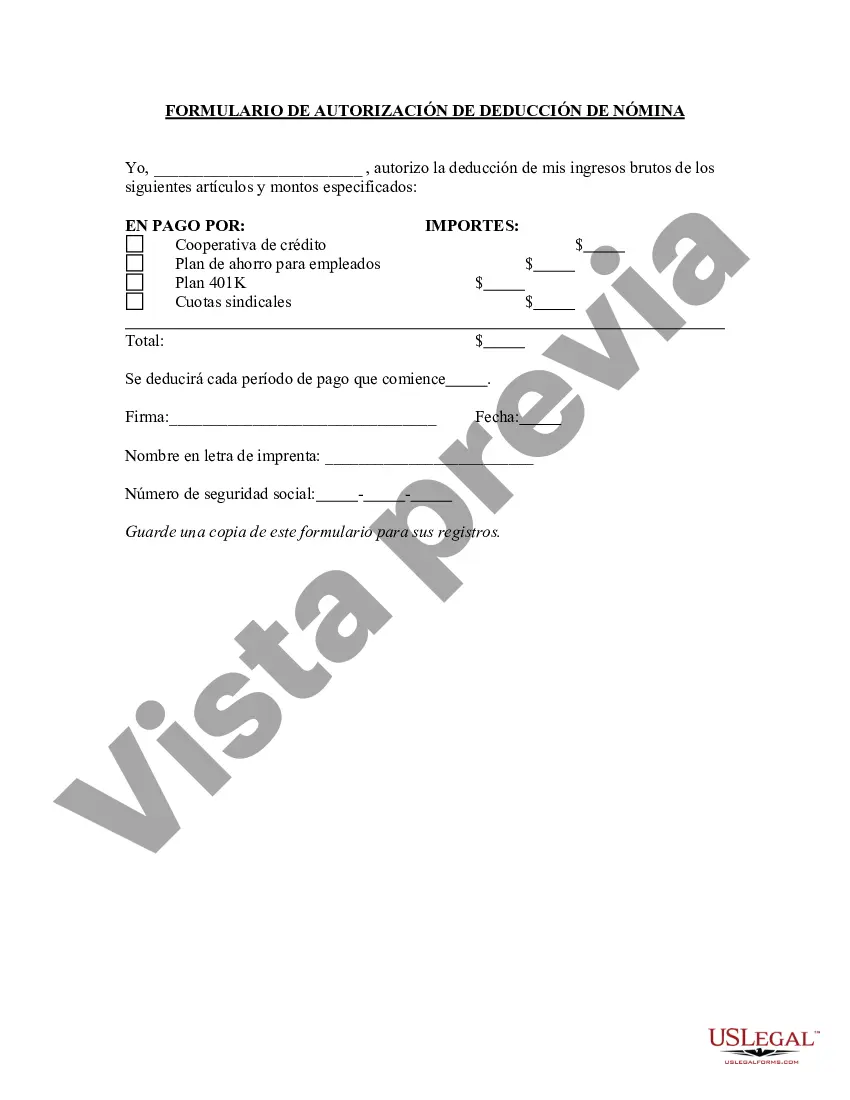

The Missouri Payroll Deduction Authorization Form is a legal document that allows employees in the state of Missouri to authorize specific deductions from their wages. This form is used by employers to ensure that the deductions comply with state laws and regulations. It provides a clear record of the employee's consent and serves as a written agreement between the employee and employer. The Missouri Payroll Deduction Authorization Form typically includes essential information such as the employee's name, address, social security number, and employer details. It also contains sections specifying the purpose of the deduction and the amount to be deducted from each paycheck. There are several types of Missouri Payroll Deduction Authorization Forms, each serving a different purpose. Some common types of these forms include: 1. Benefit Deduction Authorization Form: This form allows employees to authorize deductions for health insurance premiums, retirement contributions, life insurance premiums, and other employee benefit programs offered by the employer. 2. Wage Garnishment Deduction Authorization Form: This form may be used when a court orders an employer to withhold a portion of an employee's wages to satisfy a debt or judgment. It outlines the details of the garnishment, including the amount to be deducted and the duration of the withholding. 3. Charitable Contribution Deduction Authorization Form: This form enables employees to authorize deductions from their wages for charitable donations. It specifies the charity or organization that will receive the donation and the amount to be deducted. 4. Loan Repayment Deduction Authorization Form: This form is used when an employee wishes to authorize deductions from their wages to repay a loan. It includes details such as the loan amount, repayment terms, and the deductions' start and end dates. 5. Union Dues Deduction Authorization Form: Employees who are part of a union may use this form to authorize the deduction of union dues from their wages. It provides information about the union, the amount of dues, and the frequency of the deductions. By using the appropriate Missouri Payroll Deduction Authorization Form, employers ensure transparency, accuracy, and compliance with state laws. Employees, on the other hand, can have greater control over their deductions and ensure that they are contributing to programs or organizations of their choice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Missouri Formulario De Autorización De Deducción De Nómina?

Are you presently in the situation the place you require files for possibly organization or personal purposes nearly every day time? There are a variety of authorized record templates available online, but getting ones you can rely on isn`t effortless. US Legal Forms gives thousands of type templates, much like the Missouri Payroll Deduction Authorization Form, which are published in order to meet state and federal needs.

In case you are presently informed about US Legal Forms internet site and get a merchant account, basically log in. After that, you can download the Missouri Payroll Deduction Authorization Form design.

If you do not have an account and want to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and ensure it is for that correct area/county.

- Use the Preview option to analyze the form.

- Look at the information to ensure that you have selected the proper type.

- In the event the type isn`t what you`re searching for, use the Lookup discipline to get the type that meets your needs and needs.

- If you get the correct type, just click Get now.

- Select the costs program you want, fill in the specified info to make your bank account, and purchase your order making use of your PayPal or credit card.

- Pick a hassle-free paper file format and download your copy.

Get all the record templates you may have purchased in the My Forms menus. You can obtain a further copy of Missouri Payroll Deduction Authorization Form whenever, if possible. Just click on the necessary type to download or print out the record design.

Use US Legal Forms, by far the most substantial selection of authorized kinds, to save lots of efforts and avoid errors. The services gives appropriately made authorized record templates which you can use for an array of purposes. Make a merchant account on US Legal Forms and initiate creating your way of life a little easier.