Missouri Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

Are you currently in the scenario where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Missouri Payroll Deduction Authorization Form, which are created to satisfy state and federal requirements.

If you find the right form, simply click Get now.

Choose the payment plan you desire, fill in the required information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Payroll Deduction Authorization Form template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct state/county.

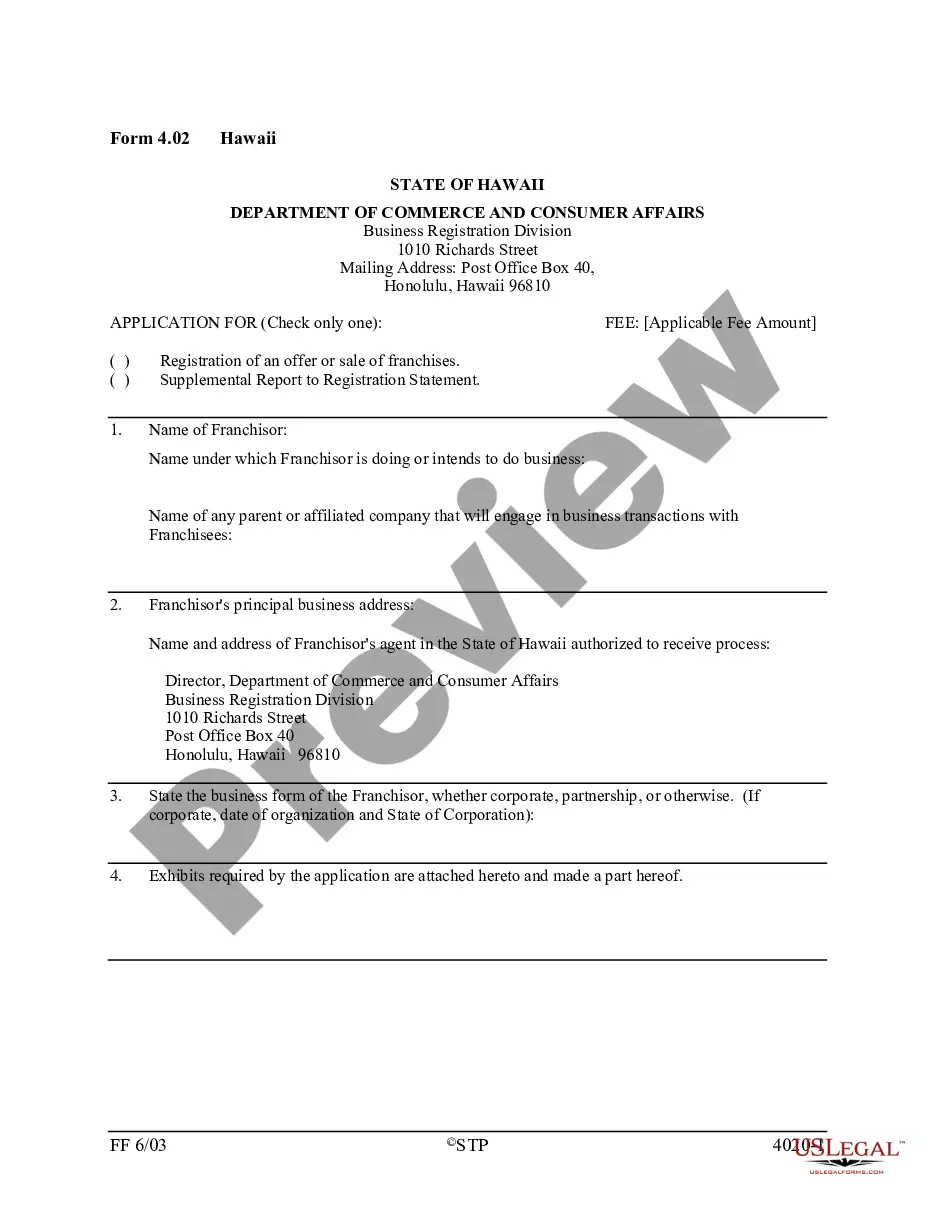

- Utilize the Preview option to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

Missouri law does require employers to give their employees written notice of a reduction of wages at least 30 days before the reduction is to take effect. (See Chapter 290.100, RSMo). If an employer fails to give the appropriate notice, it is liable to each affected employee in the amount of fifty dollars.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

Allowable Paycheck DeductionsPersonal loans (cash advances, 401(k) or retirement loan payment, bail or bond payments, etc.)Personal purchases of a business's goods or services such as: Food purchases from the cafeteria.Employee's health, dental, vision, and other insurance payments or co-payments.

Taking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support