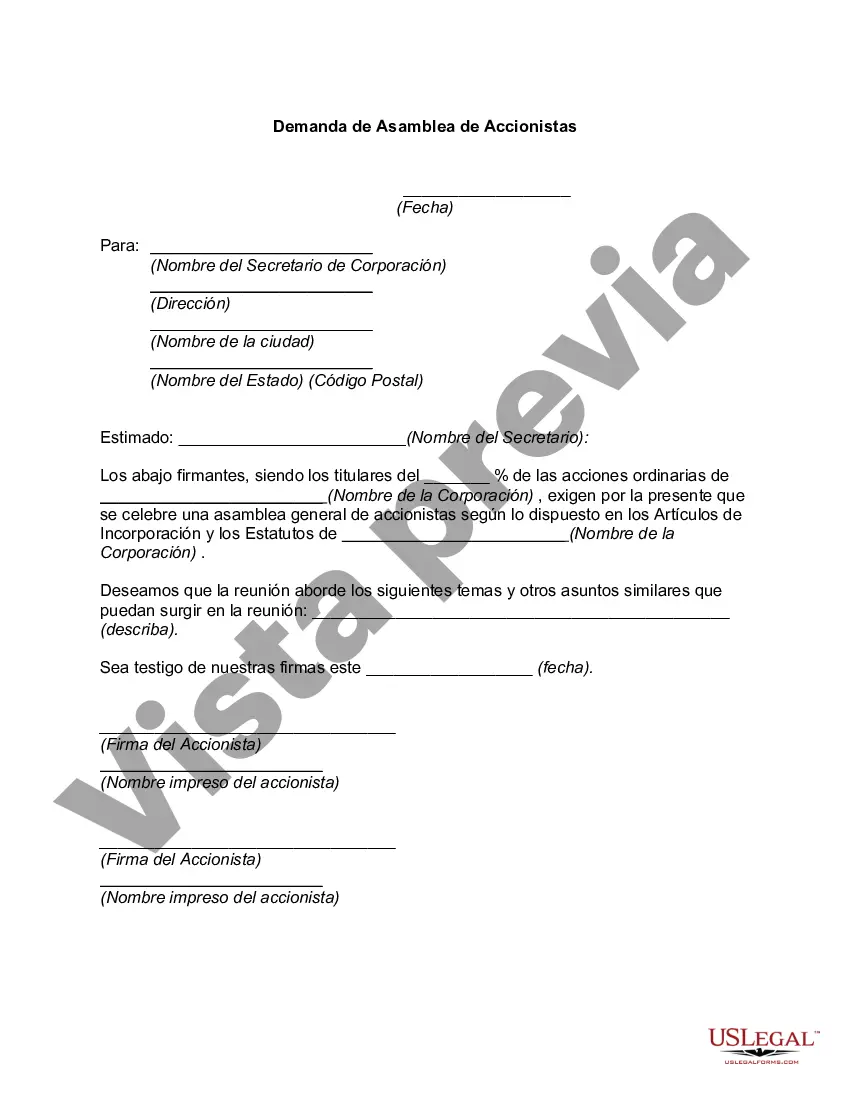

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

How to fill out Missouri Demanda De Asamblea De Accionistas?

Have you been in a placement where you need paperwork for sometimes business or specific reasons almost every day? There are plenty of legal record layouts available online, but getting types you can rely on isn`t simple. US Legal Forms provides 1000s of form layouts, such as the Missouri Demand for a Shareholders Meeting, that happen to be written to meet federal and state needs.

Should you be already acquainted with US Legal Forms internet site and possess a free account, merely log in. Following that, you may down load the Missouri Demand for a Shareholders Meeting design.

Should you not come with an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is to the appropriate town/region.

- Take advantage of the Review switch to review the form.

- Browse the description to actually have chosen the proper form.

- In case the form isn`t what you are searching for, take advantage of the Look for discipline to find the form that suits you and needs.

- When you find the appropriate form, click on Get now.

- Opt for the pricing plan you need, fill in the necessary information to make your account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file format and down load your version.

Get every one of the record layouts you might have bought in the My Forms food list. You can aquire a additional version of Missouri Demand for a Shareholders Meeting whenever, if necessary. Just select the required form to down load or printing the record design.

Use US Legal Forms, probably the most extensive selection of legal varieties, in order to save time and avoid mistakes. The support provides professionally made legal record layouts that can be used for a selection of reasons. Make a free account on US Legal Forms and initiate generating your way of life easier.